As stocks stretch further into record territory, fears about a sudden turnaround are on the rise. More and more investors are digging into their portfolios, working to ensure the safety of their stocks.

And as fear rises, folks want only the best of the best.

We can help.

We recently published an article that turned quite popular, quite quickly. It was about the key difference between price makers and price takers - the rare companies that can set their own prices versus the vast majority of firms that can get what the market gives them.

Several readers asked us for more examples. They wanted ticker symbols.

We’ll give you some stocks below. But let me warn you: That’s like the professor giving the students the answer to the exam. It’ll get you through the test, but you’ll fail when you’re on your own.

So instead, let’s take a different path. We’ll show you a metric that’s a critical indicator of a price maker... and then we’ll look at a few examples.

In the end, you’ll have a few strong examples and, most important, the knowledge to find your own.

Last time, we looked at Amazon as a shining example of a price maker.

With virtually no competition, its customers (not consumers, but the companies pushing their products on its site) are forced to take the prices Amazon offers.Sellers often pay 15% or more of their sales to the company. If they want to get their goods listed on the ubiquitous site, they don’t have a choice. They’ll pay the price.

So how do you find other companies like Amazon? Here’s the key: One of the simplest measures of profitability - profit margin - is also the best measure of a firm’s ability to set its own prices.

Simply put, companies with high gross margins are price makers.

For this exercise, we use gross margins instead of net margins because it’s a much cleaner look at how much the company gets for its products versus how much it puts into them.

To calculate it, simply divide gross profit (near the top of the statement) by total revenue.

In other words, if a company has $1 of gross profit and $2 in revenue, its gross margin is 50%.

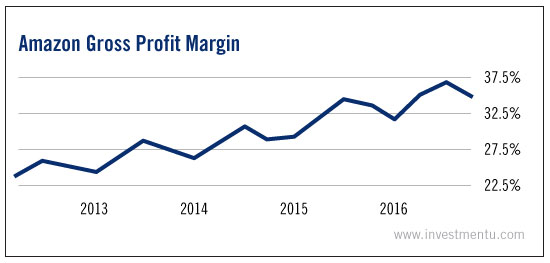

Amazon (NASDAQ:AMZN), not surprisingly, is a shining example of what a strong and growing profit margin looks like.

The web dominator’s growing profit margin is proof that it’s able to raise its prices without seeing a decrease in overall sales. It’s a sure sign of a price maker.

A strong reliance on human capital is a trait to search for that will help you find high-margin price makers.

Companies that buy parts from suppliers, slap them together and ship them out often have tight margins. But firms that use mainly the human brain have outsized margins. That’s why accounting and law firms are some of the most profitable on the planet.

Because of the strict rules on ownership in those industries, though, investors would be wise to look at other industries that depend on the brain - like the research-heavy pharmaceutical sector.

As the news has so often told us lately, drugmakers (and, oh yes, drug dealers) have some of the highest gross margins on the planet.

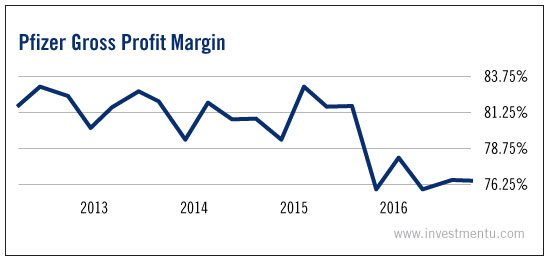

Pfizer, for instance, has an incredible gross margin - more than 76%. That’s because it uses human capital to create a unique product that it can charge virtually anything for.

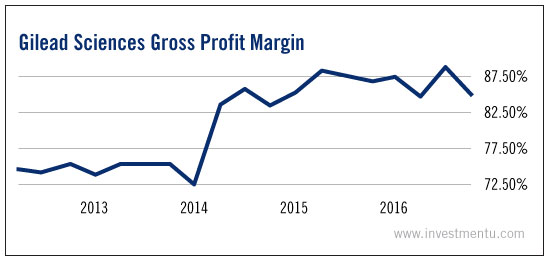

It’s an even better picture at Gilead Sciences. Thanks to its reliance on the human brain, its gross margin is just shy of 85%.

In other words, for every dollar that hits the cash register, the product costs a mere $0.15.

Again, both of these companies hit hard on the three traits of a price maker that we introduced in our last article.

- A price maker has a high barrier to entry.

- It has a monopolistic lead on its competition

- Consumers have imperfect knowledge of the market.

Like we said, as the markets move higher and investor fear creeps higher along with it, it’s wise to search out the companies that can set their own prices. They’re the stocks that will hold their ground while others crumble.

Start your search for them by looking for companies with strong margins.

It’s a surefire sign of a price maker.