Our contrarian investing playbook is simple, but not easy. We buy stocks that others are neglecting. At least currently! This means we secure prices when they are low and dividends when they are high.

Big tech stocks have been bid to the moon recently. But not all Nasdaq plays are expensive. The rally has been narrow, and believe it or not, we have five tech plays paying up to 6.7% available today.

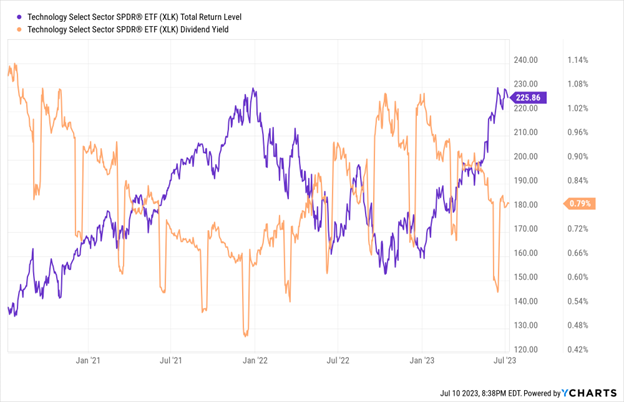

This is a lot of yield in a sector that, sadly, pays less than 1% at large:

Tech Is Back to Yielding Less Than 1%

This is why the sector ranks tenth in dividend yield. Not where we’d usually look for income!

This is why the sector ranks tenth in dividend yield. Not where we’d usually look for income!

Source: FinViz

Source: FinViz

But these are just averages. We look past the mainstream to find value and, of course, yield. Let’s start with a 4.6% tech dividend and work our way higher from there.

Seagate Technology (STX)

Dividend Yield: 4.6%

Seagate Technology (NASDAQ:STX) is a data storage company that produces hard disk drives (HDDs), solid state drives (SSDs), and network-attached storage drives, among other storage solutions.

I wouldn’t go so far as to say STX is having a bad year—most investors would take a 17% gain in roughly half a year. But that’s modest compared to the broader tech sector, in part due to weak demand. There’s plenty of blame to go around: Chinese economic softness, for one, as well as reduced enterprise IT spending here in the States as corporations weigh recession possibilities. Also not helping things: A $300 million fine for shipping its HDD products to Huawei, which now is the subject of a class-action lawsuit.

The good news? Seagate’s Q3 guidance implies a rebound in sales. Combine that with reports from Wedbush, which says conversations indicate STX and rival Western Digital (NASDAQ:WDC) might be planning to raise prices, and there’s reason to believe the low point in this latest price cycle is in the rear-view.

But while you might be buying a bottom, in a sense, you’re not necessarily buying low.

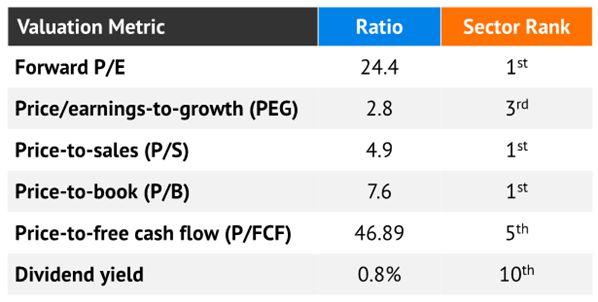

For one, STX’s yield of 4.6%, while extremely generous for a tech stock, sits around the middle-to-low end of its historical range. And I’ll point out that after a few dividend hikes around the turn of the decade, the payout has again gone dormant for more than a year. Not Exactly a Dividend Dynamo Right Now

What’s perhaps more concerning is the profits meant to pay that dividend. STX doles out 70 cents each quarter, or $2.80 per year. But it’s projected to earn just 15 cents in 2023, and $2.32 in 2024. The latter represents a nice recovery, but it’s still far below 2022 levels and meaningfully shy of what it needs to pay us.

It also represents a forward price-to-earnings ratio of 26—in line with the expensive tech sector and well frothier than the broader market. All with no earnings growth potential over the next couple of years.

International Business Machines

Dividend Yield: 4.9%

International Business Machines (NYSE:IBM) is a stranger to no investor. The multinational tech provider offers up a wide range of software, consulting, infrastructure and even financing solutions. Its product list is a “who’s who” of tech buzzwords, from hybrid cloud to business automation to artificial intelligence (AI).

IBM, like just about every big tech company, has chucked its hat into the AI ring, and in fact recently announced numerous artificial intelligence initiatives, including Watsonx. But remember: Everyone is slapping the “AI” moniker onto anything they can, and IBM investors have already been burned once by the “Watson” brand—so at least on this front, I’ll believe it when I see it.

Still, Wall Street seems encouraged by IBM’s initiatives of late, projecting low single-digit profit growth this year, accelerating to mid-single digits in 2024. Hardly great, but not bad considering you’re also buying a Dividend Aristocrat with 28 years of uninterrupted payout hikes—and a low-volatility name, to boot.

You’re also getting a (relatively) decent price. IBM trades at 14 times earnings estimates, which is lower than both technology broadly and the S&P 500. Its PEG of 2.2 is definitely overbought, but less so than its sectormates. Again, nothing to run screaming from, but nothing to scream about, either.

Xerox)

Dividend Yield: 6.2%

Xerox Corp is dirt-cheap and offers a fat yield to boot—two big boxes I love to check off at the offset.

But what else are we buying?

