It's that time of year again. This morning, thousands of adventurous (or phenomenally stupid) young men from around the world will run with the bulls in the streets of Pamplona.

I was one of those adventurous (let’s be honest — phenomenally stupid) young men once (see “¡Viva San Fermin!“). Though it was over a decade ago, I remember it like it was yesterday.

Lest I get teary-eyed, I’ll cut the nostalgia short. Today, we’re going to focus on a very different “running of the bulls.” Among individual investors, it seems there is nary a bull to be found these days.

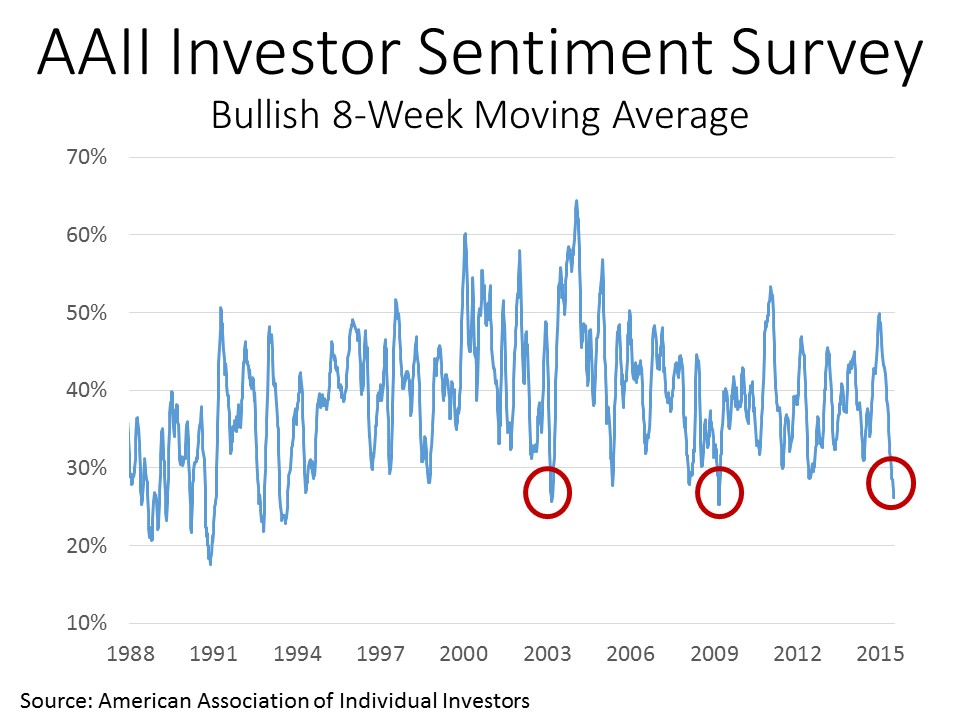

According to the latest American Association of Individual Investors (“AAII”) Sentiment Survey, there are fewer market bulls today than at any time since the 2008 meltdown:

The AAII survey measures the percentage of individual investors who are bullish, bearish, and neutral on the stock market for the next six months. To smooth out the noise a little, I used an 8-week moving average. And as you can see, bullishness is currently at lows you might normally associate with panic bottoms.

The weekly reading shows that just 22.6% of individual investors are bullish about the market over the next six months. To give a little long-term perspective, the long-term average bullishness reading is 38.8%.

While it has become cliche to call this “the most hated bull market in history,” at least by this metric it would seem like an accurate statement.

The AAII Sentiment Survey is viewed by many as a contrarian indicator. Like most measures that depend on investor psychology, it is noisy and doesn’t always give clear signals. But the takeaway here is that the bull market probably has a little longer to run. Yes, stocks are very expensive at these levels and probably won’t offer much in the way of returns over the next 8-10 years. But that doesn’t mean the market can’t continue to drift higher for the next several months.