Investing.com’s stocks of the week

You know when you used to go to the gym back in January as part of your New Year’s resolution. You would try some of the weight machines and classes but always end up back on the treadmill. There you start by walking and it is hard at first, ready to quit. But then you get a rhythm and start really rolling. You got a strong workout and put up some great stats, but despite the mini computer saying you ran 5 miles you were the same place as when you got on the machine.

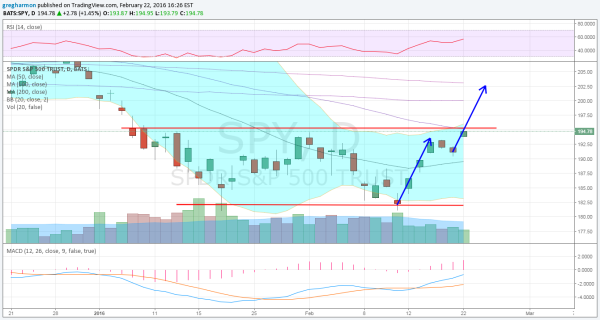

The S&P 500 has been kinda like that over the last 3 weeks. Falling back from the mini peak that started February, it found its stride upon making a double bottom February 11th on strong volume. Since then it has moved 7% higher, right back to where it started.

The chart above shows the strong move higher off of the double bottom and a pause in a bull flag to end last week for the SPDR S&P 500 ETF Trust (AX:SPY) the continuation higher Monday gives real promise for more upside. In fact there is a Measured Move to 202.70 should it continue. That would bring the SPY (N:SPY) to its 200 day SMA, where it has not been since December 30th. But there is also that pesky resistance just over 195. Until the SPY can get over that resistance there is nothing new to talk about.

So celebrate the small victory. The SPY is up 7%. But remember it is just back where it started. Not time to go all in yet.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.