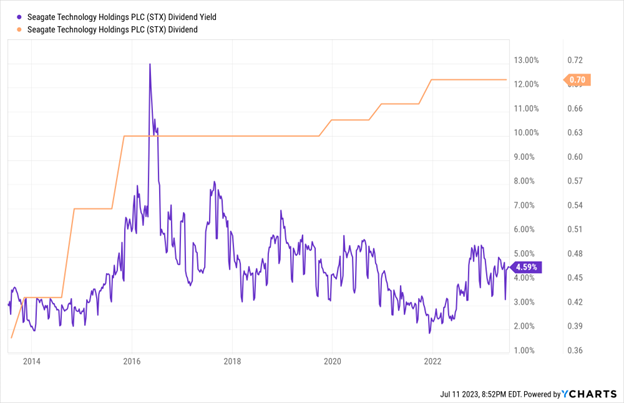

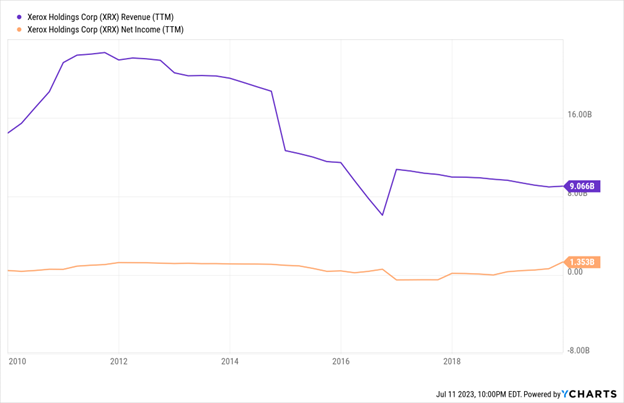

Xerox sells printers and digital document services in more than 160 countries nationwide. The latter business is a fixture in the modern office—while the former used to be. Forget COVID for a moment. Offices had been going digital for a long time before the pandemic, and the need for paper (and printers) had been on the decline for years. None of What You See Here Includes COVID.

Now, thanks to the work-from-home push, there’s an even lower ceiling for Xerox. Yes, employers are trying to push workers back into the office, but it’s clear that “hybrid” is here to stay—meaning overall less demand for Xerox’s core products.

So yes, XRX has a massive dividend and trades at a low 0.7 PEG and 11 forward P/E, but that just means it’s cheap—not necessarily a value.

Opera

Dividend Yield: 6.3%

It’s not often that you see a company with only a few years of publicly traded life doling out such a generous yield, but that’s exactly what you’re getting with browser maker Opera Ltd (NASDAQ:OPRA).

Opera is a Norwegian browser provider whose primary products include the Opera line of mobile browsers, Opera News, Apex Football, and Opera Ads (an online advertising platform). It also owns 2D gaming development platform GameMaker Studio. You might not be familiar with it, but it’s better known around the world—it operates in England, France, Germany, Ireland, Nigeria, and Spain, among other countries.

Like with Microsoft Corporation's (NASDAQ:MSFT) Bing and Alphabet’s (NASDAQ:GOOGLE) here in the States, Opera is implementing AI functions into its browsers and other software. Currently, both ChatGPT and Aria (Opera’s browser AI) are fully integrated with Opera browsers for customers in more than 180 countries.

There’s a lot to like here. Despite being a relatively recent tech IPO (2018), it has precisely zero debt on the books. And it’s growing like a weed. Last year’s annual revenues improved by 33% year-over-year, and it flipped from a 19-cent adjusted loss to a 25-cent profit. Better still, earnings are projected to explode 240% higher in 2023, to 85 cents per share.

And Opera plans on sharing almost all of those profits with us. In June, the company announced it would begin paying out a 40-cent semiannual dividend—My biggest concern? That accounts for roughly 95% of its projected profits this year. Looking out to 2024, earnings are only expected to expand to 90 cents, so there might be limited headroom for dividend growth from here, at least in the near future. It’s not exactly cheap, either, trading at nearly 30 times earnings estimates.

Himax Technologies

Dividend Yield: 6.7%

Himax Technologies Inc (NASDAQ:HIMX) is a fabless semiconductor company, which means that while they design chips, the production takes place elsewhere. The Taiwan-based chip company is heavily involved in display drivers—its products power TVs, laptops, smartphones, digital cameras, and virtual reality devices, among other applications—as well as 3D sensing technology.

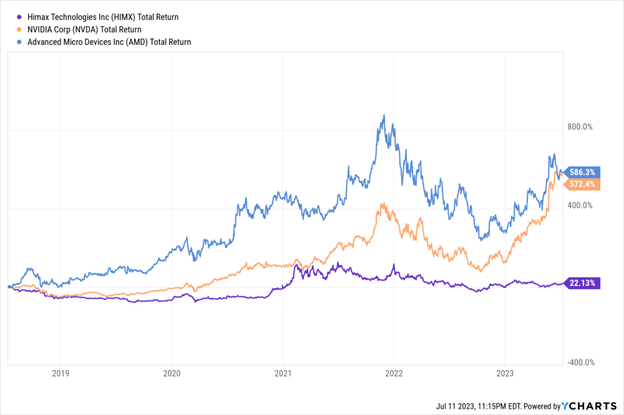

So, a chip company, eh? Must be doing well. Oh.

Truth is, all chips aren’t the same. Nvidia (NASDAQ:NVDA), for instance, has gone bananas because its chips are used in expensive enterprise and consumer applications alike—data centres, graphics processing, AI, machine learning, you name it. By comparison, many of Himax’s products’ uses are more pedestrian in nature.

There’s still money to be made here, and Himax’s technologies do have some applications in more growth technologies. It’s extremely well-positioned in virtual reality, for instance, as well as automotive touch and display driver integration (TDDI). Still, the next couple of years could be rough; HIMX’s profits will likely be cut by two-thirds this year, and earnings expectations for 2024 are still half of what Himax earned last year. So the relatively cheap forward P/E of 16 doesn’t signal a value—it indicates a lot of warranted pessimism.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."