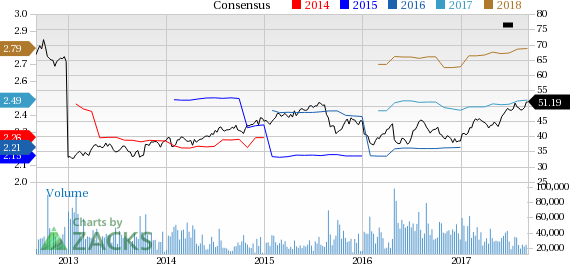

Share price of Abbott (NYSE:ABT) scaled a new 52-week high of $51.42 on Sep 6, eventually closing nominally lower at $51.19. The company has gained 9.6% over the past three months, much higher than the S&P 500’s gain of 0.7% over the same frame. Abbott has also outperformed the broader industry’s decline of 0.1% with respect to share price movement over the past three months. The stock has a market cap of $88.94 billion.

Further, Abbott’s estimate revision trend for the current year has been favorable. In the past 60 days, seven estimates moved up while one moved down. The estimates were up from $2.46 per share to $2.49 over the same time frame.

The company also has a trailing four-quarter average positive earnings surprise of 4.6%. Its positive long-term growth of 10.7% holds promise.

Abbott carries a Zacks Rank #3 (Hold). The company has an impressive Growth Style Score of B. Our Growth Style Score highlights all the vital metrics of a company’s financials to obtain a clearer picture of the quality and sustainability of its growth. Our research shows that stocks with Style Scores of A or B when combined with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 offer the best investment opportunities.

Growth Drivers

The market is upbeat about Abbott’s recent FDA approval for Full MagLev HeartMate 3 Left Ventricular Assist Device (LVAD).

The company also announced the receipt of national reimbursement for the FreeStyle Libre glucose monitoring system in Japan. The development has widened this Illinois-based medical device major’s customer base in diabetes management.

Further, the company recently signed a $252-million managed equipment service contract with North West London Pathology (NWLP), hosted by Imperial College Healthcare NHS Trust. Abbott expects this alliance to solidify its footprint in the rapidly growing diagnostics market.

Meanwhile, Abbott’s second-quarter performance has been promising with sales and adjusted earnings from continuing operations increasing year over year.

All these factors are expected to boost the company’s share price.

Key Picks

A few better-ranked medical stocks are Edwards Lifesciences Corporation (NYSE:EW) , Lantheus Holdings, Inc. (NASDAQ:LNTH) and Chemed Corporation (NYSE:CHE) . Edwards Lifesciences sports a Zacks Rank #1 (Strong Buy), while Lantheus Holdings and Chemed carry a Zacks Rank #2 (Buy). You cansee the complete list of today’s Zacks #1 Rank stocks here.

Edwards Lifesciences has a long-term expected earnings growth rate of 15.2%. The stock has rallied roughly 25.4% over the last six months.

Lantheus Holdings has a long-term expected earnings growth rate of 12.5%. The stock has gained 25.7% over the last six months.

Chemed has a long-term expected earnings growth rate of 10%. The stock has gained around 8.9% over the last six months.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Learn more >>

Abbott Laboratories (ABT): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Lantheus Holdings, Inc. (LNTH): Free Stock Analysis Report

Chemed Corp. (CHE): Free Stock Analysis Report

Original post

Zacks Investment Research