Despite being in business for nearly thirty years, and having a core product dependent on manual human labor, this company is priced like a high-flying Silicon Valley start-up with disruptive new technology. With organic growth slowing and an acquisition strategy picking up the slack, we think expectations for future profit growth embedded in the stock price have moved beyond what the company can reasonably be expected to achieve. We see an unbalanced risk/reward scenario that does not favor investors. CoStar Group (CSGP: $271/share) is this week’s Danger Zone pick.

Acquisitions Drive Growth and Margin Volatility

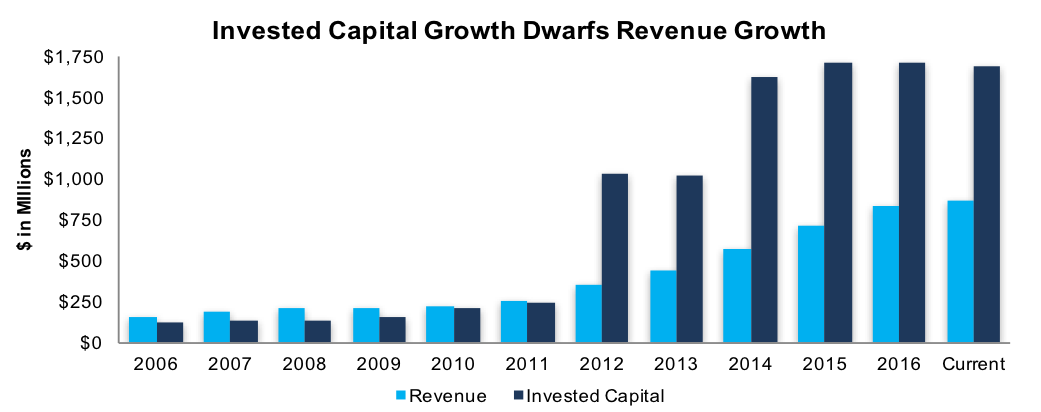

CoStar Group Inc. (NASDAQ:CSGP) has grown revenue by 18% compounded annually over the past ten years. Most of this growth (86% in dollar terms) has come over the past five years and has been heavily influenced by the acquisition of four real estate listing websites totaling $1.7 billion in deal value. 90% of the $1.7 billion went to goodwill and other intangible assets. After-tax profits (NOPAT) have grown 26% compounded annually over the past decade due to an increase in NOPAT margins from 6% in 2006 to 12% in 2016.

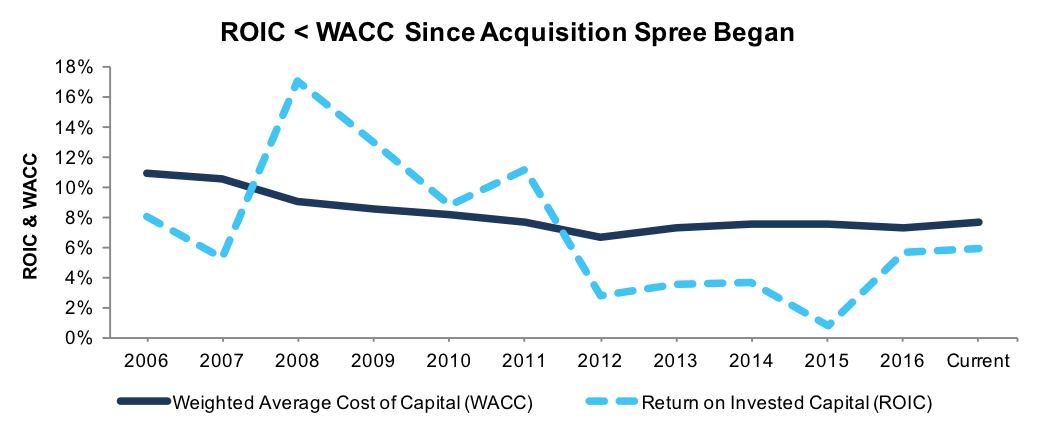

NOPAT margin has recovered from 2015’s deep decline, which was driven by high marketing costs to promote newly acquired brands. CSGP now generates a similar NOPAT margin (12%) on $864 million of TTM revenue as it did on $212 million of revenue in 2008 (11%). This lack of meaningful operating leverage should give investors pause when considering the potential for future margin or return on invested capital (ROIC) improvement. Per Figure 1 below, CSGP has failed to earn the cost of capital for over five years.

