The tables could be turning for risk, with several JPY crosses looking like they’re finally topping out and due their anticipated corrections. With indices just off record highs and several markets pausing below key resistance (, and , just to name a few), it suggests traders are hopeful U.S. and China can sign this famous deal, yet doubts linger in the air. And with reports piling up that the U.S. and China to sign the famous “phase one” trade deal until December, then risk could be ripe for a correction.

This potential correction a couple of weeks ago with so many markets pausing at the said key levels. Now momentum has turned, the probability of downside for risk assets could be increasing, although equity markets are yet to play catch-up.

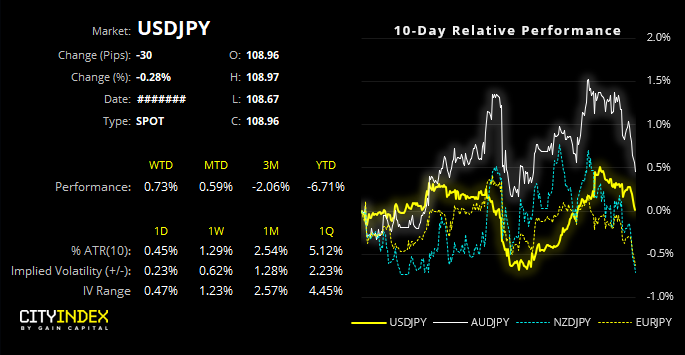

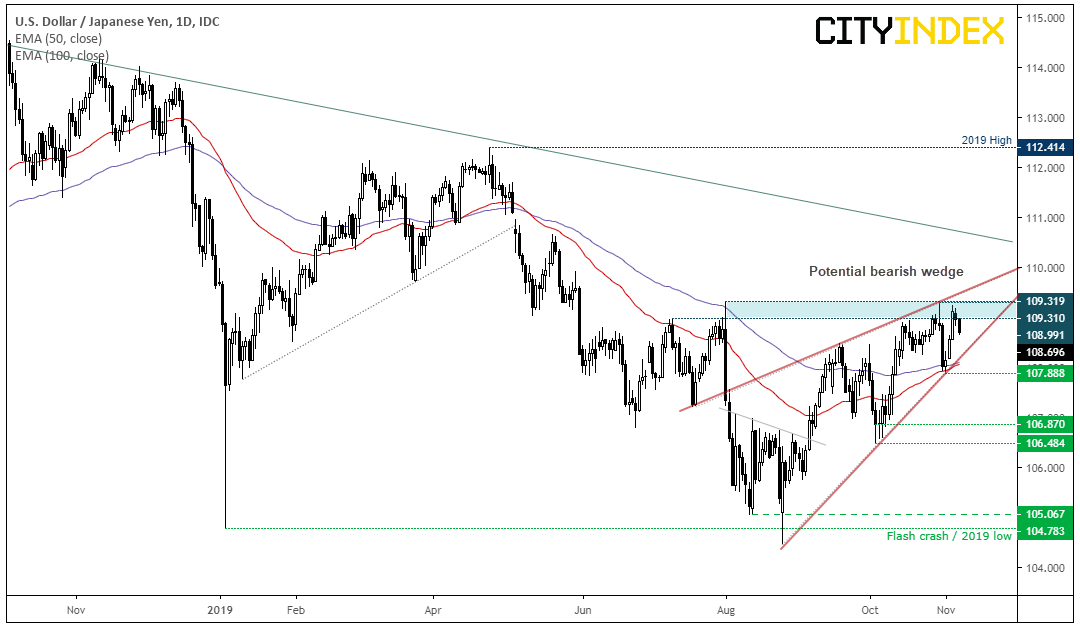

: A 2-bar reversal formed below the 200-day eMA. We outlined potential resistance following New Zealand’s and it looks like a correction is underway. That said, it appears may provide better downside potential.: A series of bearish pinbars stalled near the resistance cluster and beneath the bearish trendline. Moreover, price action has carved out a double top. Bearish momentum picked up at the end of the U.S. session and carried through to Asia, and now on the cusp of breaking key support. Bears could target the lows around 68 and/or the lower trendline.: One of the stronger performers against the since the August lows, price action reversed after perfectly hitting the upper bounds of the channel. A lower high has formed with a dark cloud cover and prices are now trying to make their way to 81.83 support. If this level breaks, the lower trendline becomes the focus for bears.: has broken out of its 100-pip range to the downside after printing a bearish pinbar beneath resistance. Given the resurgence of dollar strength, EUR/JPY may be more appealing to bears than .109.32 is clearly a big level for as it's tired and has failed to break this level three times. The elongated bearish engulfing candle marked prominent resistance on the 1st August and prices rolled over to print a fresh YTD low. Whilst a recovery saw it recoup losses, a bearish pinbar reaffirmed the key resistance levels, and prices have retreated from it once more with a bearish Harammi pattern today.

We could go as far to say that 109.32 could be the ‘phase one’ line in the sand so, without a deal, its hard to envisage a bullish breakout yet. Yet if we stand back there is the potential for a larger bearish wedge formation.

If successful, the bearish wedge projects a target near its base around 104.50. Bears could use a break of the bullish trendline, and target swing lows. However, we’d typically want to see direct losses out of such patterns (as it should be an impulsive move). So if the breakout lacks momentum, the probability of a failed pattern theoretically increases.Bulls could wait for a break above 109.31. However, we’d want to see this done with decent momentum, otherwise it could just be the bearish wedge carving out another high. Obviously, we’d want to see risk-on generally for a bullish breakout which would require broad yen weakness, higher equities and yields.Original Post