With stocks grinding along near all-time highs, decent discounts (and decent dividend yields!) are thin on the ground. But if we look close enough, they are there.

The answer to this no-yield problem is simply going one step beyond the blue chips everyone buys. Our big dividends (at discounts) are lying there in a corner of the market that few serious investors pay attention to. That’s too bad for them, but great for contrarians like us.

I’m talking about closed-end funds (CEFs), which, as a group, yield around 7% on average as I write this.

And here’s the truly underappreciated thing about these high-paying funds: many of them own the big names of the S&P 500 anyway! So we can think of a CEF as a kind of dividend amplifier, taking the no- (or low-) dividend stocks we own now and boosting those payouts by 2X, 3X, even 4X.

CEFs’ 'Buy Indicator' Is the Answer to Overbought Markets

We’re talking CEFs because this is a great time to get into them. Plenty are still cheap. Thanks to their bargain prices, we can look to these funds for strong upside, as well as 7%+ payouts.

And if the market pulls back—a good possibility as volatility picks up again—these CEFs’ discounts let us sit back, collect our dividends and wait for calmer seas.

Here’s the lay of the CEF landscape: as of now, 329 of the 500 or so CEFs out there—or about two-thirds—trade below their “true” worth. And what I’m about to reveal is a proven way to separate the bargains from overbought CEFs ripe for a fall.

The Only Predictor of CEF Upside You’ll Ever Need

The key is a figure called the discount to NAV, which is the amount by which a CEF is trading below the market value of the stocks, bonds, real estate investment trusts or whatever assets it holds.

Any CEF screener will tell us the discount to NAV. Or we can get it straight from the fund company’s website.

That makes our strategy simple: we look for a discount that’s wider than usual, then buy and ride the price higher as the fund’s “discount window” slams shut. While that happens, we’ll be pocketing our sweet 7%+ dividends!

The Power of the Vanishing Discount

To show us how an evaporating CEF discount can build a market-beating return, let’s consider the Gabelli Dividend & Income Closed Fund (NYSE:GDV). Managed by legendary value investor Mario Gabelli, it holds established blue chips like Mastercard (NYSE:MA), Microsoft (NASDAQ:MSFT)and Honeywell (NASDAQ:HON).

GDV’s holdings are known for paying—and growing—their dividends, even if they don’t boast high current yields. Mastercard, for example, pays just 0.6% today; Microsoft? A mere 0.9%.

That doesn’t matter to subscribers of our Contrarian Income Report service. When I recommended GDV in October 2020, it yielded a gaudy 7.3% (and better still, GDV, like many CEFs, pays dividends monthly).

GDV is a textbook example of the income-producing power of CEFs: Gabelli takes stocks that mainly rely on price appreciation to generate gains and then, through his timely buys and sells, realizes those gains and pays them out to us as fat dividends.

And the best part is, we’re not abandoning price upside to get these big payouts.

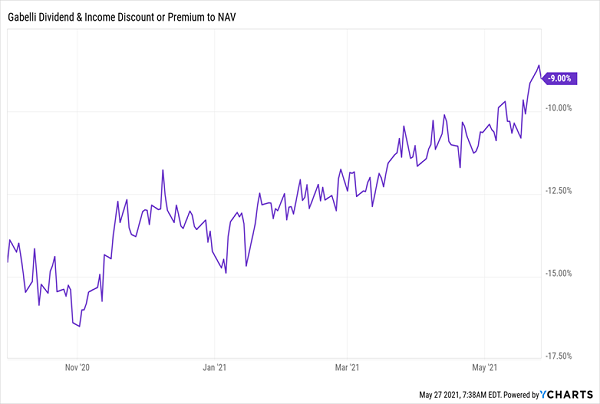

This is where the discount to NAV comes in: at the time of my buy call, GDV’s discount was an absurd 15%. In other words, we were getting its holdings of top-flight US blue chips for 85 cents on the dollar! As we can see below, that markdown bubbled away over the next eight months. It’s down to 9% today.

