The biggest bubble of all is bursting—the bond market, where companies and the government borrow money—and it's twice as big as the stock market, says Lior Gantz of Wealth Research Group.

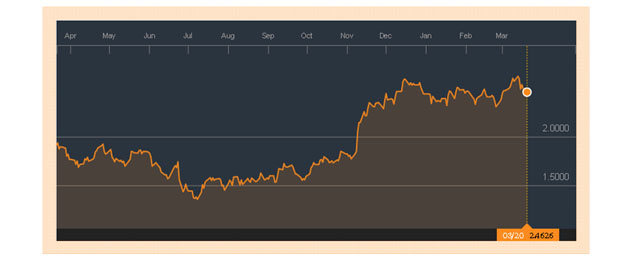

The yield on U.S. 10-Year Treasuries is now twice as high as it was last July.

At 2.46%, today's investors are lending the largest debtor in the world their own funds for a decade, while official inflation is 2.50%.

High yield investments are hard to find, but this company, for example, yields 8% for years.

The ZIRP (Zero Interest-Rate Policy) and NIRP (Negative Interest-Rate Policy), which central banks worldwide adopted for close to a decade while the credit was deflating from the system, didn't spark runaway inflation like many investors presumed.

There was too much unwinding of debt, and not even "easy money" policies could spark the attention of the average worker to originate new debt in their name.

But corporations, especially multinational ones, did take advantage of these policies.

Since the economy was sluggish, they wanted to generate "paper profits" by borrowing cheap money and buying back their own shares.

They also issued corporate bonds, which investors swallowed up since they yielded more than government bonds.

In my personal portfolio for 2017, I anticipated the gold market to be strong.

Now that the economy is picking up steam and employment is stronger, rates are rising, as people are willing to borrow—they "feel good" about the future.

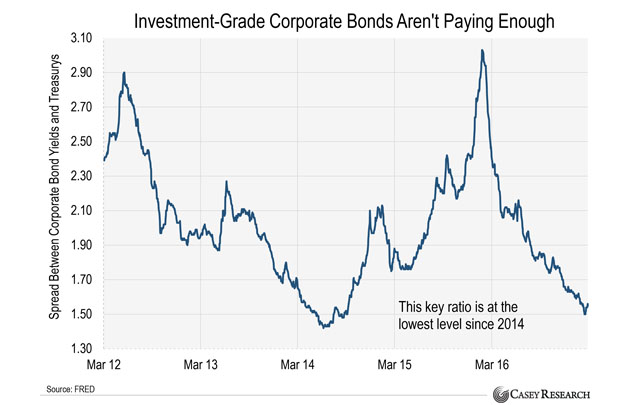

Because government bonds are paying higher yields, the spread between corporate bonds and Treasury bonds is shrinking.

This means that, as absurd as it sounds, investors are going to loan money to the government again since it can print their money back. The risk of default, in their eyes, is smaller.

To compete with this, corporate bonds will have to pay more in order to lure investors back, and with the amount of leverage they have amassed, expect turmoil.

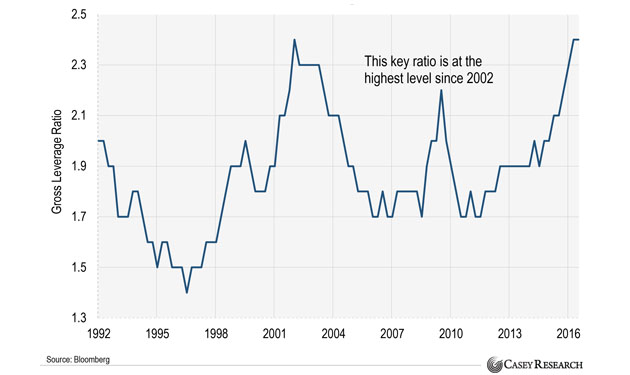

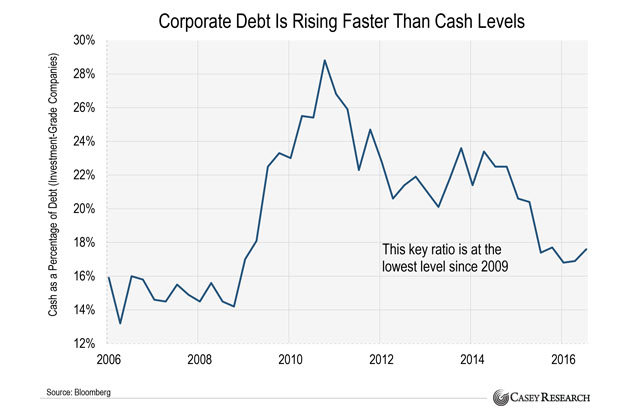

Corporate Leverage Is Soaring

Not only is corporate leverage high on a generational point of view, but this environment where stocks are historically expensive leaves fewer choices for billions in institutional money.

