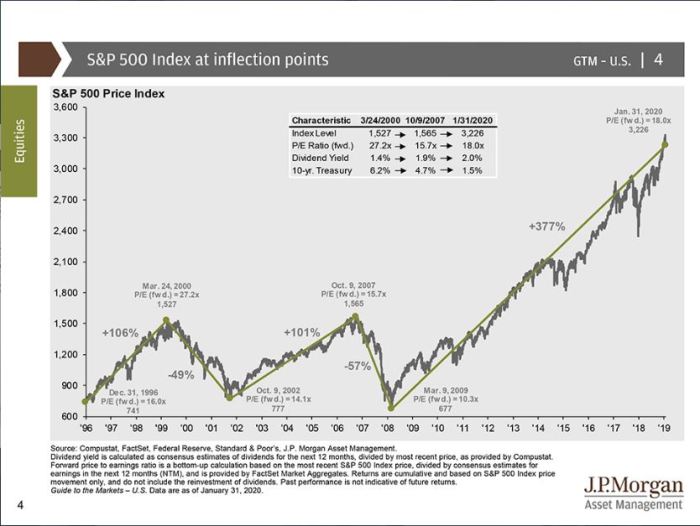

The chart above is one of the slides from the JP Morgan quarterly Guide to the Markets. With this information about the S&P 500 we can calculate the Forward EPS during the last two bull market peaks. We can use the EPS to calculate earnings yields and equity risk premiums. This is a good exercise showing that you can’t truly value stocks without taking into account interest rates.

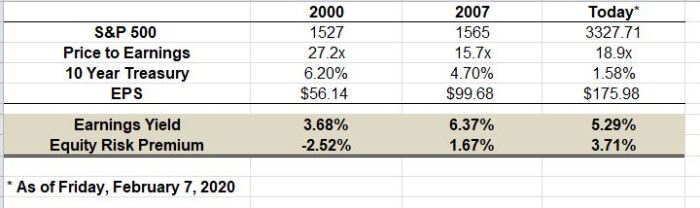

Below is the earnings yield and equity risk premium for the prior two bull market highs along with current numbers.

2000 Bull market top – PE ratio hit 27.2x forward earnings, for an earnings yield of 3.68%. When we take into account the 10-year Treasury bond happened to be 6.20% at that time, we can see a negative equity risk premium. Therefore, stocks were unattractive on a valuation basis and the recession ended up causing a nasty bear market.

2007 Bull market top – notice the PE was almost half that of the 2000 highs. The EPS had grown by almost double ($56.14 to $99.68) but the market had made little upside momentum (1527 in 2000, to 1565 in 2007). The earnings yield was 6.37%, much better than during the 2000 highs, resulting in a positive equity risk premium.

The lesson here is valuation alone isn’t a market timing tool. The market can crash during high valuations (2000) and reasonable valuations (2007). Valuation analysis must be complemented with fundamental analysis (risk of recession).

But valuation can do 2 things:

1) give us an estimate of future returns (when the market valuation soared in 2000, it meant that future return estimates had to be reduced. This turned out to be true since the S&P 500 took 7 years to get above the 2000 highs.)

2) be used in risk management decisions. Take risk when its worthwhile compared to fixed income investments. In 2000, the 10-year treasury bond was 6.2% while the earnings yield on stocks was only 3.68%. This made it attractive to hold more fixed income investments over stocks.

Today – we have a PE ratio of almost 19x. The earnings yield is less than it was in 2007, but with the 10-year treasury at 1.58%, the actual equity risk premium is more than double over what it was in 2007 (3.71% versus 1.67%). So even though the price of the S&P 500 is double what it was in 2000 and 2007, with the PE ratio today above where it was in 2007, the valuation is actually more attractive when taking into account interest rates. The market may very well be fairly (or fully) valued at these levels, but I don’t see it as over-valued (definitely not a bubble) as long as interest rates remain low.

I understand that global central banks are contributing to this low rate environment. This analysis is not an endorsement of monetary policies, its simply an analysis of risk management decisions given the current environment. Inflation is the risk that could spell the end to this bull market because it basically takes the Fed’s tools off the table. So far we aren’t seeing this yet but its worth noting.