Stocks, in general, had a pretty dull day, but there were a number of red flags from today (Friday) that does have me a bit concerned for the week ahead. It doesn’t mean that the stock market will retest the lows, however, it does mean there a risk the broader indexes retrace some of the recent gains.

We will explore this topic more over the weekend, and I start to outline some of the points below.

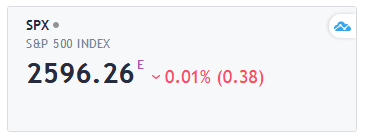

S&P 500

The S&P 500 finished the day down four basis points breaking its current winning streak. The S&P 500 has significantly struggled around the 2,600 level over the past two days. That has me wondering what Monday will bring.

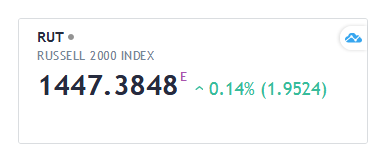

Russell 2000

Perhaps more importantly, the Russell 2000 continued to advance as well. It is now closing in our resistance level at 1,459. That level will be a critical point for the Russell because it is hitting resistance around the same time the S&P 500 is stalling out.

Housing Sector

Even more worrisome is the housing sector PHLX Housing index hitting resistance today at 269 and failing. This is not a good sign.

It sets up a very interesting scenario for Monday. Remember, the housing sector has been a perfect guide for us over the past couple of weeks as the equity market has risen. A divergence in the housing sector and the broader S&P 500 and Russell is likely to be a negative sign for stocks. That makes what happens on Monday very important!

Additionally, the topping pattern in the housing sector is no ordinary pattern; it is a very bearish reversal pattern known as a triple top. That is not a good sign either and would suggest a steep decline to follow.

General Motors

Shares of General Motors (NYSE:GM) rose sharply after the company guided FY 18 and 19 EPS above consensus estimates. Don’t get too excited this stock has done nothing since the 2016 election. Even worse look at where the stock failed today! Right at resistance around $38. Now there is a giant gap that needs to be refilled around $35. If the stock can’t get over $38, it is going back to $35.

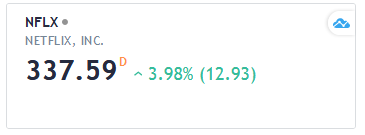

Netflix

Netflix (NASDAQ:NFLX) had a great day rising nearly 4%, and with that, the stock firmly broke above resistance at $330. The stock reports results next week and are now trading around $337, the shares were $271 on January 3. Trust me, I love seeing the stock climb, but not this fast. It is means expectations are getting harder and harder to beat when they report next week.

*Michael Kramer and the clients of Mott Capital own Netflix.

Disclaimer: This column is my opinion and expresses my views. Those views can change at a moments notice when the market changes. I am not right all the time and I do not expect to be. I disclose all my positions clearly listed on the page, and I do not trade my account on the stocks spoken of in this column unless fully disclosed.