Although the trading day got off to a flying start yesterday for the loonie, with the announcement of stronger-than-expected Canadian Retail Sales in January, our currency quickly reversed course and returned to its starting point. Although there was no particular triggering element, stock markets turned to red in favour of bonds. The result was indexes posting losses of more than 1% and Canadian and U.S. bond yields falling.

It could be possible that markets have decided that it was time to let some air out of the “Trump effect” given the absence of new fiscal measures and concrete stimuli. More specifically, there appear to be doubts as to his ability to get all his legislation passed, including his plan to replace Obamacare, by the House of Representatives and the Senate.

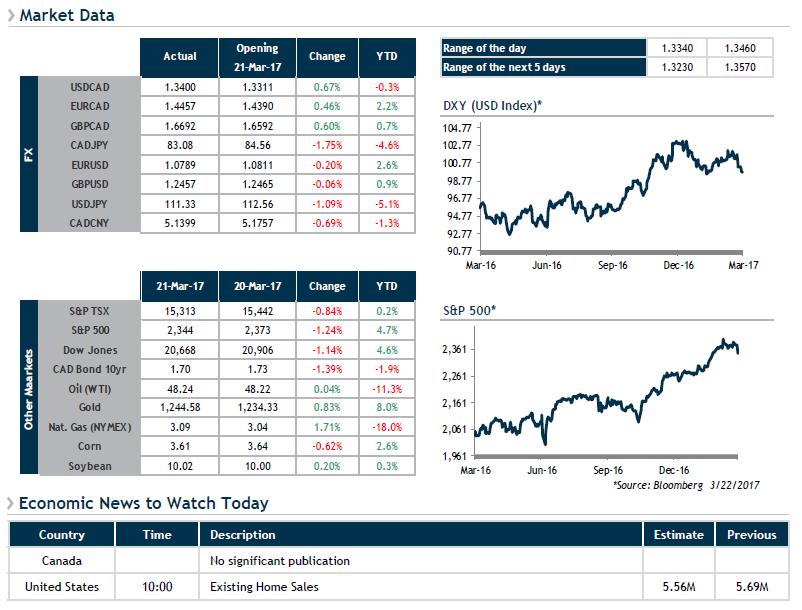

Red is the dominant colour again this morning on stock markets, and we’re keeping a close eye on the S&P 500, which appears vulnerable. In terms of currencies, safe havens such as the yen are in favour despite a stabilizing greenback. Caution is essential and it should be noted that at 4 p.m. today, Finance Minister Bill Morneau will table the federal budget.