Figure 1: ROIC Is Below WACC

Sources: New Constructs, LLC and company filings

Free Cash Flow Consumed by Acquisitions

Over the past five years, CSGP has burned through $1.2 billion of cumulative free cash flow (FCF), largely due to the acquisition strategy of rolling up commercial real estate and apartment listing websites. More recently, the pace and size of acquisitions has slowed, and FCF has increased to $126 million over the trailing twelve months. Despite this increase, the stock’s 1% FCF Yield remains below the S&P 500 (2%) and its data/information provider peer group (3%).

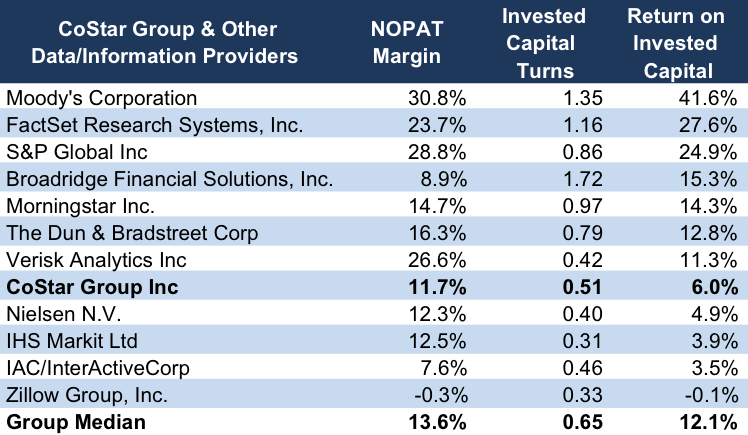

ROIC Depressed by Inefficient Balance Sheet

CSGP’s current 6% ROIC (TTM) is in fourth-quintile of our coverage universe and is well below the data/information provider peer group (median 12% ROIC) and the S&P 500 (18% ROIC). At first glance, CSGP’s low returns seem counterintuitive given a NOPAT margin (12%) in the top-half of S&P 500 companies and NOPAT growth of 26% compounded annually over the past decade.

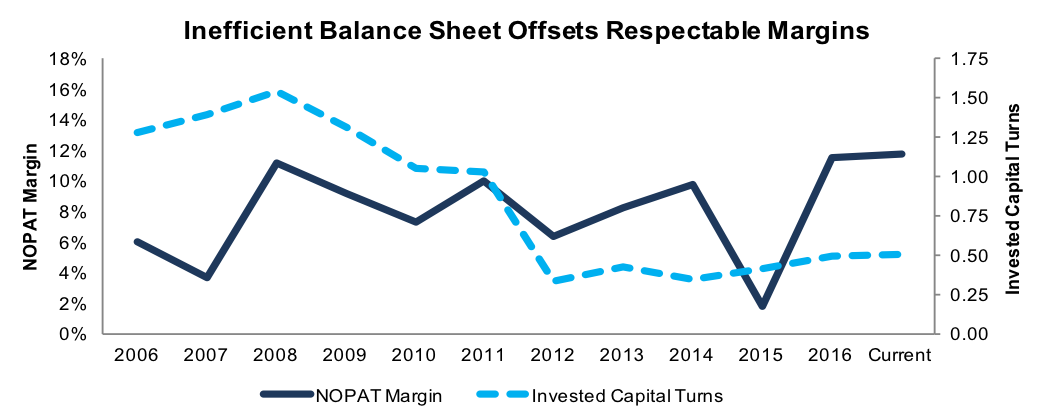

However, while margins look reasonable, the balance sheet does not. Invested capital has increased by 30% compounded annually over the past decade, from just $124 million in 2006 to $1.7 billion today. The exploding balance sheet makes margin improvement well beyond current levels imperative to value creation. If balance sheet efficiency (e.g. invested capital turns (revenue/invested capital)) declines, then margins have to rise enough to offset that decline; otherwise, ROIC declines even if margins rise.

Per Figure 2, CSGP generated a 17% ROIC in 2008 with a NOPAT margin of 11% on 1.5 invested capital turns. However, CSGP’s current NOPAT margin of 12% only translates into a 6% ROIC given the decline in invested capital turns to 0.5. Figure 3 displays the significant disconnect between margins and capital turns since the company began the acquisition campaign in 2012.

