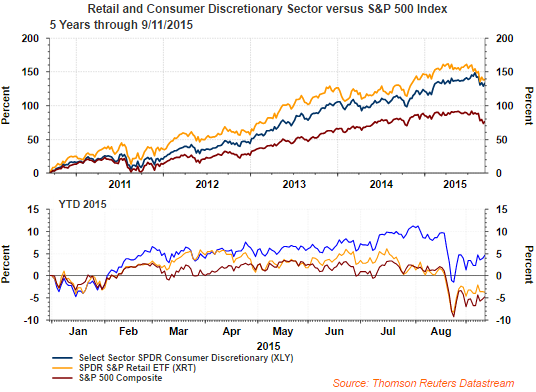

One aspect of the market's recovery since the financial crisis has been the strength of the consumer discretionary sector. Within the sector itself the retail industry group has outperformed both the S&P 500 Index and the overall discretionary sector itself. This strength could not occur over this long of a period without an improving consumer. The second frame in the below chart, however, shows the Market Vectors Retail (NYSE:RTH) ETF has begun to underperform the discretionary sector this year and is a potential sign of a weakening consumer.

This weakness in the retail sector is further confirmed by the very poor University of Michigan Consumer Sentiment Index preliminary results reported on Friday. The sentiment reading of 85.7 was over six points lower than the August reading of 91.9 and below the low end estimate of 86.5. Econoday's summary of this report indicates this may put a potential Fed rate hike on hold later this month.

"Just when you think you've gotten through the week, consumer sentiment dives and, perhaps, tips the balance against a rate hike. The mid-month September flash for the consumer sentiment index is down more than 6 points to 85.7 which is below Econoday's low-end forecast. The index is now at its lowest point since September last year.

Weakness is centered in the expectations component which is down more than 7 points to 76.4, also the lowest reading since last September. Weakness in this component points to a downgrade for the outlook on jobs and income. The current conditions component also fell, down nearly 5 points to 100.3 for its weakest reading since October. Weakness here points to weakness for September consumer spending. Inflation readings are quiet but did tick 1 tenth higher for both the 1-year outlook, at 2.9 percent, and the 5-year, at 2.8 percent.

New York Fed President William Dudley himself has said he is focused on this report as an early indication of how U.S. consumers are responding to Chinese-based market turbulence. These results offer a rallying cry for the doves at next week's FOMC meeting."