With the so-called "currency wars" escalating after Beijing's recent yuan devaluation and China's growth stalling, investors have suddenly become quite jittery. We are now seeing significant signs of stress in US equity markets.

The S&P 500 index finally broke out of its trading range,

|

| Source: barchart |

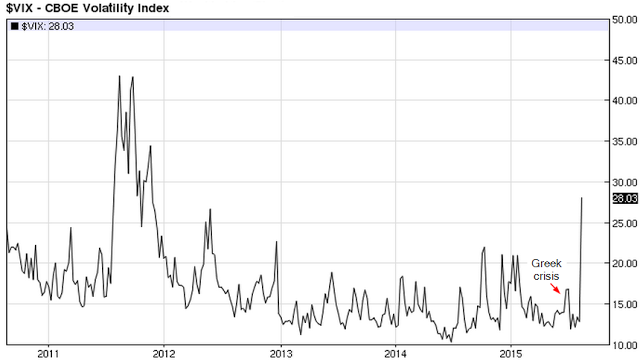

... and the VIX (implied volatility) index jumped to levels we haven't seen since late 2011 — the height of the Eurozone crisis.

|

| Source: barchart |

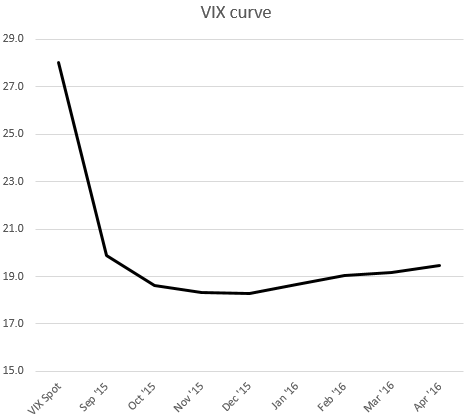

The VIX curve has become inverted, which generally indicates a heightened level of risk aversion.

Moreover, gold prices and the euro have risen materially and became more correlated over the past few days, indicating a rising "risk-off" sentiment. Both gold and the euro are viewed as "safe haven" assets.

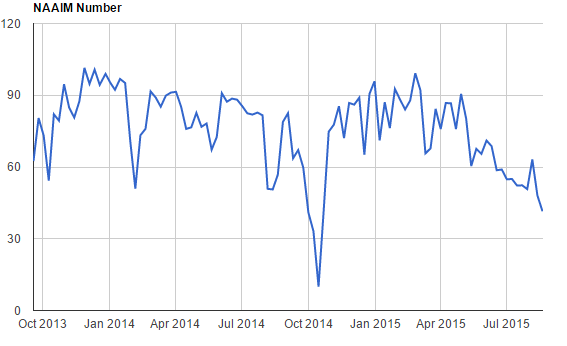

It's important to point out that risk appetite has been declining even prior to the recent selloff. Here are some indicators:

1. Investment advisors are cutting back equity exposure (as shown by the NAAIM index below).

|

| Source:NAAIM |

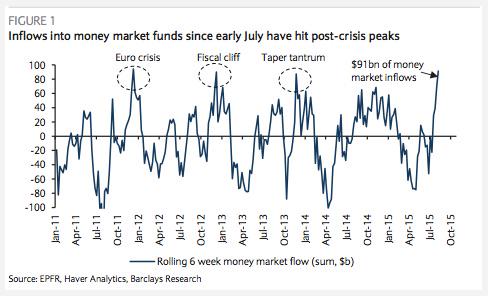

2. Money market inflows have spiked.

|

| Source: @pkedrosky |

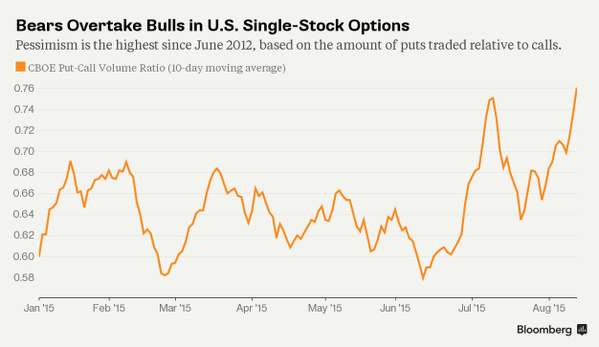

3. Single-stock put option activity has risen.

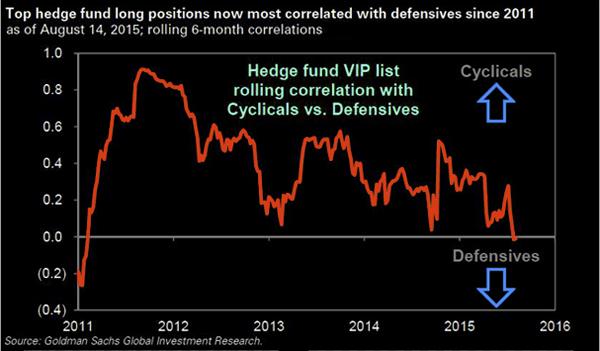

4. Hedge fund managers have been picking more defensive shares.

|

| Source: @vexmark |

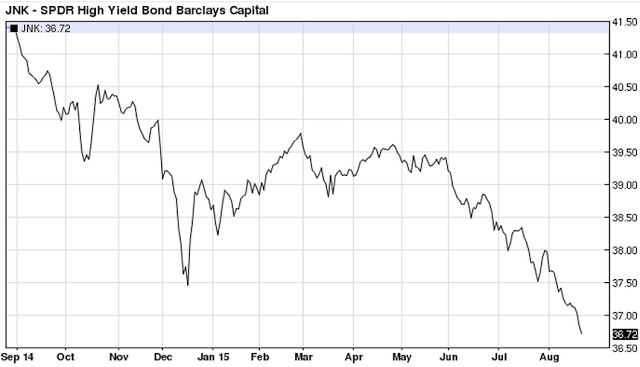

5. Leveraged finance markets have been under pressure for some time. The chart below shows the SPDR Barclays Capital HY Bond Index ETF (NYSE:JNK).

|

| Source: barchart |

While these indicators point to rising stress in the markets, in the long run this is actually quite positive. A healthy level of risk aversion is vital for a more rational approach to asset valuation in order to limit the formation of financial bubbles.