My “New Commodity Bull Market” presentation at the 34th annual World Outlook Financial Conference Feb. 5, 2021 was a follow-up to last year’s conference when I forecast a new commodity bull market was just-around-the-corner.

The slides for this year’s presentation are below—along with a few new charts and some editorial comment.

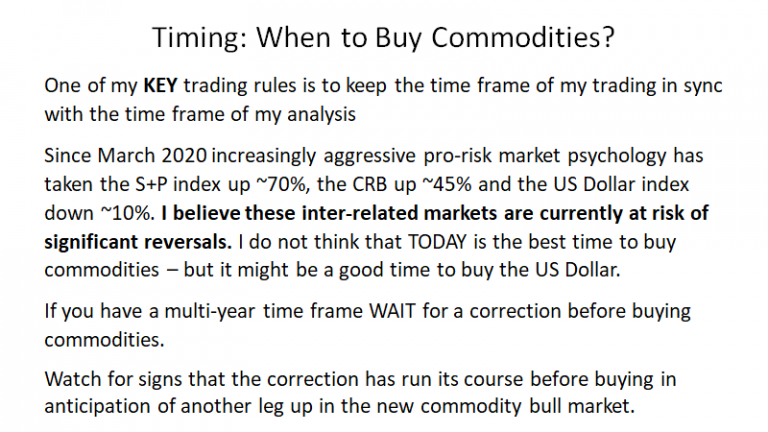

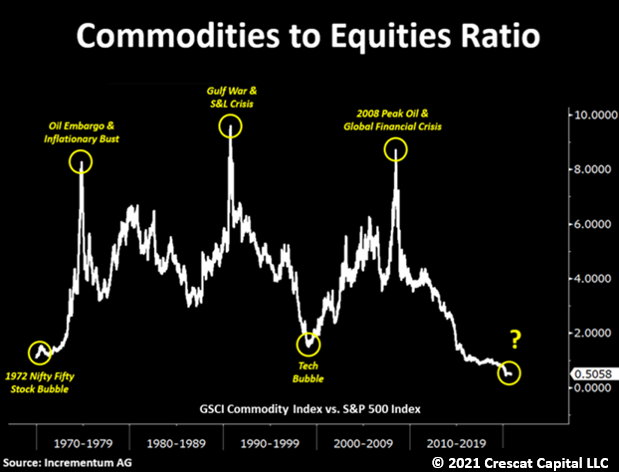

The main message of my presentation is that commodities began a new bull market in March/April of last year and that commodities are especially cheap relative to stocks and bonds.

However today is NOT the best time to buy commodities.

Reflation Trade Narrative

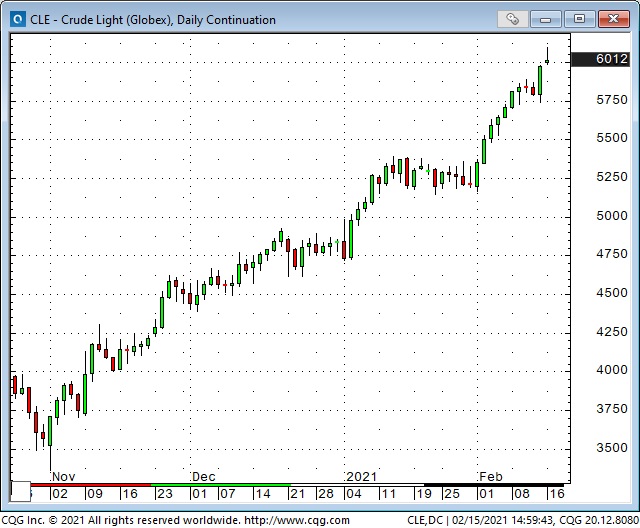

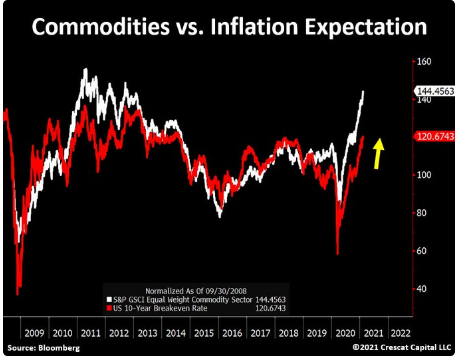

The “reflation trade” narrative that has caused stock markets to surge higher since early November has also caused commodity prices to soar–oil, for instance is up ~75% in just over 3 months.

