The past few days have been quite an emotional and price roller coaster. I’ve got one of my “deep thinking” posts tumbling around in my head that some people really like; whether or not I actually write it remains to be seen. So I’ll just do a low-thinking chart post.

One nifty way to look at where the big bounce has put us is the Semiconductor Index, which has been an important guide to market strength and weakness. It’s perfectly nailing the underside of its trendline, which is serving its role as resistance. This is a likely turning point.

Obliquely related to that is interest rates: my view is that interest rates are going to fall, and they’re going to fall hard. Our friends in Gainesville keep stating how interest rates are going to skyrocket. I’m just a simple chartist, not a wave-head, so I just don’t buy it. Here’s the U.S. 10-Year yield:

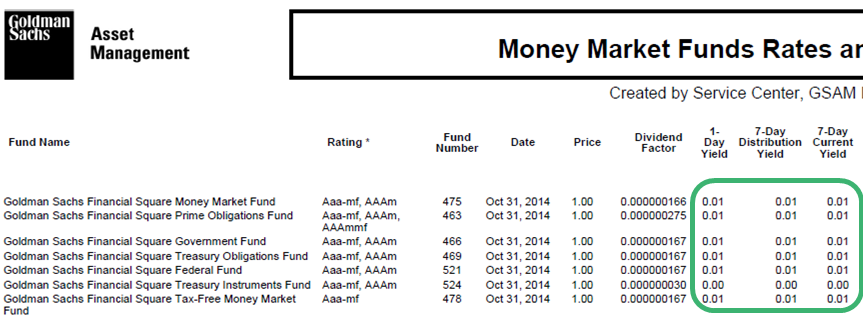

Speaking of rates, my prime broker wrote me today and, with a straight face, excitedly announced that I could choose any of these sweep accounts to earn one basis point (that’s one hundredth of a single percentage point of interest). Gosh, look at all these (identical) choices; it’s no wonder people feel “forced” into risky assets!

Lastly, I shorted iShares MSCI Emerging Markets (ARCA:EEM) yesterday. With the insane trillion-dollar/year asset whoring that the JCB started, it’s astonishing to me that markets remain relatively weak. Emerging markets in particular have been kind of pitiful, so I decided to sell what was weakest. After the spanking I took last week, I decided it was time to amp up the shorts, so I added to my positions today, of which EEM was the biggest entry.