It’s never a dull day in the financial markets, and we haven’t even reached the point where Donald Trump is officially honing in on the White House. There is little doubt that the rally in risk assets from mid-February onwards has been hugely unloved and many who have been involved have done so reluctantly. One of the key sources of the huge volatility we saw in January and February was the belief that central banks have little juice left in the tank, and traders felt increasingly vulnerable. How wrong that looks now. There is a growing belief that a number of key central banks have fought to regain credibility with a coordinated response.

Whether or not there has been a genuine coordinated response forged during the February G20 conference, there seems little doubt that the intention was to weaken the USD. Subsequently, the moves higher in EUR/USD and AUD/USD and lower in USD/JPY have not been a great help for the likes of the BoJ and RBA. However, reflation materializing in commodity and equity appreciation, as well as credit spread tightening, is offsetting this FX headwind. As long as the USD continues to attract sellers and implied volatility stays anchored, then risk assets will find buyers. It all sounds so simple, but traders continue to buy, but hate themselves for doing so.

Spot USD

Price action in the S&P 500 looks outright bullish and 2080 remains the upside target from the January/February double bottom. Just when we thought the market could roll over, this view of doing the opposite of what feels right comes into play again.

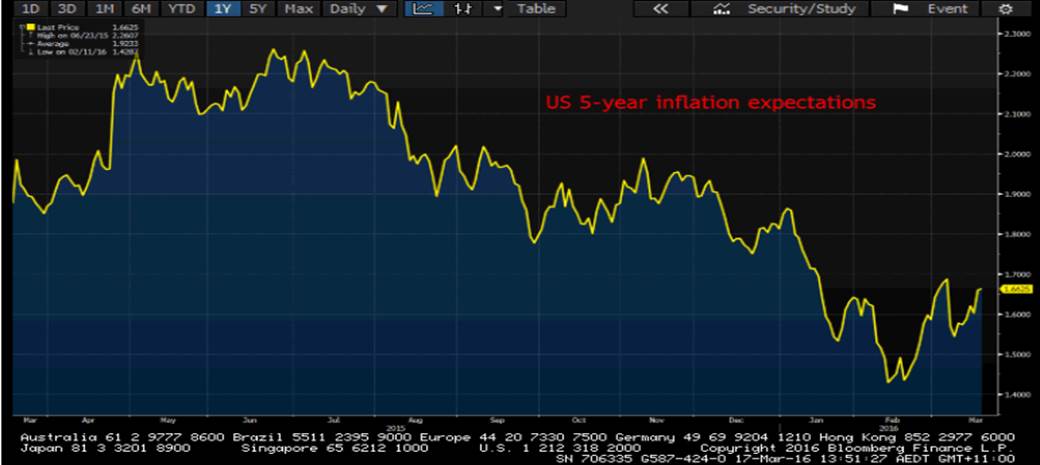

The Federal Reserve has inspired Asian markets today. Clearly, when the Fed are concerned by heightened global risk and persistently low inflation expectations, the result is traders reaching for the buy button. The Fed have used its fed funds projection (known as the ‘dot plot’) as a monetary policy tool, so by only implying two hikes in 2016 the Fed have in effect eased policy. The USD will find it hard to rally, and downside risks prevail in the short-term. While the likes of the RBA, who would have mixed feelings about today’s Aussie February employment figures, can only sit here and advise that they would ‘welcome a lower exchange rate’, as Guy Debelle said in his speech today. The fact the PBoC fixed the CNY 211 pips firmer is also providing support to risk assets (think additional purchasing power for Chinese importers) and clearly the PBoC are joining in the coordinated response.

As the USD goes, so goes risk. Emerging markets will do nicely in a weak USD environment, so put the iShares MSCI Emerging Markets (NYSE:EEM) ETF on the radar as it looks like it’s going higher if we focus on the daily chart. Gold will presumably do well if the USD is falling, as will oil, which has broken out today to the highest level since 4 January and is eyeing a break of $40. Importantly, five-year inflation expectations have pushed up six basis points and the Fed would take this as a small win.