The U.S. stock market is not the only market to rise with alacrity since the start of the year. The Chinese market has also been going gang busters. In fact the Shanghai Composite is up over 20% from its early January low.

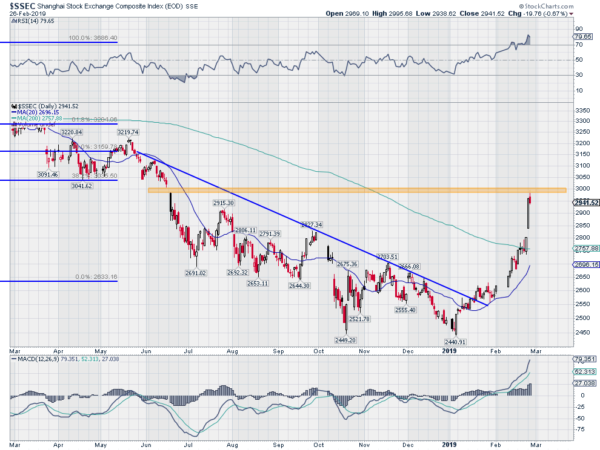

That is a good year for most. And perhaps that is why it may be time for a pause in the run higher. The chart below shows that after pushing over the 200 day SMA at the end of last week it has exploded to the upside this week. But the Composite is now at a critical area.

The big round number 3000 has left its mark. there is also a gap in the chart that causes some pause. Momentum is overheated with the RSI near 80 and the MACD at an extreme. Will this be the end of the run for the Shanghai Composite? That is not clear, but a pause here to reset momentum would be welcome to long term holders.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.