Remember the Dotcom crash? Probably not. Fueled by fever driven sentiment and scare mongering around Y2K (remember that either?) companies were raising money in the equity market with no earnings, or sales or prospects for either. Sounds incredible right? A sock puppet became the poster child for the whole situation when it came crashing down. At the bottom in 2002 the Nasdaq 100 had lost almost 85% of its peak valuation. It was the talk of the markets until the Financial Crisis refreshed participants fears. the second drop in 2008 wiped out a near tripling for those that bought the bottom. How could you get back in now?

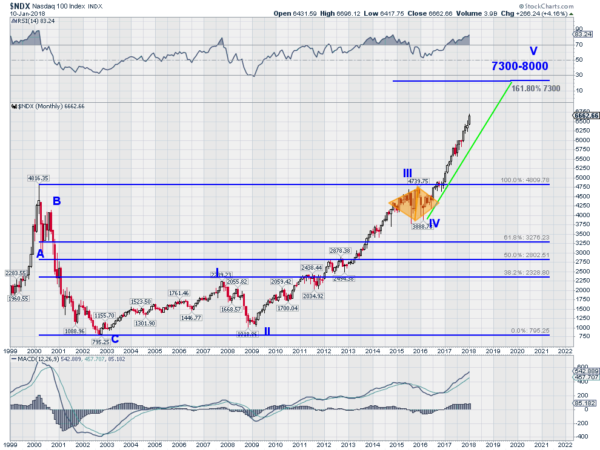

We all know that getting back into the market was the right call now. But the scars remain. The chart below shows the path and gives some clues about the future. The Dotcom crash can be seen as a Corrective Wave to its bottom in 2002. The run higher to the 2007 top was the first Wave of an Impulse Wave higher. The second Wave was the Financial Crisis bringing the Nasdaq 100 to a higher low. Wave III raced higher and ended at a retest of the Dotcom highs and was followed by the corrective Wave IV with a sideways character, looking more like a pit stop along the way. Then in 2016 Wave V began.

How far will it go? Nobody knows for sure. One estimate using Elliott Wave principles would give a range of 7300 to 8000 looking at the length of Waves I and III as a guide. The 7300 figure would also be a 161.8% extension of the retracement of the Dotcom fall. Many traders would look for that level. Momentum is very strong, perhaps overheated. With the RSI over 80 there are two other instances to look at for prior behavior. The first led to the Dotcom Crash. The second led to a sideways correction and a shift into high gear. Not much help there. For now take the RSI as supportive of more upside. The MACD also support higher prices. And it has room before it reaches the Dotcom extreme. The path higher remains the easiest path.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.