The next time you’re ready to buy a stock, ask yourself this simple profit-boosting question: “Is this company a price taker or a price maker?”

It’s a simple question that, if you follow the clues it leads to, will add significant gains to your trading portfolio.

In the digital world of instant information, pricing power is vital. The price discovery process that once took great effort, if it was even possible, can now be done with a few clicks on our keyboards.

Instantly, we can know what similar models of cars have sold for across the country. We can see what cattle in North Dakota traded for in this morning’s auction. We can search the web to find the absolute lowest price - on the planet - for a good we want to buy.

It’s a trend that’s shaken core parts of the economy in recent years and flat-out rules others. And yet few folks consider the idea in their investment models.

Take Wal-Mart (NYSE: NYSE:WMT) for instance.

Once one of the greatest price makers on the planet, its suppliers used to fear the company’s incredible ability to set prices. Now, though, it’s under attack. The giant’s notoriously tiny margins have been cut even further as online competitors offer many of the same products at even lower prices. The company’s CEO Doug McMillon said recently,

We want to get back to a point where we are playing offense with price because of the way we go to market.

Playing defense has hurt business... and shareholders.

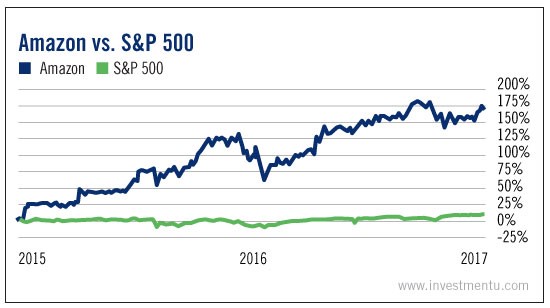

Amazon (Nasdaq: NASDAQ:AMZN), on the other hand, has a powerful offense. It’s a price maker.

With virtually no competition, its customers (not consumers, but the companies pushing their products on its site) are forced to take the prices Amazon offers.

Sellers often pay 15% or more of their sales to the company. If they want to get their goods listed on the ubiquitous site, they don’t have a choice. They’ll pay the price.

With no other company quite like Amazon, that trend won’t change until a competitor chips away at the company’s powerful pricing power.

In the meantime, shareholders will continue to do quite well.

But this vital business trait isn’t something that matters only in the evolving world of retail.

Far from it.

In fact, the commodity game is where investors must pay heaviest attention to the idea of price makers versus price takers.

Almost all companies producing or selling commodities are price takers. It’s the very definition of the commodity game.

But there are exceptions - very profitable exceptions.

For example, the average corn farmer lives and dies by the whims of the global market. But the niche farmer - in this case, the organic corn farmer - offers a different product. With his unique corn, he can charge a premium. And if he’s able to sell it to a small local market that doesn’t fully understand his costs, he can charge a large premium.

It’s similar with coal, oil or metal producers.

While nobody has slapped an organic label on a pile of coal quite yet (although they could - it’s a 100% organic product), miners that have the margins or the scale that allows them to wait for better pricing or to shake their head at lackluster prices have a much better, safer business.

It’s why OPEC was once so powerful - it had the scale and margins to control the market. But now so do so many oil firms across the globe... and OPEC has paid the price.

Again, it’s a simple yet overlooked concept.

If we create a list of just three traits that turn a price taker into a price maker, this is it.

- Price makers have high barriers to entry (big miners).

- They have a monopolistic lead on their competition (Amazon).

- Consumers have imperfect knowledge of the market (organics).

This is not a difficult or complex idea. It’s Investing 101. And yet so many investors fail to pay attention to it.

Before you buy your next stock, ask if it’s a price taker or a price maker.

It’s guaranteed to boost your profits.