On Aug 22, Zacks Investment Research downgraded Acacia Communications, Inc. (NASDAQ:ACIA) to a Zacks Rank #5 (Strong Sell).

Of late, the stock has been witnessing downward estimate revisions. In fact, the Zacks Consensus Estimate for fiscal 2017 dropped 15.6% to $1.89 over the last 60 days. Estimates for fiscal 2018 declined in the same time frame, resulting in a drop of 11.3% in the Zacks Consensus Estimate to $2.58.

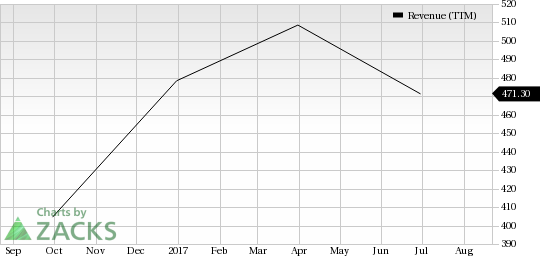

The negative estimate revision was primarily due to disappointing second-quarter 2017 results. The company reported non-GAAP earnings of 26 cents per share, which declined 66% on a year-over-year basis. Revenues of $78.9 million declined 32% year on year.

Acacia has lost 31.1% of its value year to date against 17.2% growth of its industry.

Factors Affecting the Company

Acacia’s second quarter was largely affected by a quality issue detected in some of its 1,300 AC400 units and 5,000 CFP units produced by one of the company’s three contract manufacturers over a period of four months.

The root cause of the quality issue was a circuit board cleaning process, which was eliminated and manufacturing resumed in the second quarter. However, the company faced supply constraints as the defective ones were to be replaced and new orders fulfilled. This was one of the major reasons for significant revenue decline from the year-ago quarter.

Moreover, sluggish demand from China and DCI customers also hurt the top line of the company. Notably, stiff competition from Inphi (NYSE:IPHI) , NeoPhotonics (NYSE:NPTN) and Oclaro (NASDAQ:OCLR) is an additional headwind for the company.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

NeoPhotonics Corporation (NPTN): Free Stock Analysis Report

Acacia Communications, Inc. (ACIA): Free Stock Analysis Report

Oclaro, Inc. (OCLR): Free Stock Analysis Report

Inphi Corporation (IPHI): Free Stock Analysis Report

Original post

Zacks Investment Research