Cheers to the German market! After a mid-year swoon, it was able to recover and post a solid 11.5% gain for 2017. That said, much of the rest of the world's markets, including the US, were up substantially more. A gain is a gain right? But what's in store for the German market in 2018 and beyond? Brexit remains an uncertainty and now tax cuts in the US make the competitive landscape tougher.

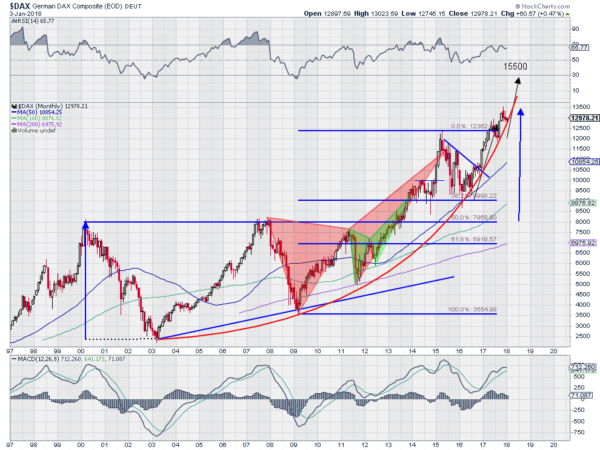

With all this uncertainty, the only truth is in the price action. The chart of the German DAX Composite below tells a strong story. The first thing to note is the rounding higher in the chart. The curved red line shows a series of higher lows that indicate acceleration in the trend higher.

The first bullish point was in 2013 as it broke an ascending triangle higher. That gave a target to about 13,500. As it continued to move higher into 2015, it completed a bearish Deep Crab harmonic (the two triangles) and pulled back a nearly perfect 38.2% before reversing again. Where was the 38.2% retracement? Right at that ascending arc.

The continuation higher met resistance at the prior top and digested the move in a bull flag. With a second thrust underway, the Measured Move higher gives a target to 15,500. Momentum remains strong with the RSI in the mid 60s and the MACD is positive. As long as it holds over 12,000, Germany's DAX looks like it will give investors cause cheer again again next year.