Figure 2: Decline in Invested Capital Turns Is More Than Rise in NOPAT

Sources: New Constructs, LLC and company filings

Figure 3: Paying Too Much For Revenue Destroys Shareholder Value

Sources: New Constructs, LLC and company filings

ROIC/Valuation Regression

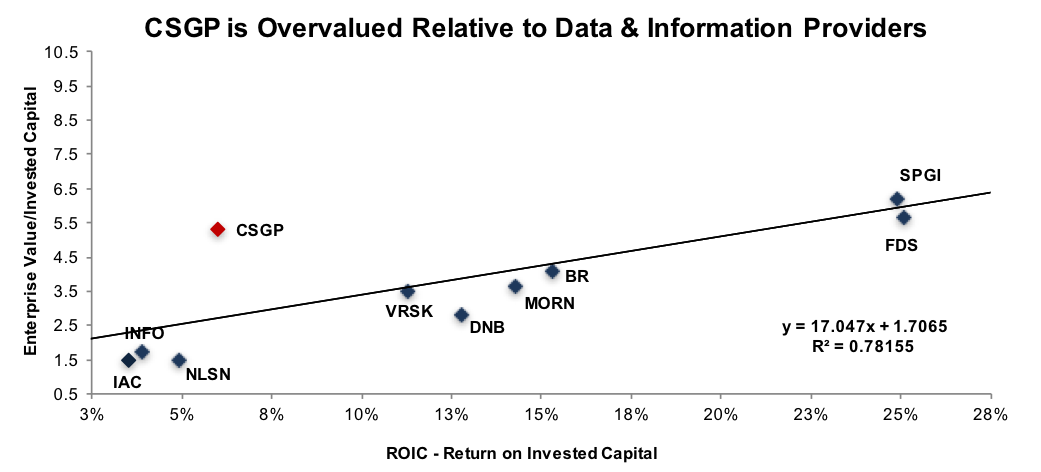

Per Figure 4, ROIC explains nearly 80% of the valuation difference among the selected data and information provider peer group. Despite CSGP’s relatively low ROIC (6% vs. 12% median for the peer group), the stock trades at a significant premium as shown by CSGP’s position above the trend line in Figure 3. If CSGP stock were at parity with the group, it would trade at $130/share – 52% below the current price.

Figure 4: Correlation Between ROIC & Valuation

Sources: New Constructs, LLC and company filings

Executive Comp Aligned with the Wrong Metrics

We know from Figure 3 above, and numerous case studies, that changes in ROIC are directly correlated to changes in market value. Accordingly, we favor executive compensation plans that use ROIC to measure performance to ensure executives’ interests are aligned with shareholders’ interests. Revenue and non-GAAP performance targets can be an incentive to sacrifice profitability for volume, or worse, engage in acquisitions that destroy shareholder value.

CSGP executive compensation plans are tied to exceeding their own internal expectations for metrics they define, such as adjusted EBITDA (cash incentives), non-GAAP net income (restricted stock grants) and three-year revenue growth, adjusted for stock price performance (restricted stock grants).

