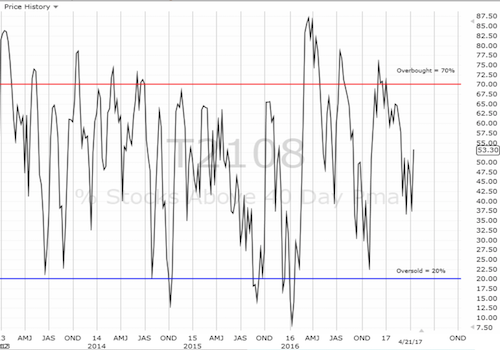

AT40 = 53.3% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 61.1% of stocks are trading above their respective 200DMAs

VIX = 14.6 (volatility index)

Short-term Trading Call: cautiously bullish)

Commentary

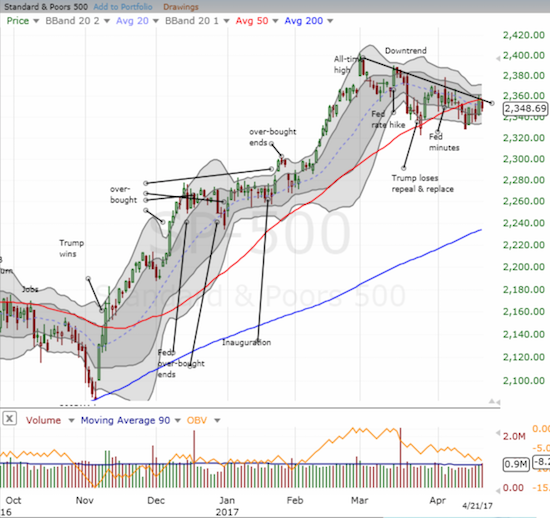

In the middle of last week, the S&P 500 (via SPDR S&P 500 (NYSE:SPY)) looked firmly locked in a state of stasis. The very next day, the index rallied right through resistance at its 50-day moving average (DMA) before closing directly beneath it. While sellers returned to close out the week, the pattern of higher lows continued even as the downtrend from all-time highs held as resistance. (Note that I redrew the downtrend one more time to align with the daily closes – the method recommended by Trader Vic in “Methods of a Wall Street Master”).

The S&P 500 is knocking on the door of a breakout as sellers gradually lose their resolve with higher lows.

Like the S&P 500, AT40 (T2108), the percentage of stocks trading above their respective 40DMAs, is knocking on the door. My favorite technical indicator closed the week at 53.3%. The previous day it closed 55.9% and set a marginally higher bar for the current trading range.

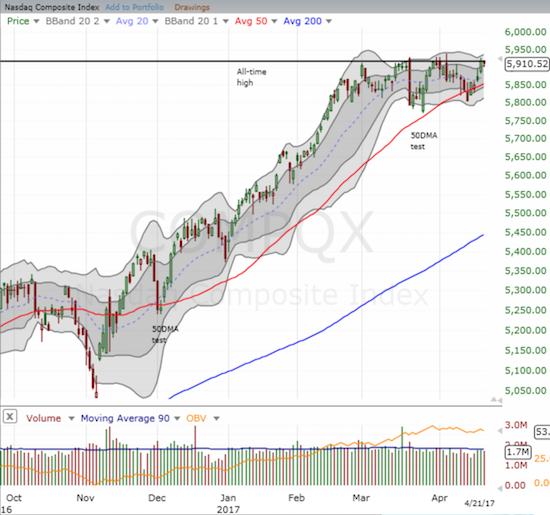

The NASDAQ (PowerShares QQQ Trust Series 1 (NASDAQ:QQQ))* is also knocking on the door. On Thursday, the tech-laden index made a new (very) marginal all-time high. The small slide on Friday leaves the appearance that the NASDAQ is finally ready to make a new major breakout.

The NASDAQ (QQQ) looks like it is ready to break out after several teases since March 1st.

While the stock market knocks on the door, the volatility index, the VIX, pivots. On Friday, the VIX once again demonstrated the significance of the 15.35 pivot. The VIX reached as high as 15.33 before fading back to a 14.6 close. Perhaps the volatility index is elevated because of looming geo-political risks. If so, the door-knocking by the major indices becomes all the more impressive.

The volatility index, the VIX, is finally elevated but now stuck around the 15.35 pivot.

In trading, my call options on ProShares Ultra S&P500 (NYSE:SSO) expired harmless. The upward momentum on the S&P 500 stalled out after the trade and then did not recover fast enough. I will lay off the options on SSO until earnings season is more in the rear view mirror.

“Above the 40” uses the percentage of stocks trading above their respective 40-day moving averages (DMAs) to assess the technical health of the stock market and to identify extremes in market sentiment that are likely to reverse. Abbreviated as AT40, Above the 40 is an alternative label for “T2108” which was created by Worden. Learn more about T2108 on my T2108 Resource Page. AT200, or T2107, measures the percentage of stocks trading above their respective 200DMAs.

Active AT40 (T2108) periods: Day #295 over 20%, Day #115 over 30%, Day #5 over 40%, Day #2 over 50% (overperiod), Day #36 under 60% (underperiod), Day #67 under 70%

Daily AT40 (T2108)

Black line: AT40 (T2108) (% measured on the right)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%)

Weekly AT40 (T2108)

Be careful out there!

Full disclosure: long SSO shares, long UVXY puts

*Note QQQ is used as a proxy for a NASDAQ-related ETF