I expect at least a “correction” to the current “reflation trade” and that will be the time to look for long-term buying opportunities in the commodity markets.

New Commodity Bull Market

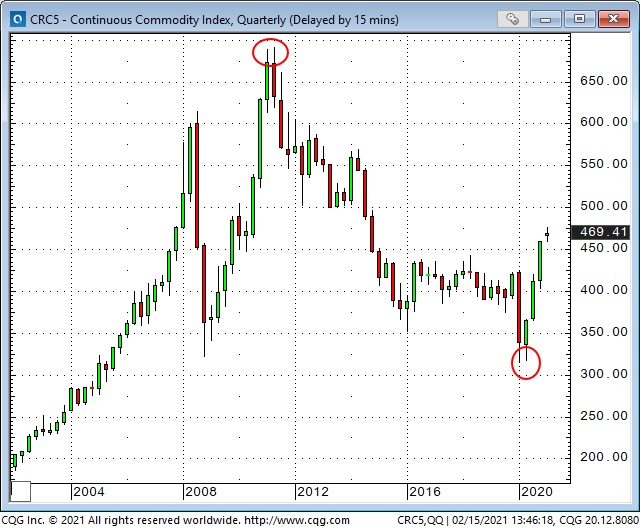

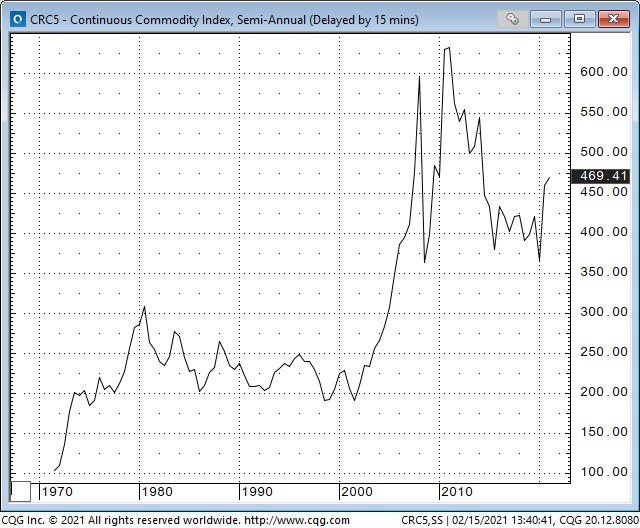

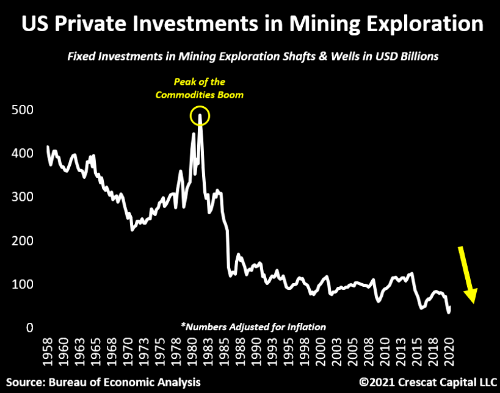

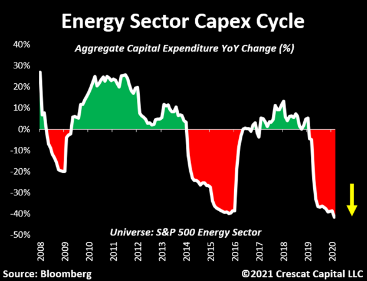

I think a new commodity bull market started in April 2020 after a brutal 9 year bear market that cut prices by >50%.