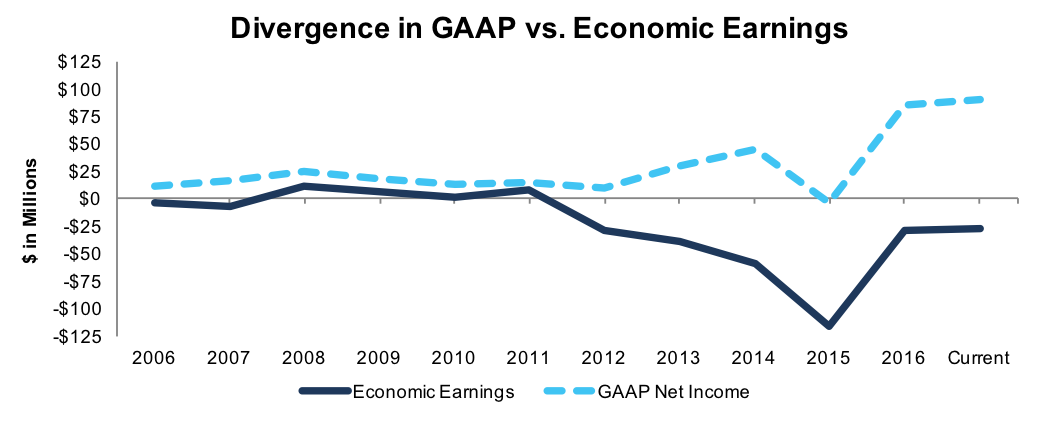

When the focus shifts from organic growth to acquisitions and non-GAAP measures such as adjusted EBITDA, it is time for investors to call out management’s self-serving incentive structure. CSGP’s executive compensation plans incentivizes management to invest capital in sub-optimal ROIC endeavors in order to achieve revenue or non-GAAP earnings targets. Per Figure 5, the implications are clear. CSGP has generated $272 million of negative economic earnings over the past five years, while GAAP earnings have risen considerably.

Figure 5: Ten-Year GAAP vs. Economic Earnings

Sources: New Constructs, LLC and company filings

Competitive Pressures Likely to Build, Putting Margin Expansion at Risk

First mover advantage is imperiled by failing to identify and counter new competition. While much attention has been paid to the explosion of financial technology startups, the rise of real estate technology startups has been less noted. Investors allocated over $1 billion to such firms over the past few years and almost half of the top 100 real estate technology companies are less than five years old. This increasing number of real estate technology startups seems likely to challenge CSGP’s market share or at least its margins.

Given that significant margin expansion is required for CSGP to drive ROIC improvement, we view the company’s balance sheet dynamics as a meaningful competitive disadvantage. The bloated balance sheet, and resulting low ratio of invested capital turns, will make it more difficult to counter competitive pressures by competing on price or ramping up investment in new product development.

Figure 6: Balance Sheet Inefficiency Represents Competitive Disadvantage

Sources: New Constructs, LLC and company filings

While CSGP is currently generating the highest NOPAT margin (12%) of the past decade, it came one year after posting the lowest (<2%) due to cost containment issues tied to the build out of new initiatives, particularly advertising and promotion costs. Questionable spending continued into 2016, perhaps best characterized by a $5 million Super Bowl ad (featuring rapper Lil Wayne, no less) for a very niche product vs. one with a wide audience. We remain cautious on the level of spending required to maintain revenue momentum, and think market expectations are overly optimistic on potential margin improvement.

Bull Case: Based on Hope

The Bull Case for CSGP is based on a continuation of solid organic revenue growth in the core commercial real estate (CRE) data business with accelerating revenue growth in the apartment listings business. We are cautious on growth prospects for the core business due to market saturation and are not sold of the long-term prospects of apartment listing websites, a business with naturally low barriers to entry.

The market for CRE data is much smaller than the residential side of the market. We believe CSGP has limited upside with the largest CRE firms (C.B. Richard Ellis, Jones Lang LaSalle, etc.) while pricing the product above where many smaller, regional CRE brokerage firms find it an attractive value.

The bull case is also predicated on margin expansion due to management’s focus on generating 40% “incremental adjusted EBITDA margins” on new revenue growth. We believe investors should view this flawed metric skeptically and remain focused on NOPAT margins.

In order to generate ROIC above the weighted average cost of capital (WACC), CSGP must now generate a higher NOPAT margin than it ever has historically. This challenge requires significant additional revenue without growing expenses or investing significant additional capital. Even if CSGP were to operate at the average NOPAT margin of the five highest performing companies in Figure 4 (a 25% NOPAT margin, over 2x CSGP’s current level), the resulting 13% ROIC would remain well be below the average 24% ROIC generated by the same five companies.

Bear Case: Classic Poor Risk/Reward Trade-Off

The Bear Case for CSGP is based on the combination of extremely high market expectations for future cash flows and the misleading nature of the firm’s GAAP and non-GAAP earnings when compared to economic earnings.

In addition, the expectation of increased competition for CSGP’s core CRE data products from new market entrants, slowing growth in the core business due to market saturation and the questionable long-term outcome of investing heavily in apartment listing websites add to the bear case. We believe that all of these concerns have merit, but do not believe any necessarily have to go badly against the company for the stock to underperform.

