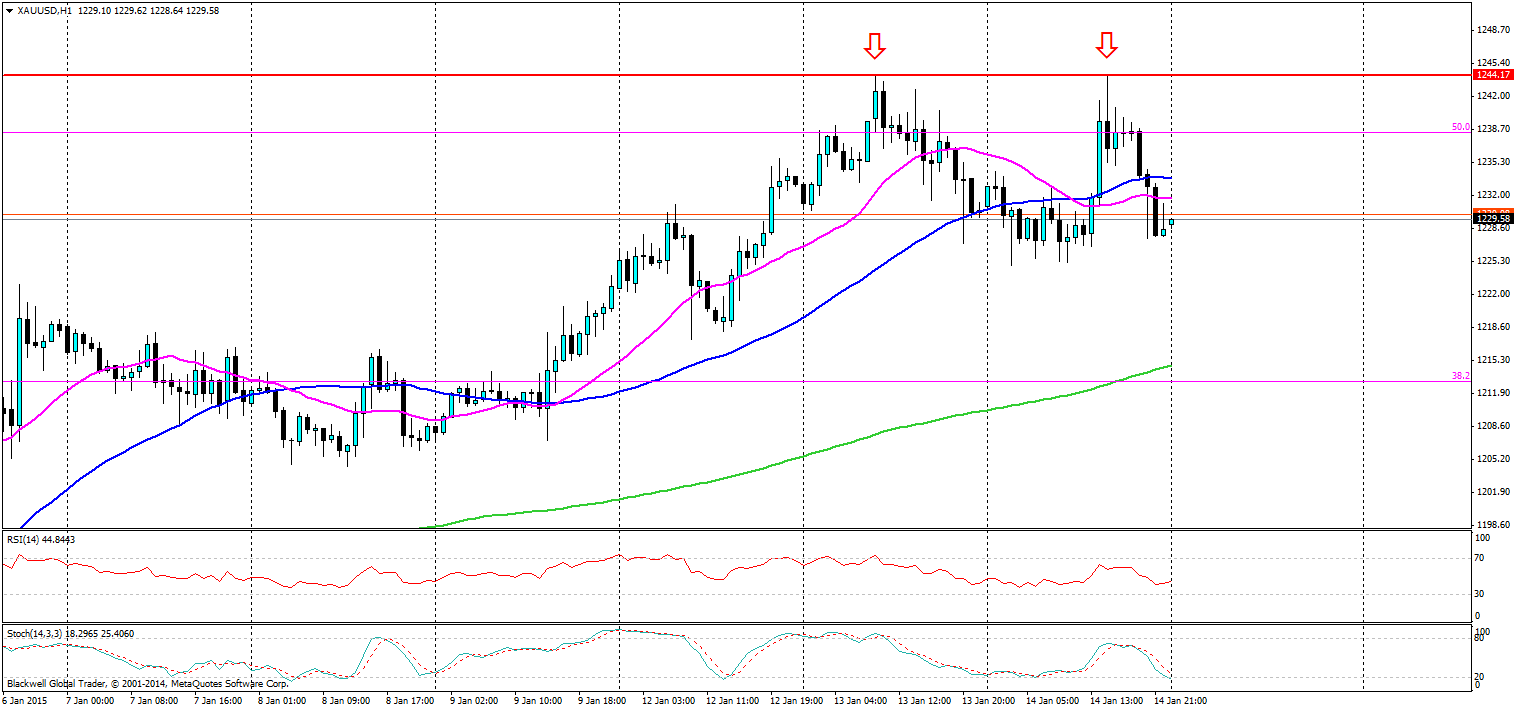

Gold and technical patterns go hand in hand in the market. Many believe that gold finds more power in movements from technical patterns than fundamentals and I’m generally inclined to agree with them on that, except when it comes to FOMC and Non-farm payroll days. So last night’s movement was a great one at that with a solid double top that formed.

(Source: Blackwell Trader Gold, H1)

The market reaction was strong and a solid pullback was the result. Markets will now be looking for further legs down if the selling pressure continues.

