Right after I posted “Long Bonds Enter The Blowoff Stage,” Jeff Gundlach expressed some similar concerns to those I shared in that post:

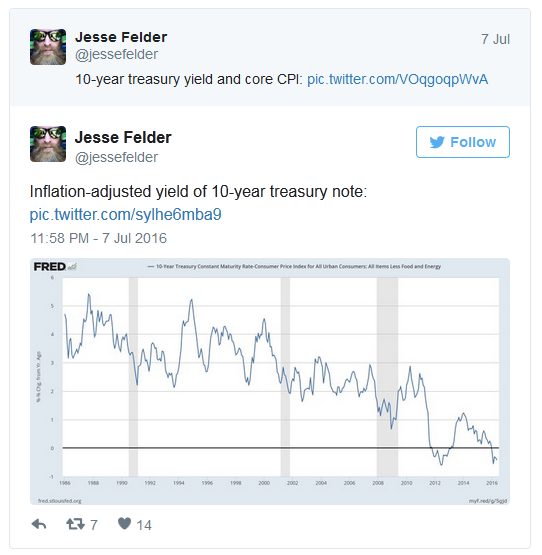

I think one thing he might be looking at, beyond what I wrote about last week, is the chart below which shows how rare it’s been over the past 30 years to see the 10-Year Treasury note yield less than the current rate of inflation as measured by core CPI:

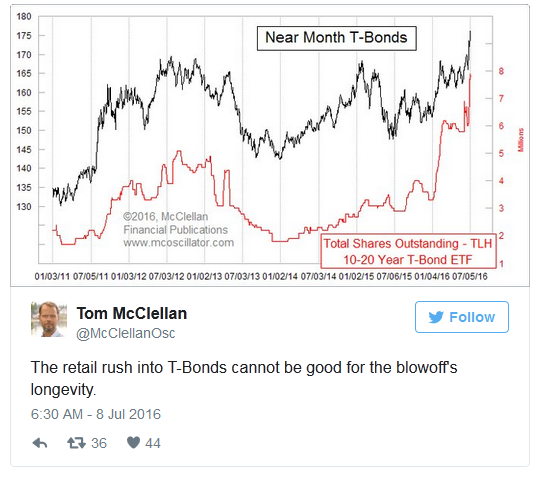

Gundlach may also be concerned about the rising euphoria I mentioned in that earlier post and Tom McClellan recently demonstrated in the chart below:

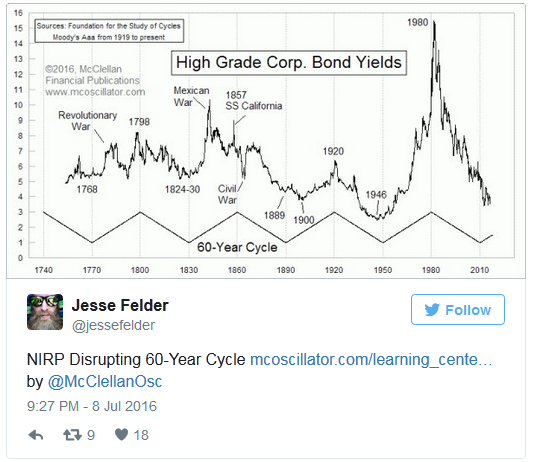

Tom also brings up another interesting point in a post of his own this week. The long-term cycle may soon be ready to turn.

If I wasn’t clear enough in that last post, my point is the risk/reward equation in buying long bonds today just isn’t what it was 18 months ago. Fundamentals, sentiment and technicals now suggest risk far outweighs potential reward.