As such, CSGP represents a classic poor risk-reward trade off. We prefer to buy stocks with low expectations, and sell stocks with high expectations. The expectations for revenue growth and margin expansion reflected in expectations for CSGP represent a very high bar for organic growth and management execution, and ignore the various risks and economic profit realities of the company’s acquisition activities to date.

Is CSGP Worth Acquiring?

The proprietary value of the core product (CoStar Suite, 49% of revenue) is debatable while the digital apartment listing business is crowded and competitive with low barriers to entry. While CSGP does operate an array of well trafficked real estate websites, the real engine behind the core database product (CoStar Suite) is the large department of ~1,600 researchers and contractors engaged in labor intensive data collection and manual entry (cold calling, public records searches, field visits, etc.).

While CSGP is the dominant player in CRE data and apartment listings, we do not believe CSGP has the kind of proprietary “tech” value that occasionally results in companies selling at nonsensical multiples to much larger acquirers. Could an S&P Global (SPGI) consider beefing up their commercial real estate data offerings via acquiring CSGP? Yes. Could SPGI make economic sense of acquiring CSGP in anything other than a take-under? The math makes it very unlikely, given that a deal for CSGP at the current price would be very dilutive to SPGI’s ROIC from both a NOPAT margin and balance sheet perspective.

Walking Through the Acquisition Value Math

To begin, CoStar Group has liabilities of which investors may not be aware that make it more expensive than the accounting numbers suggest.

- $152 million in off-balance-sheet operating leases (2% of market cap)

- $44 million in outstanding employee stock options (<1% of market cap)

- $11 million in deferred tax liabilities (<1% of market cap)

After adjusting for these liabilities we can model multiple purchase price scenarios. Even in the most optimistic of scenarios, CSGP is not worth the current share price.

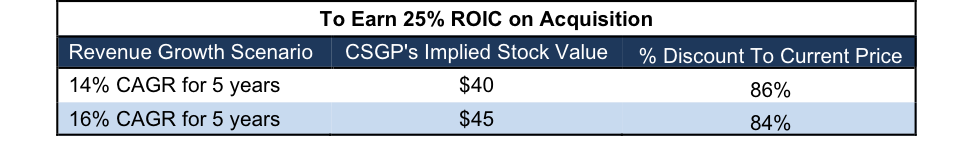

Figures 7 and 8 show what we think S&P Global (SPGI) should pay for CSGP to ensure it does not destroy shareholder value. S&P Global could immediately integrate CoStar’s data to bolster its real estate data offerings and bring increased scale to the business. However, there are limits on how much SPGI would pay for CSGP to earn a proper return, given the NOPAT or free cash flows being acquired.

Each implied price is based on a ‘goal ROIC’ assuming different levels of revenue growth. In each scenario, the estimated revenue growth rate in year one and two equals 14%, which is the consensus estimate of revenue growth in the next two years. For the subsequent years, we use 14% in scenario one because it represents a continuation of next year’s expectations. We use 18% in scenario two because it assumes a merger with SPGI could create revenue growth through increased sales & marketing efforts and a larger customer base.

We conservatively assume that S&P Global can grow CoStar’s revenue and NOPAT without spending anything on working capital or fixed assets beyond the original purchase price. We also assume CoStar immediately achieves a 20% NOPAT margin, which is the average of SPGI and CSGP’s current NOPAT margin. For reference, CoStar’s current NOPAT margin is 12%, so this assumption implies immediate improvement and allows the creation of a truly best-case scenario.

Figure 7: Implied Acquisition Prices For SPGI To Achieve 7% ROIC

Sources: New Constructs, LLC and company filings.

Figure 7 shows the ‘goal ROIC’ for SPGI as its weighted average cost of capital (WACC) or 7%. Even if CoStar can grow revenue by 16% compounded annually with a 20% NOPAT margin for the next five years, the firm is worth less than its current price of $273/share. It’s worth noting that any deal that only achieves a 7% ROIC would be only value neutral and not accretive, as the return on the deal would equal SPGI’s WACC.

Figure 8: Implied Acquisition Prices For SPGI To Achieve 25% ROIC

Sources: New Constructs, LLC and company filings.

