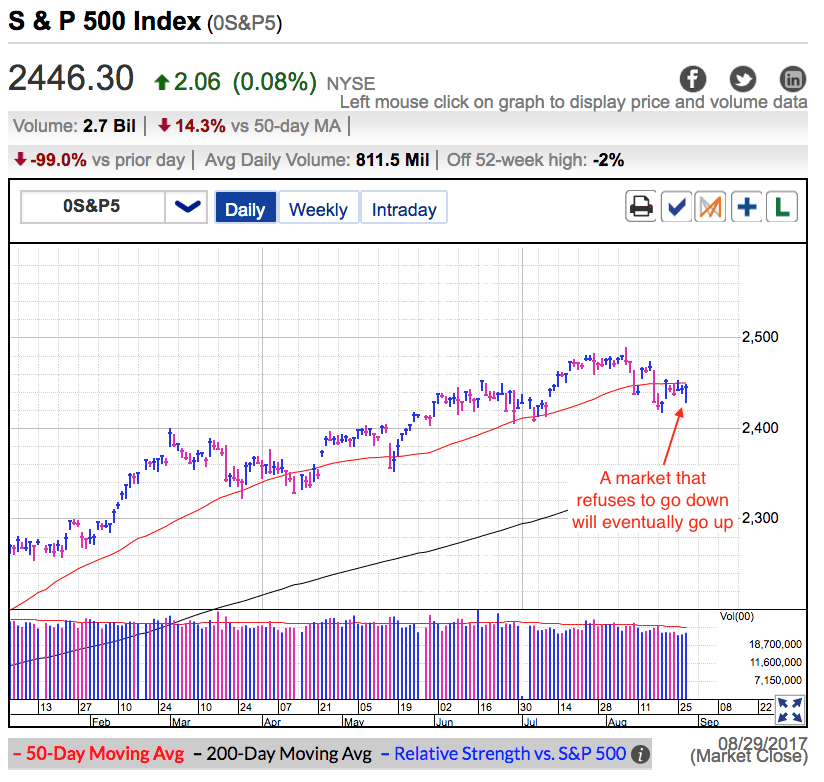

Tuesday was a wild ride for the S&P 500. We gapped lower at the open following North Korea’s provocative firing of a missile over Japan. But rather than devolve into another spiral of relentless selling, we bounced off the early lows and actually finished the day with small gains. It was a shocking reversal for everyone who automatically assumed the bottom falling out of this market.

I’ve been saying for weeks, the path of least resistance is higher and today’s resilience confirms that outlook. Headlines have been overwhelmingly negative in recent weeks. An escalating war of words between Trump and North Korea. A revolving door of senior advisors in the Trump administration. An exchange of sharp barbs between Trump and senior Republican leadership following the Charlottesville tragedy. The worst natural disaster to hit U.S. in over a decade.

And now North Korea moving beyond words by launching a missile over Japan. If anyone knew the barrage of negative headlines that was coming, they would certainly expect the market to be dramatically lower. Yet here we stand, less than 2% from all-time highs. What gives?

Most traders focus on what the market is doing. But I find it far more insightful to see what the market is not doing. That is a far more predictive indicator of what the market’s next move because it exposes the crowd’s false assumptions. In this case, that we are vulnerable to a collapse. If we were going to crash, it would have happened weeks ago. It doesn’t take much to trigger an avalanche of selling when the market is fragile. Yet the last few weeks we withstood headline after headline. We slipped a bit and nervousness definitely spread through the crowd, but prices barely budged.

For anyone that was paying attention, that resilience told us we were standing on solid ground. And each day of selling further firmed up support as nervous owners were replaced by confident dip buyers. Rather than get weaker, this market has been getting stronger. And today’s flaunting of the North Korean missile story confirms that analysis.

This reversal is as bullish as it gets. While I’d love to see us race ahead, sideways churn is just as constructive. The market isn’t following anyone’s timeline, but trust me, a market that refuses to go down will eventually go up. Trade against this strength at your peril.