Private equity, sovereign wealth, hedge funds, and pension funds can't afford not to return high yields to their clients.

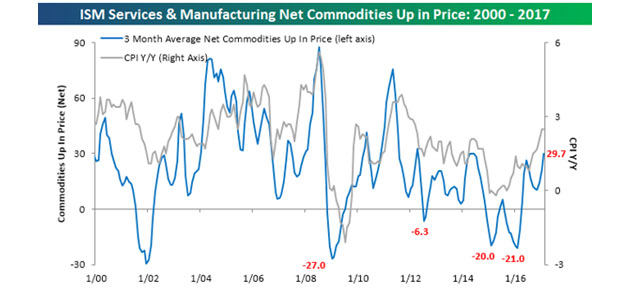

They are searching for what is cheap and not leveraged, and they are starting to diversify into commodities.

As you can see, inflation and commodity prices are directly correlated, and inflation rates are going higher.

Middle-class America has fully put its trust in Trump's protectionist plans to bring manufacturing back.

That's exactly why our zinc exploration play is potentially sitting on top of a prime asset, and it's why Wealth Research Group has made it a top-ranking opportunity.

The fear in the Western World is subsiding—America is spending again.

U.S. citizens are buying less gold and silver, but in the East, they are seriously afraid of U.S. foreign and domestic policies.

They do not like these swift changes.

I do not trust this rally, and I have not been buying the S&P 500 index companies for a very long time.

Wealth Stocks are what I invest in when I allocate funds for long-term compounding of riches, but our picks have gone up substantially and are above our buy-up prices.

When I look at companies for the long-term, the first analysis is how frugal the management team is.

As it stands, most CEOs are choosing to borrow more, while their companies are earning less.

The fact is that institutional investors are starting to shy away from bonds and will look elsewhere for safety.

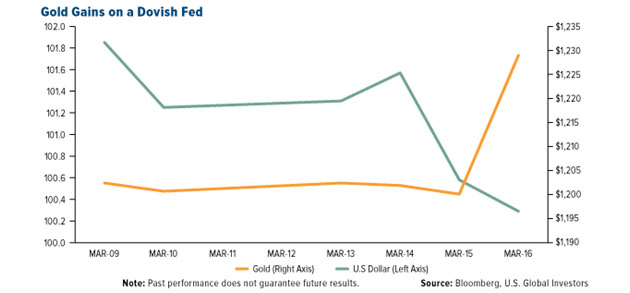

The retail investors, who are normally bullish when they shouldn't be and bearish near bottoms, are exiting gold investments just as the major miners are reporting profits for the forst time in years—these are contrarian playbook situations that are coming into fruition.

Smart money is buying gold as the Fed raises rates since they know that real interest rates remain close to zero, and they also know that the Chinese are gobbling up gold.

3-Part Investment Theme

1. Protection: If you haven't already bought gold or silver coins and bullion, or allocated funds into protective instruments, such as Bitcoin, this is a good time to start, as the U.S. government enters the summer with a debt ceiling debate that might get heated up and send the market to mayhem.

2. Inflation and infrastructure: Consider owning shares of cobalt stocks, which can certainly become top performers in the coming months.

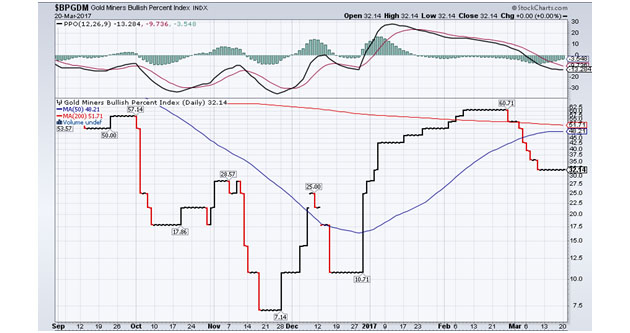

3. Contrarian Gold Stocks: These are literally the most hated investments today, and are therefore one of the cheapest.

A read of 32.14 is very low, and in the coming weeks, Wealth Research Group will be following this in order to make sure that we, the contrarians, will be able to do exactly what the majority is too conditioned not to do: lead, instead of be led.

It does require guts and stamina to be part of the party after you've seen a number of funerals, but that's exactly how people like Rick Rule become multimillionaires.

Disclosures:

1) Statements and opinions expressed are the opinions of Lior Gantz and not of Streetwise Reports or its officers. Lior Gantz is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Lior Gantz was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview or article until after it publishes.