SECULAR TREND

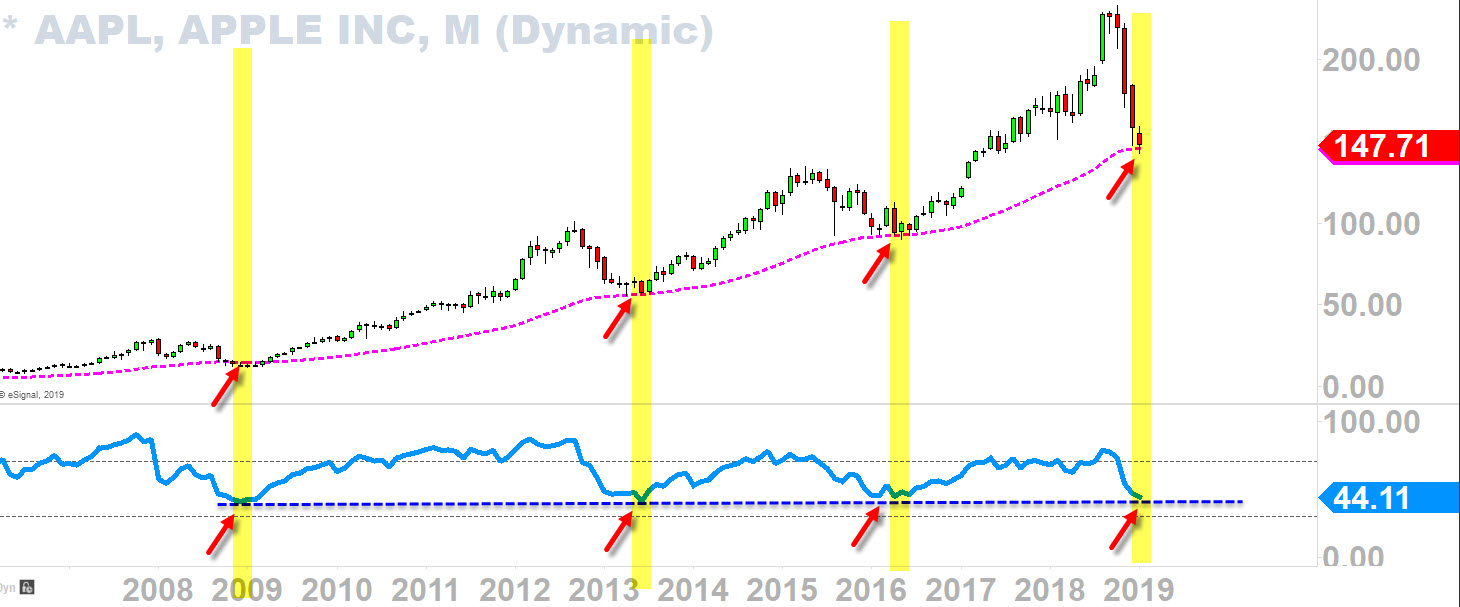

The chart below was screened back on January 4 when Apple (NASDAQ:AAPL) was trading at 147.71 as I was accumulating more longs at that time. As you can see in the chart below with my moving average and the oscillator, my research is showing me that we may be bottoming here. Of course, this being a monthly chart I would have to give some wiggle room for the daily movement to play out, but I believed that we were very close to the bottom (as I write this post, AAPL is currently trading at 165ish). 2009, 2013 and 2016, AAPL has bottomed in a very similar manner.

(Monthly AAPL chart)

FASTER DECLINE FASTER RECOVERY

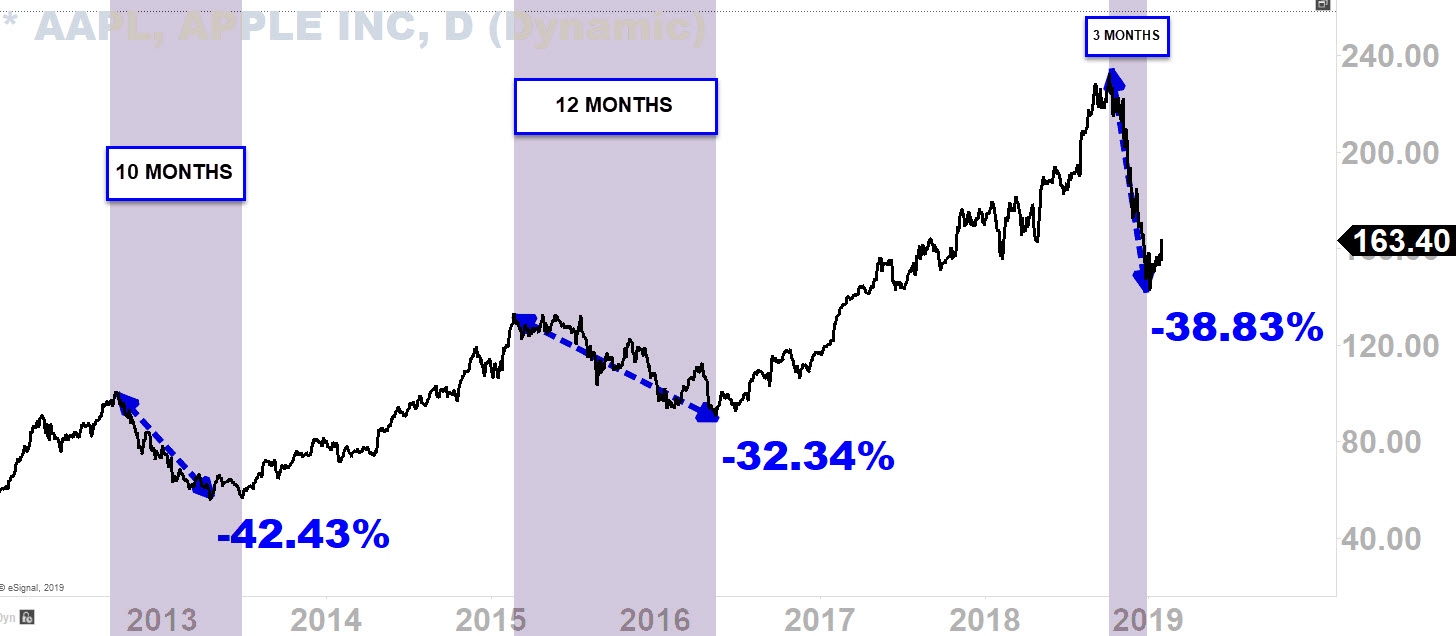

Contrary to what most believe, the faster the decline the faster the recovery. Actually, the fast decline scare the investors more versus if the stock would take it's time to cultivate a downtrend such as 2013 and 2016. Because when the market establishes downtrend, there is still a lower-high up-moves within a downtrend that gives investors hope for the recovery. But when the stock comes straight down (like it did last quarter on AAPL), it scares the hell out of them thinking it may never stop.

- In 2013, it took 10 months for AAPL to decline 42%

- In 2016, it took 12 months for AAPL to decline 32%

- In late 2018, it only took a quarter for AAPL to decline almost 40% -- that's insane

What most investors don't realize is, the faster the decline the faster the recovery. Just as fast as it came down, just as fast will it get back up, which, this setup makes very attractive for buying this dip and accumulating longs as AAPL is starting to develop another uptrend that could last few years.

(Daily AAPL Chart)

*I am targeting 300 and then 320 and even possibly 370 for my holding SHARES.

DISCLOSURE: Currently I own SHARES and LEAPS on AAPL