Emerging Markets ETF (NYSE:EEM) has received a good deal of positive press for its performance off the 2016 lows. No doubt it has done well, as its is up around 50% off the lows of last year, while the S&P 500 is up nearly 30%. This 18-month rally has caused many to tout how well emerging markets are doing. It has certainly been a better place for whomever bought the lows last year.

If you look back a little further at the returns since 2015, 2014, 2013 and 2011, buy-and-hold investors of this ETF don’t have much to brag about.

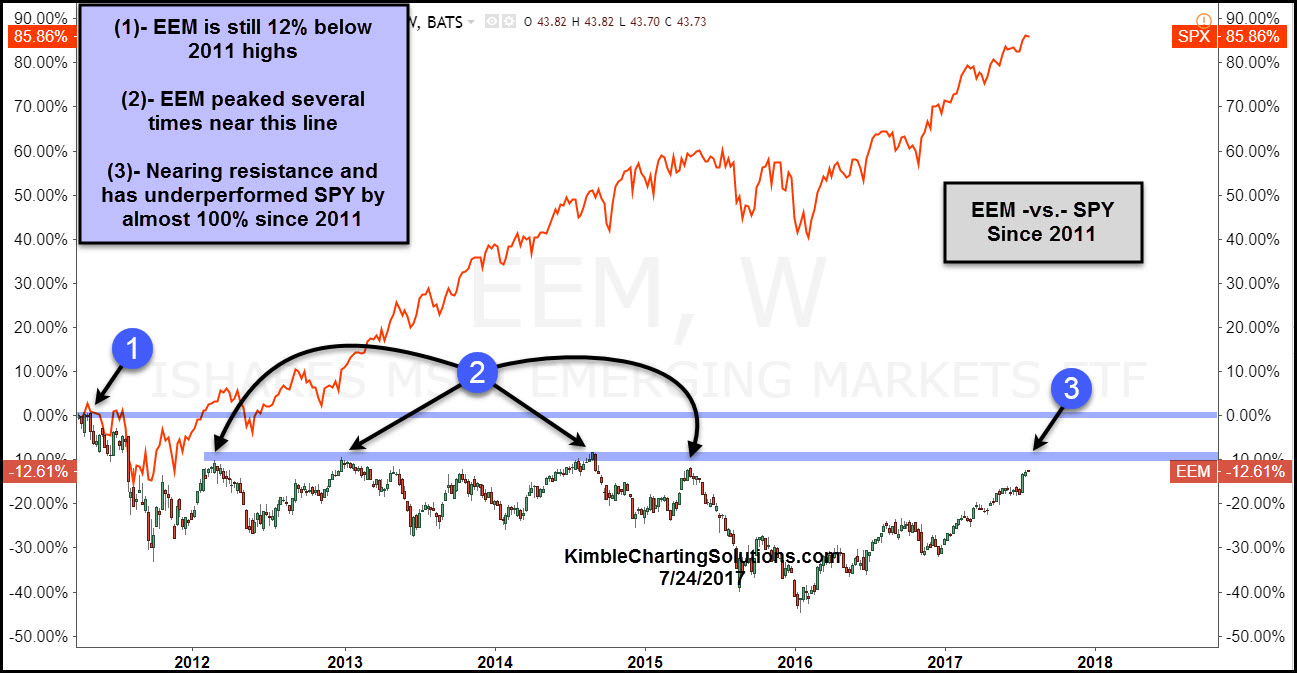

Below compares the performance of EEM to the S&P 500 since 2011.

EEM peaked in 2011 at (1) and since then is still over 12% below those highs. It also peaked four different times at (2). For those investors that bought at those highs, they are still underwater on the initial investment. I pitty whoever bought at those highs.

Now EEM is nearing a heavy resistance line (2) at (3). Four different times EEM has created lower highs along line (2).

Will EEM run out of gas again at this key resistance zone or will it be different this time at (3)? What EEM does at this heavy resistance zone could send an important message to world markets and the S&P 500!