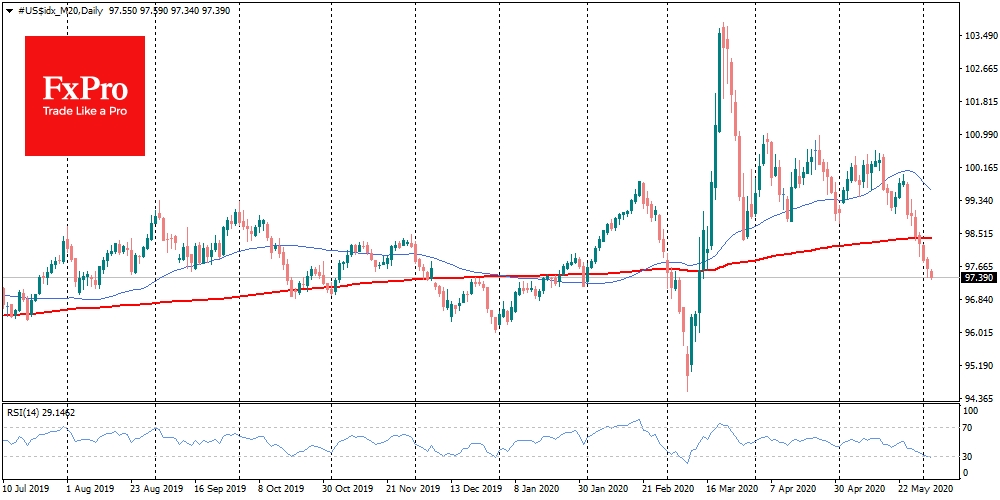

The rally of world markets continues, and the dollar is rapidly losing ground. Very often, the weakening of the U.S. currency goes hand in hand with the strengthening of purchases on world markets. With a few exceptions, this is a normal state of healthy markets, which makes one believe that this trend will continue.

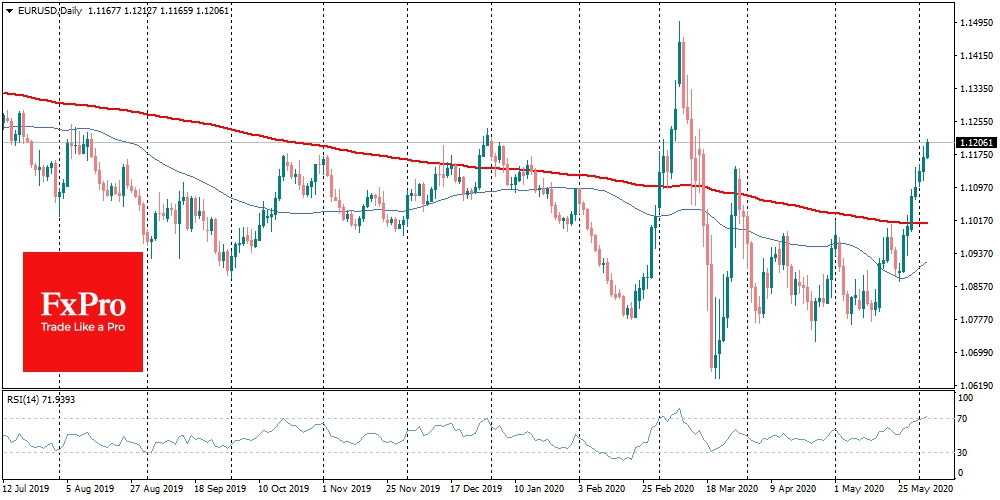

The single currency reached 1.1200, having recovered its losses since the beginning of the year, showing growth during the eighth trading session in a row. After sharp fluctuations in March, EURUSD still managed to turn back to growth and shows signs of breaking the two-year downtrend.

An additional positive sign is Australian dollar dynamics, which was approaching 0.7000 earlier in the morning, and as euro, almost completely restored its decline so far this year.

It is also fascinating that the ECB is expected to expand its asset purchase program later this week, which is a negative factor for the currency. Australia reported today a decline in GDP in the first quarter, and the government is talking about a present recession as the economy shrinks rapidly in the second quarter.

Meanwhile, the markets are optimistic, suggesting a V-shaped economic recovery as we can see on the charts of stock indices and AUDUSD pair. Currencies of large emerging countries follow the suite: the Russian ruble jumped by 12% over two months, while the South African rand – by 10%.

And at the moment investors are faced with the vital question, which is right, markets or economists and policymakers? The latter group are looking to the future with anxiety and are considering new measures to support the economy. So far, there is a feeling that the markets are too carried away buying on the rebound and have gone too far, offsetting the March collapse.

We saw the same thing earlier this year when the S&P 500 climbed to new heights in January amid a burgeoning epidemiological disaster. The same can be said about the currency market, where technical indicators show that the dollar is oversold compared to a vast number of currencies from AUD, EUR and CAD to RUB and ZAR.

This week we will see U.S. job data for May, where it is expected that more many millions decline in employment and rise in the unemployment rate to 20%. This release may sober the markets, bringing back the idea loss of employment can trigger a downward spiral, where spending cuts lead to job losses and new spending cuts. And not for weeks anymore, but many months.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

A Healthy USD Decline?

Published 06/03/2020, 04:06 AM

A Healthy USD Decline?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.