GDV’s Discount Shrinks

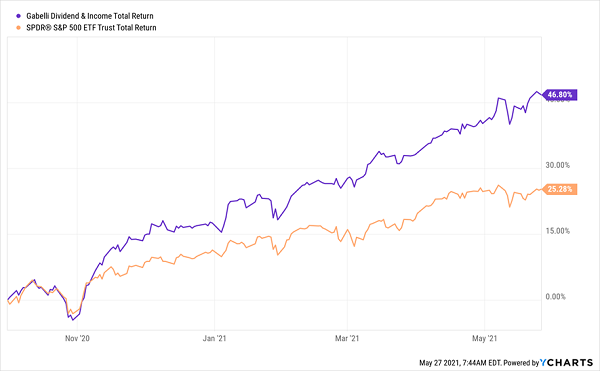

That helped propel GDV to a 47% total return in just eight months—double what the benchmark SPDR® S&P 500 (NYSE:SPY) returned.

GDV Outperforms With Dividends …

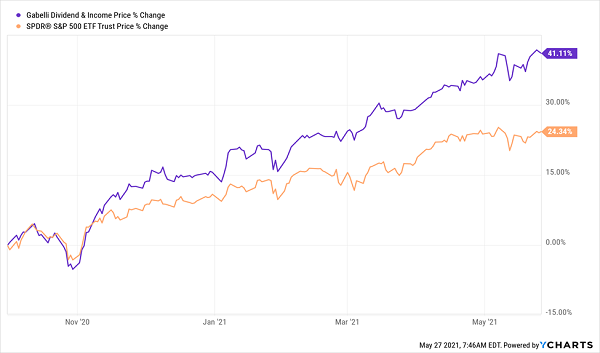

Heck, even just on a price basis (with GDV’s huge dividend set aside), it clobbered SPY. It just goes to show you how powerful that closing discount window can be:

… And Without

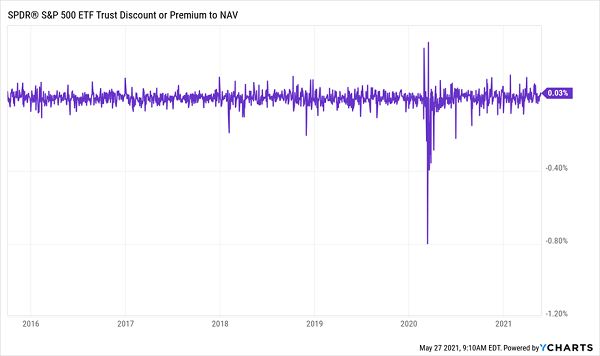

ETFs, by the way, never trade at a discount—the discount to NAV is solely a feature of CEFs and is the main driver of their upside.

You can see that with SPY, which only gave us a “deal” in the once-in-a-generation crash back in 2020. Even then, our “bargain” was just 0.8% and you needed cat-like reflexes to grab it!

SPY’s Last 'Deal': Blink and You Miss It

CEF Discounts Jolt Normally 'Sleepy' Asset Classes

Another nice thing about buying a CEF at a discount is that doing so can throw a nice lift under assets we don’t normally look to for strong price appreciation.

Consider high-yield corporate bonds, or “junk” bonds, and preferred shares, which are stock-bond hybrids that can trade on an exchange, like a stock, but trade around a par value and dole out a regular payment, like a bond.

When most people buy these assets, they do so through an ETF like the SPDR Bloomberg Barclays High Yield Bond ETF(NYSE:JNK) for corporates and the iShares Preferred and Income Securities ETF (NASDAQ:PFF) for preferreds.

Not in Contrarian Income Report, though. We almost always demand a discount—and these ETFs never give us one!

Instead, we buy our preferreds and corporates through a CEF like the Flaherty and Crumrine Dynamic Preferred and Income Closed Fund (NYSE:DFP), which holds both asset classes.

Back in October 2015, DFP traded at an 8% discount, so we jumped in. Right on cue, the CEF profit cycle repeated: today, DFP trades at an 8% premium to NAV! And that disappearing discount resulted in this:

DFP’s Discount Whips It Past the Benchmarks

As you can see, we’ve doubled our money on DFP (with dividends included) and we’ve more than doubled the returns of PFF and JNK, too! Best of all, DFP’s big dividend (which yielded 8.5% when we bought) means that two-thirds of our return has been in cash.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."