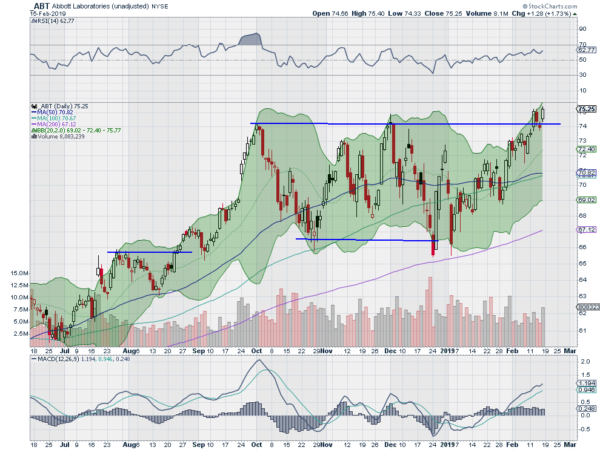

Abbott Labs, Ticker: $ABT

Abbott Labs (NYSE:ABT) rose to a peak in early October and then pulled back. Over the next 4½ months, it settled into a consolidation zone. That ended with the move higher last week. The break out retested Thursday and then resumed Friday. The RSI is in the bullish zone with the MACD rising and positive. Look for continuation to participate.

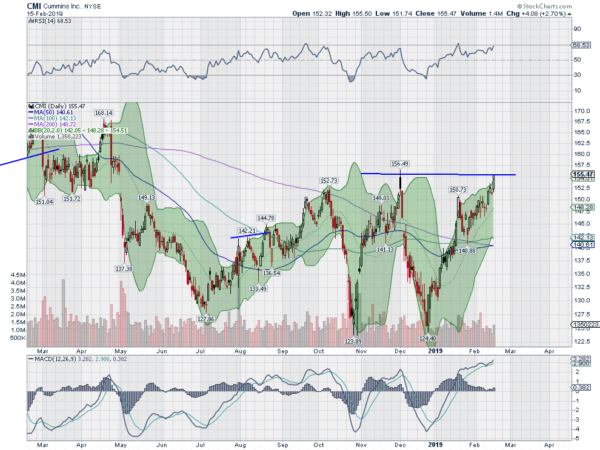

Cummins, Ticker: $CMI

Cummins (NYSE:CMI) is completing a “W” pattern as it moves back to the top of a broad consolidation range. A strong Friday saw it close on the high and at resistance. The RSI is in the bullish zone and the MACD is rising. Look for a pushover resistance to participate

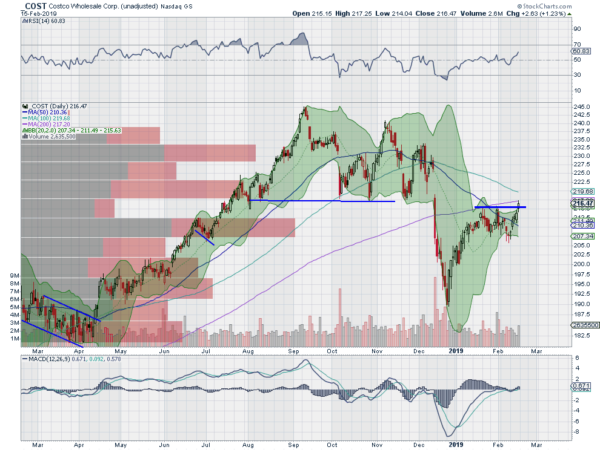

Costco, Ticker: $COST

Costco (NASDAQ:COST) reached a peak in September and started to move back lower. It found support at first and then accelerated to the downside in December. It found support Christmas Eve and reversed higher. That move up stalled just short of the 200-day SMA and it has been consolidating. Friday saw a push over short term resistance and up to the 200-day SMA. The RSI is rising into the bullish zone with the MACD turning positive. Look for continuation to participate higher.

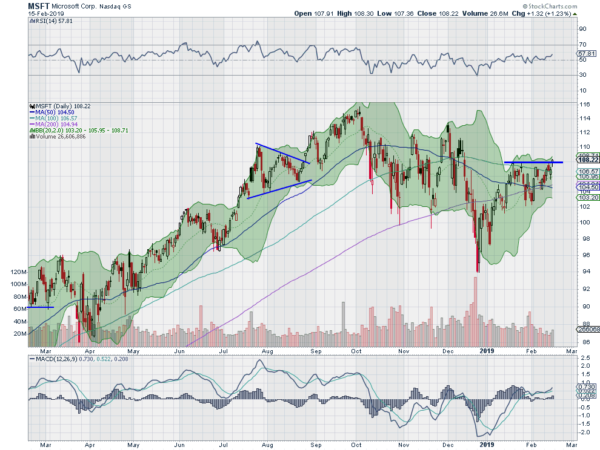

Microsoft, Ticker: $MSFT

Microsoft (NASDAQ:MSFT) made a top in October and then started to pullback. It stabilized later that month and held until a further drop in December to a Christmas Eve low. Since then it has been moving higher. It has been making higher lows against resistance since late January though. Friday it poked over that resistance. The RSI is rising toward the bullish zone with the MACD positive and turning up. Look for continuation to participate.

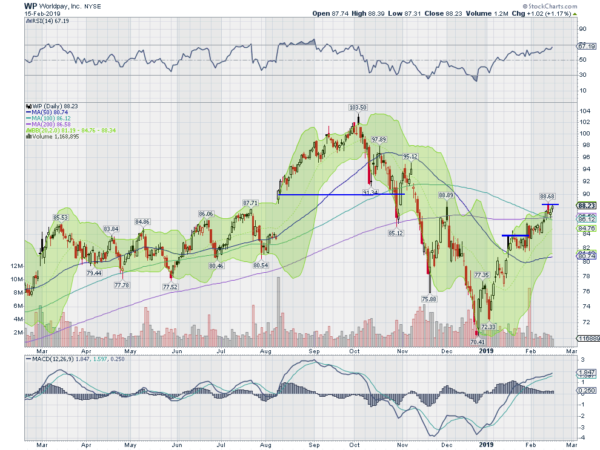

Worldpay, Ticker: $WP

Worldpay Inc (NYSE:WP) dropped from a high in October, finding support at the end of December. It has reversed from there and continued to move higher. Last week it started a mini consolidation at the December high. The RSI is rising and bullish with the MACD positive and moving up. Look for a pushover resistance to participate higher.

Up Next: Bonus Idea

Elsewhere look for Gold to bounce continue higher in its uptrend while Crude Oil joins it with a renewed push higher. The U.S. Dollar Index looks to continue to mark time sideways while US Treasuries are stalled at resistance in their move higher. The Shanghai Composite is driving higher and Emerging Markets are basing after a digestive pullback.

Volatility looks to remain very low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts showed strong weekly moves with momentum for more as the SPY breaks firmly over the 200 day SMA and the QQQ joining it. Only the IWM is left to join the club and it is driving higher fast. Use this information as you prepare for the coming week and trade them well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.