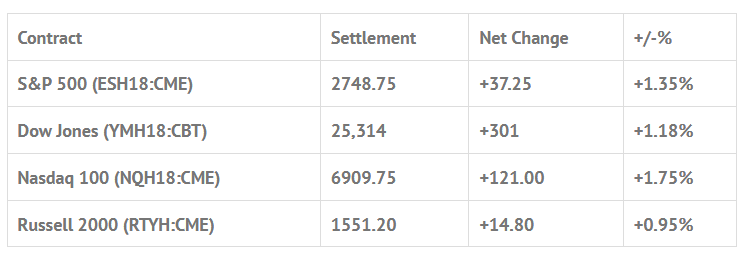

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 9 out of 11 markets closed higher: Shanghai Comp +0.74%, Hang Seng +1.25%, Nikkei +1.19%

- In Europe 12 out of 12 markets are trading higher: CAC +0.54%, DAX +0.33%, FTSE +0.56%

- Fair Value: S&P -0.56, NASDAQ +3.23, Dow -13.38

- Total Volume: 1.2mil ESH & 1.6k SPH traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Chicago Fed National Activity Index 8:30 AM ET, New Home Sales 10:00 AM ET, and the Dallas Fed Mfg Survey 10:30 AM ET.

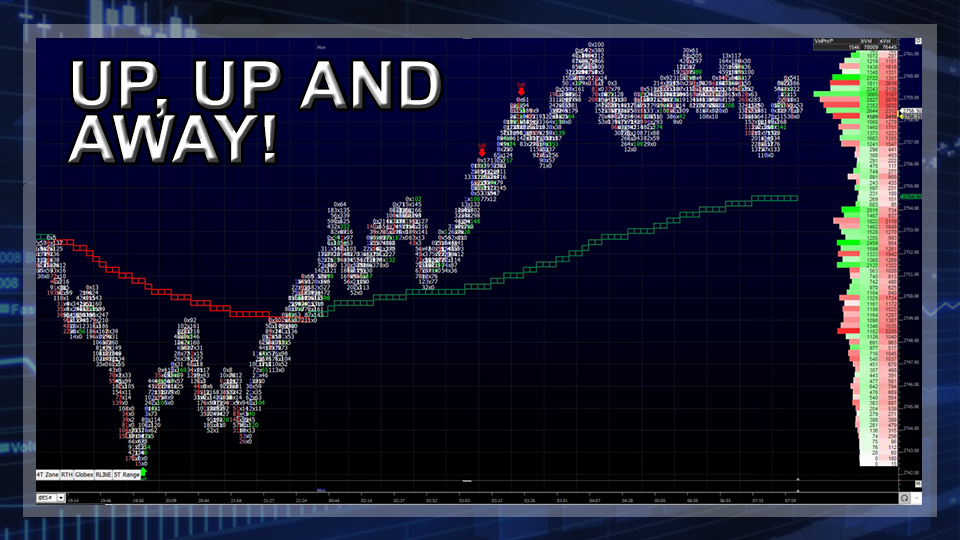

S&P 500 Futures: #ES Pop, #VIX Dip, And The Late Friday RIP

The E-Mini S&P 500 futures sold off last Tuesday and Wednesday, and then there was another big rally and sell off on Thursday when the ES traded down to 2696.50 from a 2731.25 high. The MiM ended up showing $1.6 billion for sale, but in the final minutes of the day, the ES popped back up 2712.00, and traded up to 2727.75 on Globex.

On Friday morning, the ES sold off down to 2713.00, and opened at 2719.50 on the 8:30 CT bell. After several pops and drops below the vwap, the ES made its early low at 2712.75 at 9:30, and made a high at 2729.75 just after 11:00 am. The next move was down to 2721.50. The volume was lower, at 12:45 only 730,000 contracts had traded.

After the pullback, the next move was back up to a new high at 2730.50. At 1:26:20 CT I blasted this out in the MTS forum:

Dboy:(1:26:14 PM):if they get back down to 2726.50 I going to buy

Dboy:(1:26:40 PM):I think they run the stops above 2730.50

Dboy:(1:30:43 PM):gonna blast the stops.

The futures pulled back down to 2626.25, and at at 2:30 the ES traded up to a new daily high at 2743.75. From there, it pulled back down to 2738.50, and traded 2747.50 on the 3:00 cash close, up 21.25 handles from the 2726.25 late day pullback. After 3:00 the ES traded up to 2749.50 and settled at 2748.25, up 34.75 handles, or up 1.38%, on the day.

In the end, we thought the ES was setting up to run the buy stops above 2730.50, but we didn’t think it was going to traded up to the 2750.00 level. Once the ES started running the buy stops, several being waves of buy programs hit, and with so much selling and hedging being put on over the last two weeks, and the lower volumes, its was not hard for the buyers to push the index markets up.

Several years ago there was a two month period where the ES would rally sharply late in the day on Friday. We coined it ‘the late Friday rip’, and that’s exactly what happened last Friday.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.