After spending several sessions deciding on a direction, global stock markets seem to have taken a decision early this week. The direction is down.

Leading the losses are the tech stocks, which had largely outperformed the market during recent periods of volatility but are now receiving their comeuppance. The NSDQ100 is down more than 1% at the time of writing.

Investors on Wall Street are now looking to a new indicator of the durability for this market, the IPOs of two much-anticipated shares. Dropbox will be going live this Friday and Spotify will be open for public trading on April 3rd.

The scope of sentiment from investors looking to add these two tech giants to their portfolios should give us a nice indication of how confident they are in the entire market.

Two new pages have now been added in eToro where you can discuss your views on SPOT & DBX with all the traders on the world's greatest social investment network.

Today's Highlights

Brexit Transition

Crypto G20

The Size of the Bitcoin Whale

Please note: All data, figures & graphs are valid as of March 19th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

Also moving this morning is the British Pound Sterling. Several updates are expected regarding a possible Brexit transition deal with the European Union.

The European Commission is expected to convene for an urgent Brexit announcement, which will be streamed live at 12:45 in Brussels at this link.

The buzz on social media and in the press is that they will be discussing a possible transition deal that will carry both sides through the Brexit process.

The GBP/USD is up sharply this morning and is now trading near the middle of its range.

Remember, no matter what happens with Brexit today, the focus is likely to shift quickly to the Bank of England's interest rate decision, which is happening on Thursday, and of course the US Fed's rate decision on Wednesday.

G20 Meetings

Updates from the meetings today and tomorrow will be closely watched both by traditional investors and cryptotraders.

A six-page letter sent from the FSB Chairman Mark Carney to the G20 was published last night and has since been widely circulated in the crypto community.

Carney is also the Governor of the Bank of England and is widely considered to be a thought leader on all things economic. His speech to the G20 in February 2016 provided a backstop for the global economy and very likely caused the world not to go too far with negative interest rates.

In the letter, he points out that cryptocurrencies are now less than 1% of the world's GDP and so are not a threat to the global financial system.

