Kudos to outdoor retailer REI for actually giving its employees time off on Black Friday, the day after Thanksgiving. REI created an #optoutside campaign to encourage fellow enthusiasts to join vacationing employees outdoors, far away from the Black Friday shopping madness that has become quite the bewildering American consumerist tradition.

Back on the asphalt, results apparently were underwhelming. Here is some of what ShopperTrack had to say in its annual Black Friday report:

“… preliminary sales estimate for brick-and-mortar retail on Thanksgiving Day (11/26/15) and Black Friday (11/27/15). The two dates accumulated a projected $12.1 billion in combined sales, which is an estimated decrease versus 2014…

The two dates also saw thinner crowds as the preliminary numbers indicate a decrease in shopper visits on both Thanksgiving Day and Black Friday when compared to last year…

Following initial numbers, ShopperTrak maintains its estimated 2.4 percent increase in sales for brick-and-mortar retail during the 2015 holiday season.”

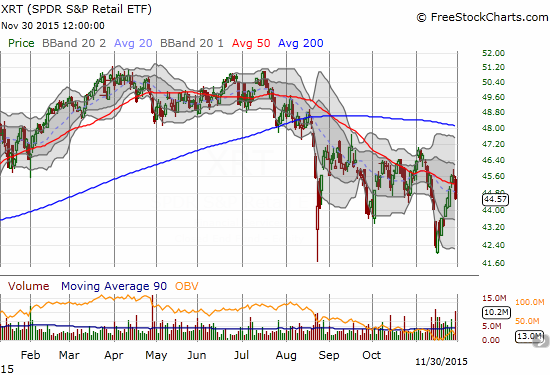

The disappointment could be seen in the 2.2% decrease in the SPDR S&P Retail (N:XRT). Trading volume surged as XRT broke down below its downtrending 50-day moving average (DMA).

Unlike the general market, like the S&P 500 (N:SPY), XRT has yet to recover from the selling of the “August Angst”

This quick trigger reaction is of course no guarantee of future selling. However, this further confirmation of resistance at the 50DMA at such a time provides a strong case for going short. I started with put options expiring in January. The trade ends if XRT manages to close above its last high at $46. I am targeting fresh lows on XRT.

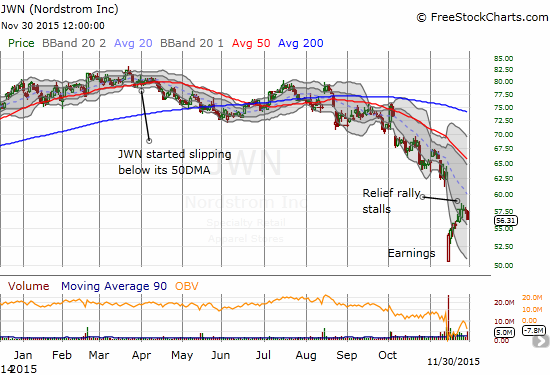

The drop in retailers created definitive bearish patterns across a spectrum of retailers. Nordstrom (N:JWN) is one of the most compelling bearish charts. JWN gapped down hard from earnings in mid-November. Buyers took the reins immediately and sent the stock well into its gap down. The rally notably stalled the day before and after Thanksgiving. Monday’s 2.3% drop on high volume signals the return of the sellers…

Nordstrom’s (JWN) impressive post-earnings relief rally comes to a screeching halt in post-holiday trading.

Be careful out there!

Full disclosure: long XRT put options