On August 20, 2015, I wrote “A Broad and Bearish Breakdown for the Stock Market” that described a converging set of indicators which flagged short-term bearish conditions in the stock market. The post happened to precede the August, 2015 flash crash by two trading days. It was one of those moments when the technicals worked exactly as a technician would hope (although I was also a bit early in playing a bounce from oversold conditions).

One of those bearish indicators was the amount of U.S. Federal taxation as a percentage of GDP. At that time, this percentage was at levels last seen in 2000 which meant it surpassed the peak from the last bull cycle. This level of taxation seemed destined to suck liquidity out the economy that might otherwise be used to pump up the stock market. Over a year later, it now looks to me that the timing of seeing this chart just ahead of the August flash crash was kind of a “happy” coincidence. The chart below is current through the third quarter of 2016 (the vertical axis, on the left, is percentage).

The level of Federal taxation relative to GDP peaked last year.

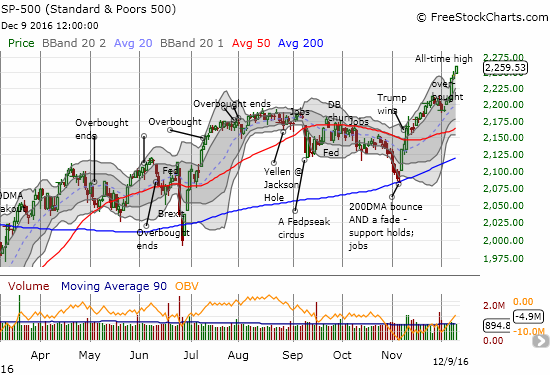

The S&P 500 (via SPDR S&P 500 (NYSE:SPY)) is now at new all-time highs and has managed to spend most of the year trading well above the sell-off levels from August, 2015.

The S&P 500 (SPY) accelerated into fresh all-time highs during the past week.

The index has maintained these lofty levels even as the percentage of GDP going to Federal taxes has stabilized around last year’s peak. This apparent contradiction of the liquidity thesis suggests to me that there is little use in trying to anticipate the kind of peak in the percentage of taxation that precedes a recession and/or a major sell-off for stocks. Indeed, I think it makes more sense to wait for this percentage to experience a sharp drop before using it as part of a bearish case. Of course, by the time these data come available, it may be too late to do react in a meaningful way. Stay tuned.

Market sentiment is also now firmly staring down any bearish liquidity thesis. Measures of sentiment suggest that market liquidity could actually increase in the near future. On December 9th, Nightly Business Report published a summary of the results of CNBC’s All-America Survey. Apparently, America is experiencing another post-election surge of optimism:

“The CNBC All-America Economic Survey for the fourth quarter found that the percentage of Americans who believe the economy will get better in the next year jumped an unprecedented 17 points to 42 percent, compared with before the election. It’s the highest level since President Barack Obama was first elected in 2008.”

The survey was heavily influence by political affiliation: Republicans have awakened from the dead; Independents are happy to hop along for the ride; Democrats have fallen into the pit of despair formerly occupied by Republicans although Dems were not particularly optimistic before the election anyway…

“The surge was powered by Republicans and independents reversing their outlooks. Republicans swung from deeply pessimistic, with just 15 percent saying the economy would improve in the next year, to strongly optimistic, with 74 percent believing in an economic upswing. Optimism among independents doubled but it fell by more than half for Democrats. Just 16 percent think the economy will improve.”

I know some incurable bears will look at these data and think it is time to get contrary. However, I caution the bears to look before they leap: I believe economic optimism is a lot different than elation over the stock market. Just as animal spirits can be blamed for recessions, economic bullishness can drive all sorts of spending and investing that can create virtuous cycles of economic activity. This economic activity in turn is hard for the stock market to ignore. This potential economic activity is completely separate from whatever the government will promise to add to the country’s economic engines. When investors get giddy and bubbly about the stock market, they are usually running far ahead of economic reality or trying to climb over each other anticipating hard to predict outcomes that sit somewhere far off into the future. In other words, government promises aside, we could very well have a stock market scrambling to catch up to economics rather than the other way around.

Moreover, this bull market is well-known for how much average investors have hated, despised, and mistrusted it. Retail investors were bailing at the beginning of this bull market and have rarely stopped since. As a reminder, I post below a chart the New York Times published on August 20, 2010. Notice the prescience retail investors showed AHEAD of the financial crisis: stock fund flows slowed sharply as the rally matured and even flipped negative right at the market’s peak in 2007!

Retail investors were actually shifting out of stocks AHEAD of the financial crisis….

Investors have readily traded in stocks for bonds. The contraction of interest in the stock market has been so thorough stock ownership is at an extremely concentrated level. Again, from Nightly Business Report:

“A Gallup poll conducted in April of this year stated that 52 percent of Americans say they invest in stocks, matching a record low, after hitting a record high of 65 percent in 2007…

New York University economist Edward Wolff estimated that in 2013 about 90 percent of all stocks were owned by the wealthiest 10 percent of households.”

And as crazy as it sounds with savings accounts earning next to nothing, as late as April Americans ranked stock market investments as barely more attractive in the long-term relative to savings accounts…

“A Gallup poll of American households in April of this year indicated that only 22 percent of Americans believe that owning stocks are the best long-term investment, a figure that has been declining for several years:

A full 35 percent of Americans think real estate is the best investment for the long run, while 17 percent say gold and 15 percent think it is savings accounts. Another 7 percent think the best investment is bonds, according to the poll.”

So yes, the current level of Federal taxation as a share of GDP may still not signal a suffocating lack of liquidity. There are a LOT of people STILL on the sidelines of the market. When the benchwarmers enter the game led by economic optimism, I am guessing that the stock market can and will run a lot longer and better than many of us might otherwise expect.

In the meantime, the market is putting on its first real show of post-election strength with the launch of an overbought rally that looks to get quite extended.

Be careful out there!

Full disclosure: no positions