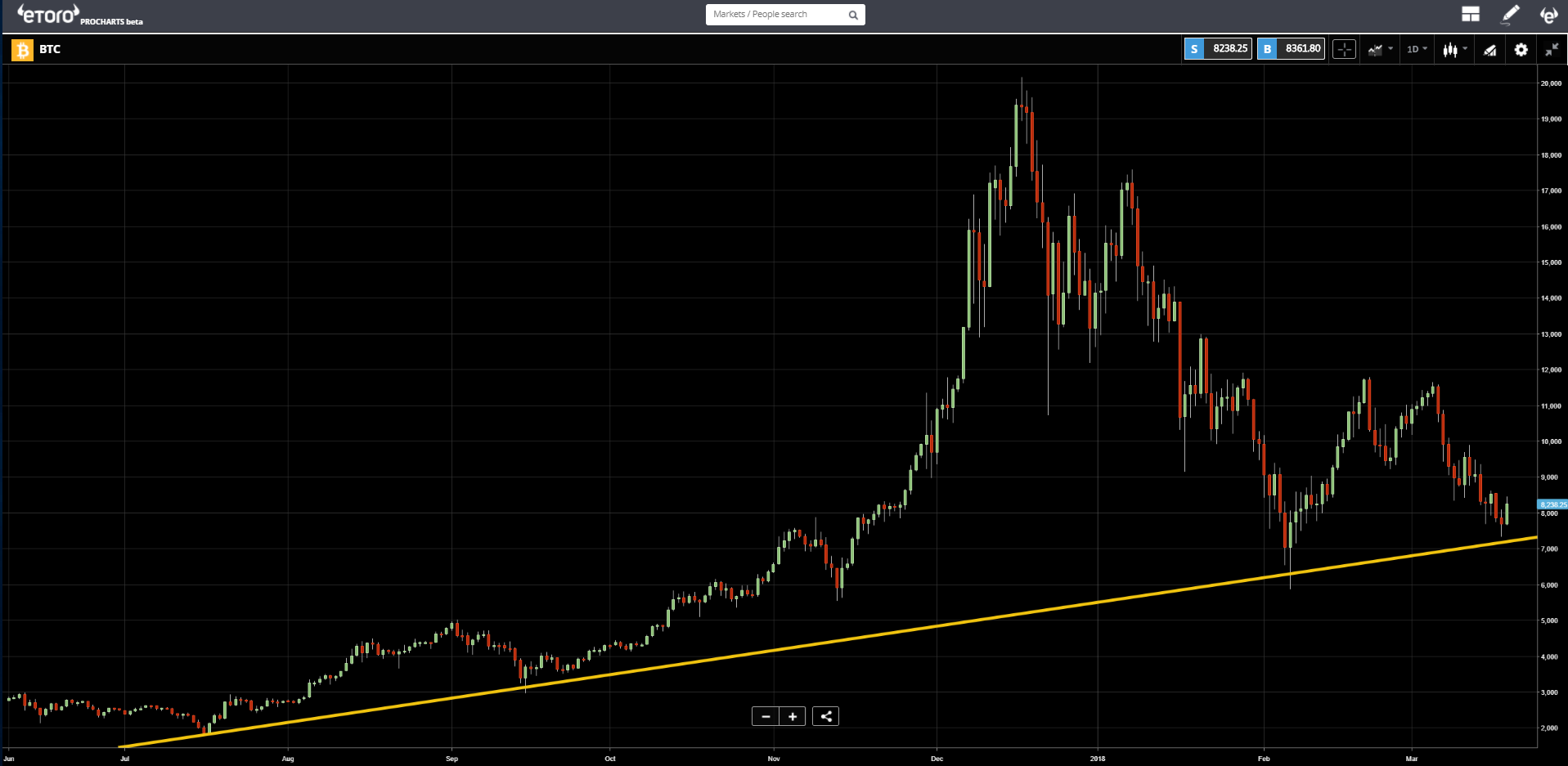

Soon after the letter was published, the price of Bitcoin) and other cryptos saw a massive surge. This push from the lows could not have come at a better time. As you can see, the price was just testing that long term trendline (yellow) and a turnaround here would certainly be welcome by Bitcoin bulls.

Nevertheless, the meeting is far from over, in fact it has just begun. What I'm waiting for are the updates expected from Japan regarding some proposed AML (anti money laundering) measures.

Size of the Whale

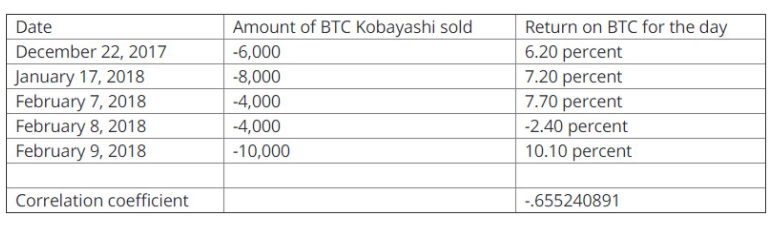

Many of you will no doubt recall the recent announcement that Nobuaki Kobayashi, the trustee charged with the assets in the case against Mt. Gox, was selling off a large amount of BTC and BCH on the open market.

The good news is that a recent analysis indicates that the effect on the market may not be as big as we all thought.

As we can see, all in all there were 6 massive transactions and on five of those six days the price of Bitcoin went up.

What else?

Vladimir Putin has won another six-year term in office with almost 74% of the vote in his favor. For some reason though, the Ruble doesn't seem to be celebrating and the USD,RUB has spiked up on the announcement.

Also, watch for rumors that Twitter will be joining Facebook (NASDAQ:FB) and Google (NASDAQ:GOOGL) to ban cryptocurrency advertisements on the platform. I'm taking this one with a grain of salt though as the CEO of Twitter is also the CEO of Square (NYSE:SQ), which has recently added Bitcoin payments as part of its offering.

As always, please keep sending me your questions and comments. I'm really enjoying every one. Let's have an amazing week ahead!

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.