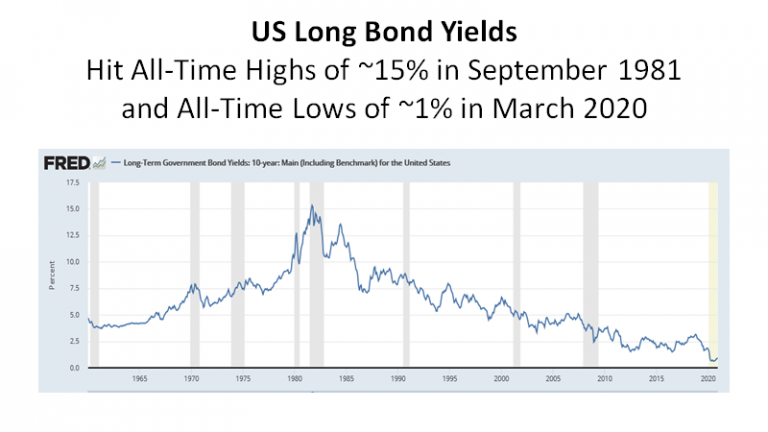

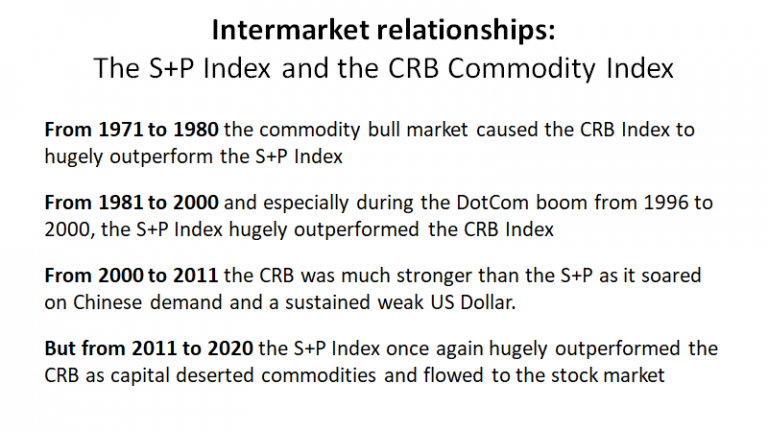

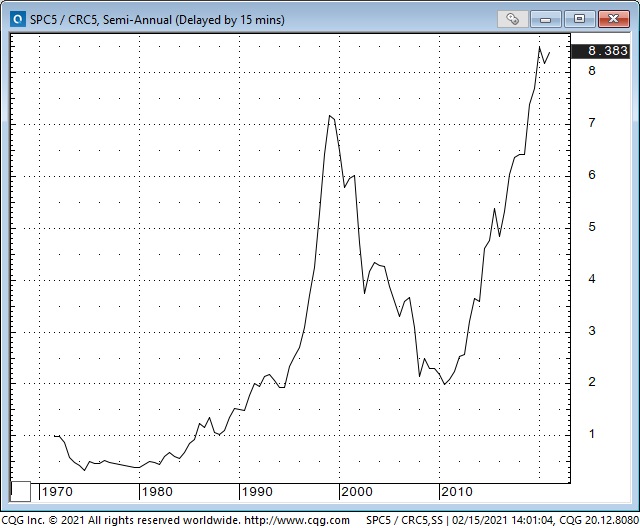

Inter-Market Relationships

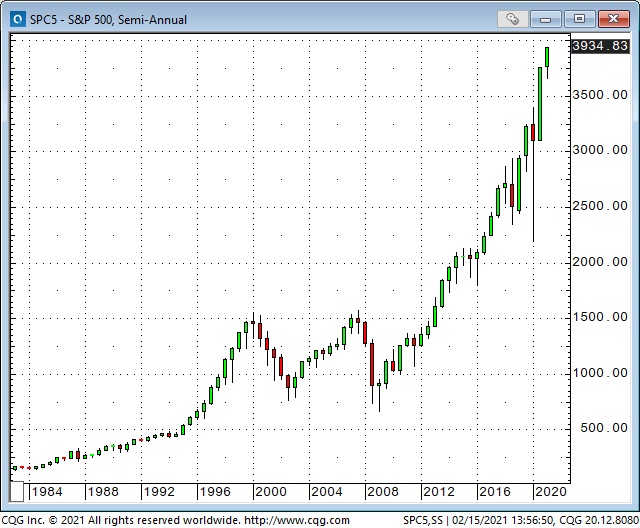

Interest rates falling for 40 years created a very bullish environment for the stock market and the real estate market.

