Oh boy... here we go. It’s election week.

It feels like our wedding day all over again. We spent the last year hoping it would get here fast... but now that we’re about to make the big commitment, we’re nervous as hell.

What the next few days holds for our grand union, nobody knows. It’s an idea that has markets on edge.

Throughout the last five days, the go-to gauge for volatility - the VIX - made a steady march higher. In a whopper of a week, it surged by more than 50%.

Clearly, investors aren’t too excited about what could happen on Tuesday night.

It’s why I want to tell you about a type of stock you must own as risk runs higher. I call them HERO stocks.

Or to be a whole lot clearer, they are stocks that boast High Earnings and Reliable Outcomes.

You’ll have the chance to learn about four must-own HERO stocks below.

I’ve written about these . Often, these are the kinds of stocks you’ve never heard of. Like most heroes, they do their best to stay out of the headlines. But they do their job of creating outsized wealth reliably and honestly.

You can invest in HERO stocks and trust your money will grow... most often, far outpacing the headline-driving fad stocks.

The last HERO stock we looked at was General Mills (NYSE: NYSE:GIS) - a stock that’s more than doubled the results of the S&P 500 over the last decade - with far less volatility.

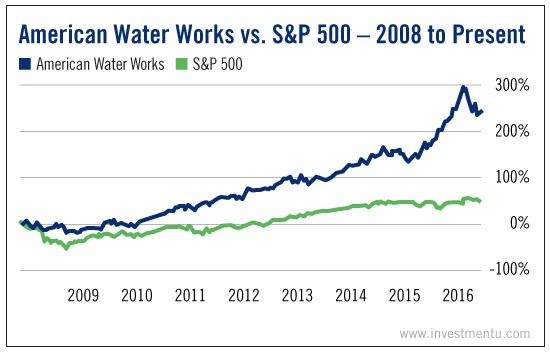

American Water Works (NYSE:AWK) is perhaps even more conservative... and yet its performance has been even stronger. So far this year, it’s up 20% versus a virtually flat market. And during its publicly traded existence, it has outpaced the S&P 500 by more than 4-to-1.

It’s not hard to understand why American Water Works is a go-to stock in a high-risk market. It’s all in the name. The company offers the ultimate recession-proof product... water.

As a provider of public water, the company sells a product nobody can live without, and it has a monopoly nearly everywhere it works. No matter what happens to your job or your portfolio - and no matter how bleak the election outcome on Tuesday - you’re going to pay your water bill next month.

One of the key metrics for a HERO stock is beta. Think of this figure as a correlation to the overall market. A stock that boasts a beta of 1.0 has a perfect tie to the S&P 500. If the index moves higher by 1%, the stock moves higher by 1%.

A beta of zero means there’s no correlation. While a beta of -1.0 tells us of an inverse correlation - if the market moves up by 1%, our stock moves down 1%.

Simple.

American Water Works has a beta of just 0.23. In other words, its share price doesn’t care much about what the broad markets are doing. It seems to keep rising and rising regardless of the headline du jour.

And in the rare instances where this ultra-reliable stock isn’t rising, investors can count on its rising dividend. Since 2008, the annual payout has risen every year - adding an overall increase of up to 70% in less than a decade.

Today, the stock yields 2.08%. That’s a nice yield considering American Water Works acts more like a growth stock than a value play.

But it’s that low beta that makes the company quite attractive these days. With so much political and monetary uncertainty, it’d be nice to know you have a HERO stock in your portfolio that’s ultrareliable and won’t succumb to market volatility.