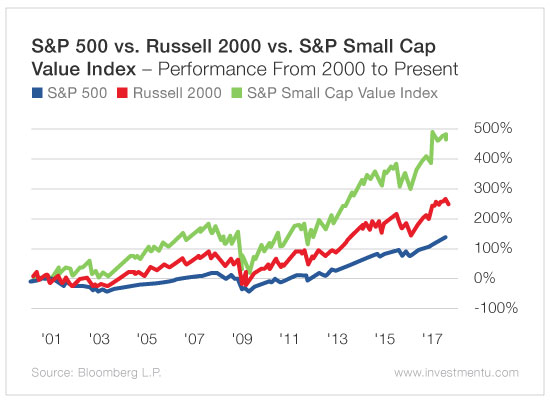

It’s always a bumpy ride for small cap stock investors... but it’s been worth it since the turn of the millennium. Small cap stocks have almost doubled the performance of the S&P 500.

Small caps in general have better opportunities to grow compared to large companies. And when you add a value component, returns really shoot to the moon.

Small cap value stocks are up 464% since 2000. They’ve more than tripled the S&P 500. That’s huge! And you can gain access to these returns.

There are many low-cost small cap value funds... but some are better than others. So I’ll list a couple of my favorites below.

But first, let’s take a closer look at small cap value stocks...

Small Cap Value Stocks

One powerful model that analysts use to value stocks is the Fama-French three-factor model. It incorporates market risk, value and market cap components.

The creators, Eugene Fama and Kenneth French, back-tested thousands of random stock portfolios. They found that the three factors explained 95% of a portfolio’s return compared to the market as a whole.

The research showed that small cap stocks outperform large cap stocks... and that value stocks generally have higher upside potential than growth stocks do.

The main downside for small cap value stocks is the short-term volatility. To capture the big returns, you have to weather the short-term swings.

But over the long term, small cap value stocks are outstanding investments. The chart above shows you proof of that. Yet few folks allocate a portion of their portfolio to them.

When optimizing your portfolio, you should first look at your long-term goals. This will help you determine if small cap value stocks are a good fit. The Oxford Wealth Pyramid gives you more insight into asset allocation.

If you determine small cap value stocks should play a part in your portfolio, the funds below are a good place to start...

Two Funds for Outsized (Long-Term) Returns

{{1007937|Vanguard Small Cap Value Index}}: Vanguard is known for its low-cost funds, and this one doesn’t disappoint. Its expense ratio comes in at 0.19%. That’s 85% lower than the average expense ratio of funds with similar holdings.

SPDR S&P 600 Small Cap Value ETF (NYSE:SLYV) : This fund includes stocks with market caps between $400 million and $1.8 billion. The stocks also have strong value characteristics based on price-to-book value ratio, price-to-earnings ratio and price-to-sales. The expense ratio comes in at a low 0.15%.

Both of the funds above are a great way to invest in small cap value stocks. If you have a long-term investment horizon, you should consider adding them to your portfolio.