Commodities outperformed the stock market during the inflationary 1970s. From 1981 to 2000 the stock market outperformed commodities. The CRB got revenge from 2000 to 2011 but since 2011 the S&P has been the clear winner! I think commodities will outperform stocks over the next few years.

Ideal Conditions for a Sustained Commodity Bull Market

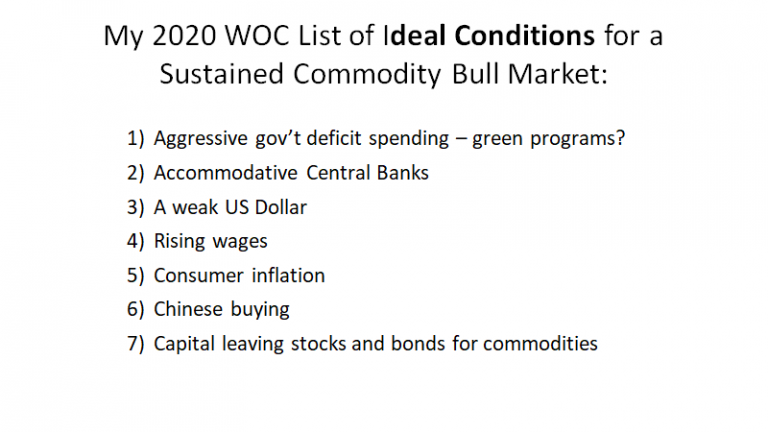

The 2020 World Outlook Financial Conference was Feb. 7 & 8—just 2 weeks before the stock market began a steep tumble into the March lows. I told my audience that I thought stocks were at risk of a correction, that I owned bonds and I set out my list of Ideal Conditions for the coming commodity bull market.

Several of my “Ideal Conditions” for a commodity bull market have developed over the past 12 months and commodities have had a sharp rally. I think the rally has much further to go, after a “correction” to the current “reflation trade.”

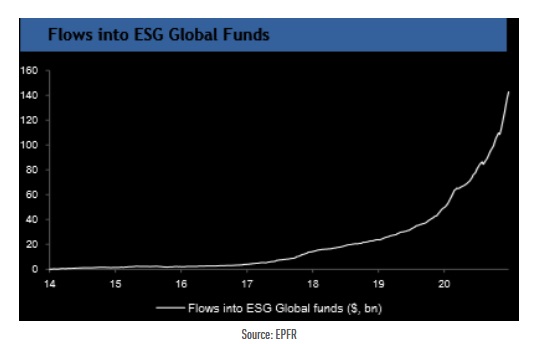

Capital flows into ESG Global Funds are accelerating and give us some idea of the growing impact (both positive and negative) that climate change policies will have on markets.

Soybean prices have jumped >50%, corn is up ~90% since year-ago lows on heavy buying from China.

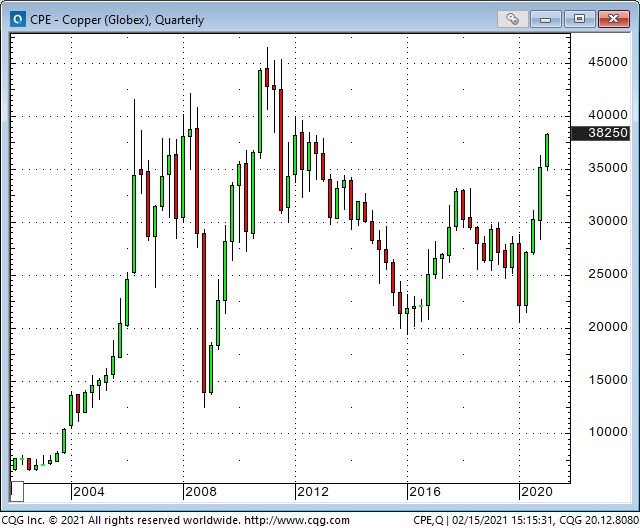

Copper prices have soared ~85% in the last 11 months on expectations that demand will outstrip supply in our new “electric” world.