Figure 8 shows the next ‘goal ROIC’ of 25%, which is SPGI’s current ROIC. Acquisitions completed at these prices would be truly accretive to SPGI shareholders. Even in the best-case growth scenario, the most SPGI should pay for CSGP is $45/share (84% downside). Even assuming this best-case scenario, SPGI would destroy over $7 billion by purchasing SPGI at its current valuation. Any scenario assuming less than 16% CAGR in revenue would result in further capital destruction for SPGI.

Very High Expectations Embedded in Valuation

Despite consensus expectations for 2017/2018 revenue and EPS being lower now than one year ago, the stock has outperformed the S&P 500, rising 45% YTD and 23% over the last year. At the current price, we believe CSGP’s valuation embeds a dangerous level of market expectations due to the chasm between historical financial performance and the expected performance implied by its market value.

To justify its current price of $271/share, CSGP must maintain current NOPAT margins of 12% and grow NOPAT by 13% compounded annually for the next 23 years. In this scenario, CSGP would be generating over $15 billion in annual revenue, over 2.5x S&P Global’s (SPGI) current revenue. The market for CSGP’s current products is simply not large enough for such a scenario to be plausible.

Even if we assume CSGP can more than double its NOPAT margin to 25% (the average of the top 5 performing companies in Figure 4) and grow NOPAT by 17% annually for the next decade, the stock is still worth only $167 today – a 38% downside risk. This scenario assumes CSGP grows revenues to over $2 billion in ten years from $864 million (TTM), or ~10% compounded annually.

Each of these scenarios assumes CSGP is able to grow revenue, NOPAT and free cash flow without increasing working capital or investing in fixed assets. This assumption is unlikely (particularly in light of Figure 3) but allows us to create very optimistic scenarios that demonstrate how high expectations in the current valuation are.

CSGP Offers No Yield to Shareholders

CSGP does not currently pay a cash dividend nor have a buyback program in place. As such, the stock offers none of the downside protection that a solid shareholder yield can provide. Given the level of risk we see in the valuation and forward expectations, this downside protection could be sorely missed.

Insider Trading and Short Interest Trends

Insiders own 3.7% of outstanding shares, including a 0.5% interest held by CEO Florance. Ownership has been diluted by acquisition issuance over time while insiders have been steady net sellers for well over a decade. Insiders owned 1.8 million shares or 10.3% in 2004 compared to 1.2 million today. We could not find a single open-market purchase by an insider over the same period. Short interest is not high at 3% of outstanding shares or 5.6 days to cover. The level of short interest has bounced around from 2% to 6% over the past few years.

Impact of Footnotes Adjustments and Forensic Accounting

Our Robo-Analyst technology enables us to perform forensic accounting with scale and provide the research needed to fulfill fiduciary duties. In order to derive the true recurring cash flows, an accurate invested capital, and an accurate shareholder value, we made the following adjustments to CoStar Group’s 2016 10-K:

Income Statement: we made $42 million of adjustments with a net effect of removing $12 million in non-operating expense (1% of revenue). We removed $27 million related to non-operating expenses and $15 million related to non-operating income. See all the adjustments made to CSGP’s income statement here.

Balance Sheet: we made $767 million of adjustments to calculate invested capital with a net decrease of $319 million. One of the most notable adjustments was $152 million (7% of reported net assets) related to off-balance sheet operating leases. See all adjustments to CSGP’s balance sheet here.

Valuation: we made $1 billion of adjustments with a net effect of decreasing shareholder value by $28 million. Apart from $456 million in total debt, which includes the operating leases noted above, the most notable adjustment to shareholder value was $44 million in outstanding employee stock options. This stock options adjustment represents <1% of CSGP’s market cap.

Dangerous Funds That Hold CSGP

The following funds receive our Dangerous-or-worse rating and allocate significantly to CSGP.

- Baron Partners Fund (Baron Partners Institutional) – 13.4% allocation and Dangerous rating.

- Baron Focused Growth Fund (BFGFX) – 8.3% allocation and Very Dangerous rating.

- Baron Opportunity Fund (Baron Opportunity Retail) – 5.9% allocation and Very Dangerous rating.

- AMG TimesSquare All Cap Growth Fund (MTGZX) – 4.5% allocation and Dangerous rating.

- William Blair Small-Mid Cap Growth Fund (William Blair Small-Mid Cap Gr N) – 3.0% allocation and Dangerous rating.

Disclosure: David Trainer, Kenneth James, and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.