I said over the weekend that, “It’s been a long time since I’ve felt so energized about the stock market. Bit by bit, things are truly beginning to break down.” The 900 point drop on the Dow I was staring at yesterday helps explain why.

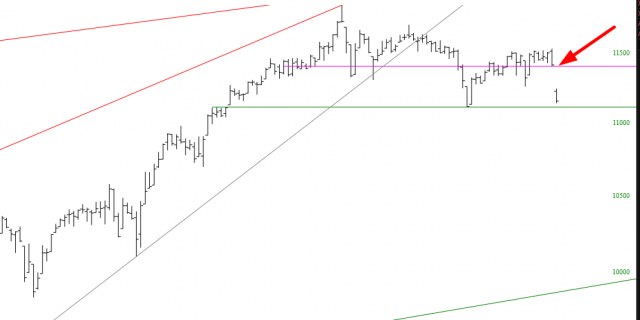

Monday provided us an exceptional new ally in the form of a major price gap. I’m not even afraid of Fed Chair Jerome Powell anymore. I’ve got fantastic positions, and I think he’s going to have knives thrust into his eye sockets in the months ahead. Here, for example, was the Dow Jones Composite. Go ahead, Powell, Rally up to the magenta line again. Once that green line gives way you are beyond screwed.

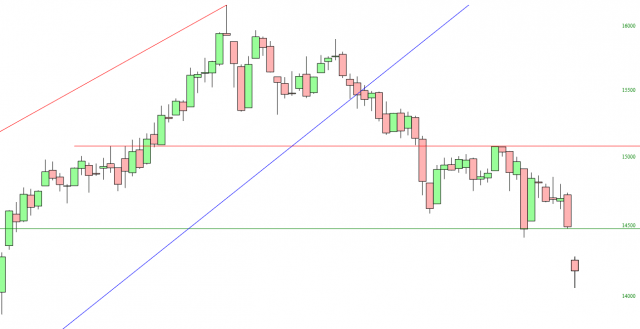

Similar setups abound. The Dow Transports, for instance, have completed a marvelous inverted cup with handle pattern and were sporting the same terrific gap that just about every financial instrument has now.

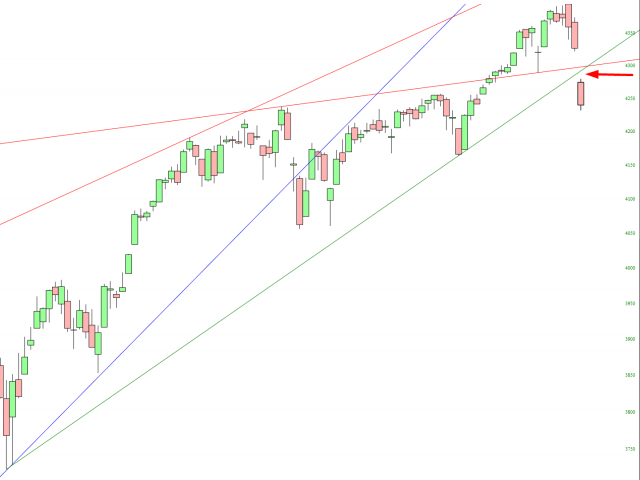

The S&P 500 reached its highest point in human history just five days ago. The 15th of July is probably a day we’ll commit to memory, just like Mar. 6, 2009, in terms of major turning points. The trendline failure here is just what the doctor ordered.

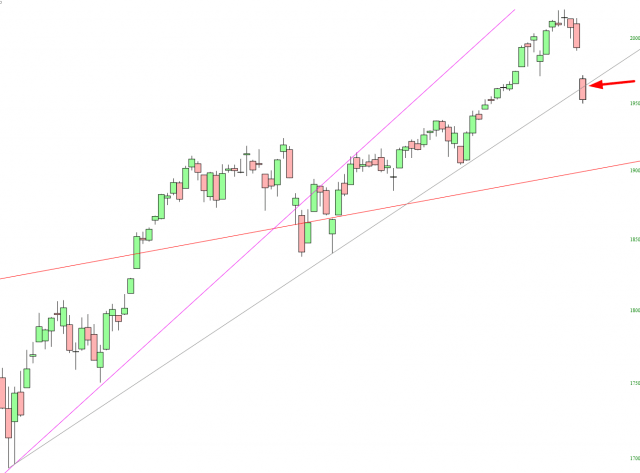

The more narrow S&P 100 had a similar situation.

I think my task has suddenly become gloriously boring, since I love my positions and don’t really need to tend to them. I’ve got SOME cash waiting in the wings, in case something gets bid back up again, but on the whole, it’s time to be a relaxed bear.