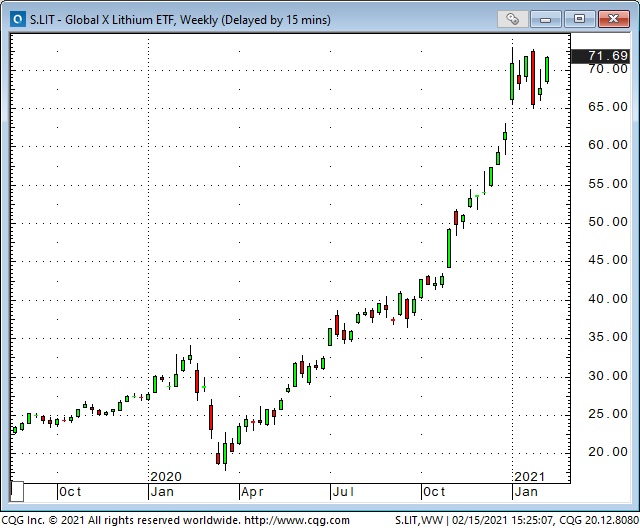

Lithium prices have nearly quadrupled from last year’s lows on expectations that “battery” demand will outstrip supply.

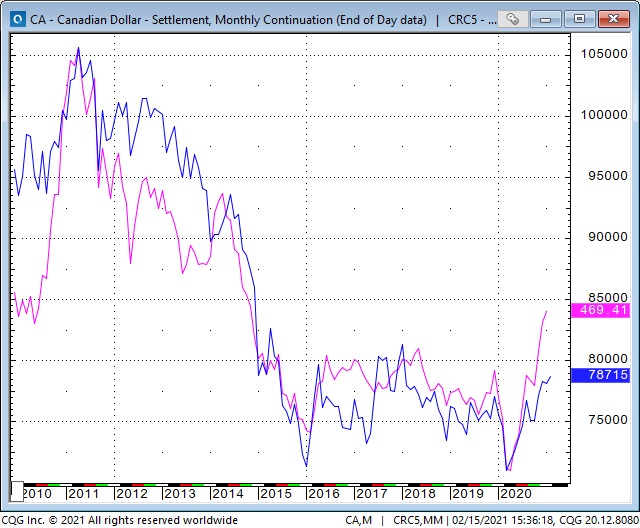

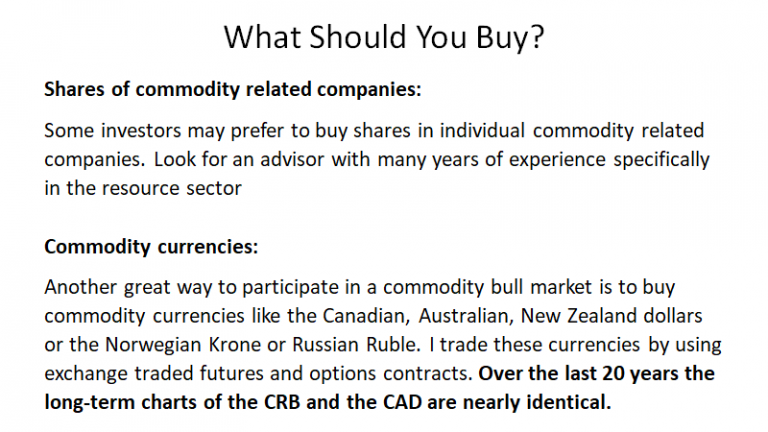

In this chart the CRB Total Return is pink and the Canadian dollar is blue.