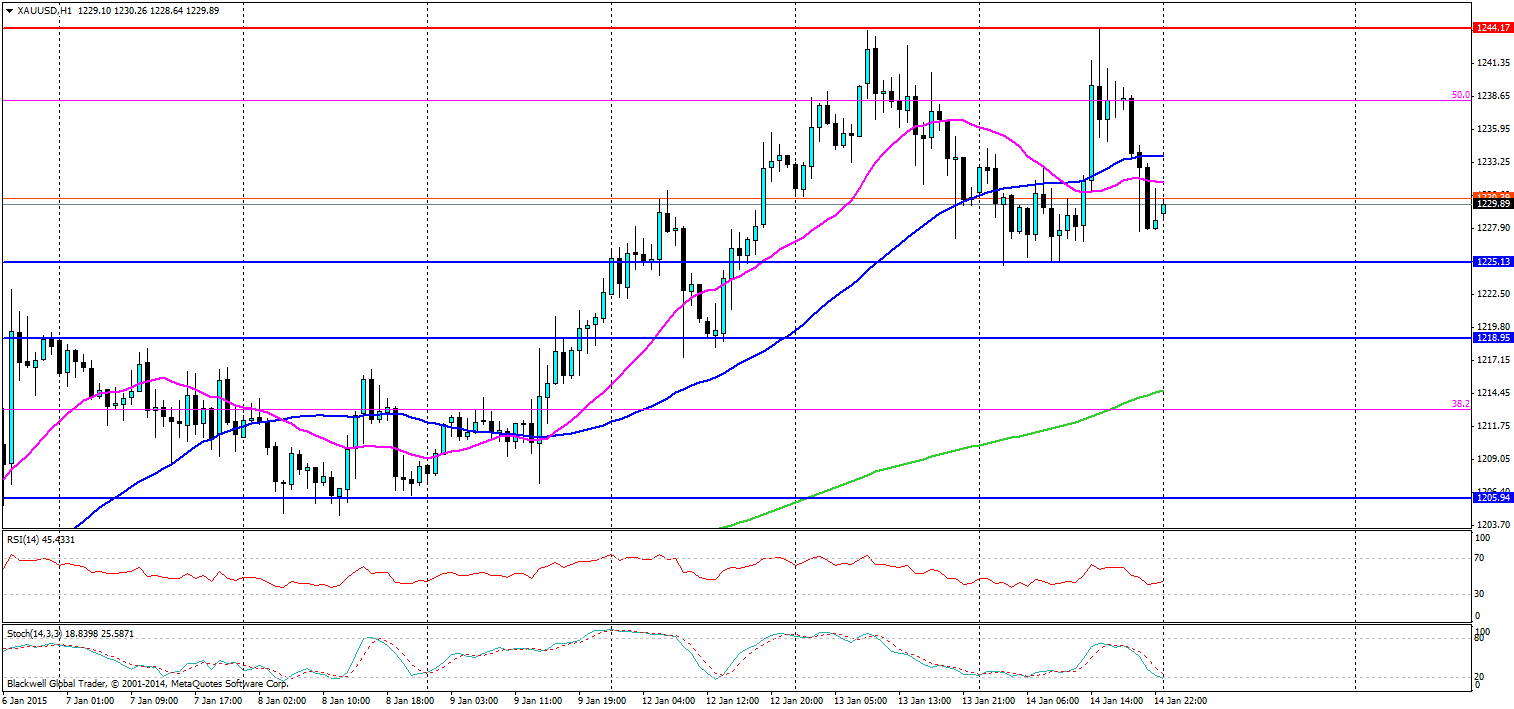

(Source: Blackwell Trader Gold, H1)

The next legs down are at 1225, 1218 and 1205. The first two legs are likely to be short term targets, for any mid to long traders the 1205 level. In last night's trading session the 1225 level looked very possible and a break of that could see a quick rush down to 1218. A further breaking of that and I would look for a longer target of 1205. But with that being said it’s certainly not for everyone holding on for that long in this market.

The catalyst for rapid movements though were certainly in the cards last night with unemployment claims due out; a traditional mover for the gold market.

Either way the gold bulls have had a decent run as of late, and the bears are surely looking for a swing in the current market. The question is will they swing now after a double top has formed. If we do see some bullish movements the double top support level could turn into a triple top, and a pullback of that would almost be certain if not brief – a few easy dollars for some traders. But gold is certainly one to watch today.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.