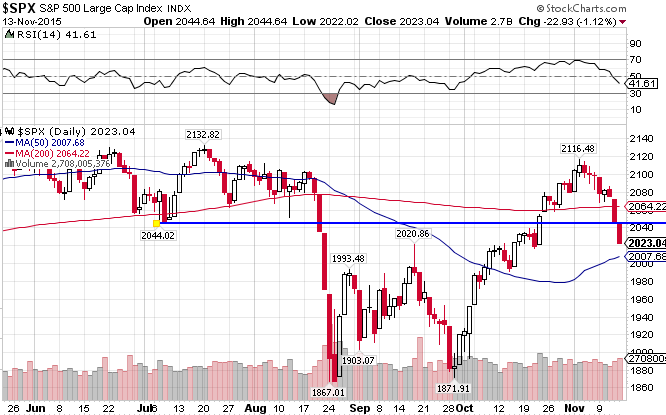

After trading within a range of 150 or so points during 2015, the S&P 500 Index (N:IVV) fell off a cliff in late summer, decisively breaking both moving averages but holding support at the 1870 level. Within the last month and a half though, it has rebounded remarkably, getting close to new all-time highs. Those gains are once again at risk following last week’s trading, as the index failed to hold the 200-day MA and was punished as a result. The 50-day MA is the next support level. The S&P 500 is barely in positive territory, up 0.04% year-to-date.

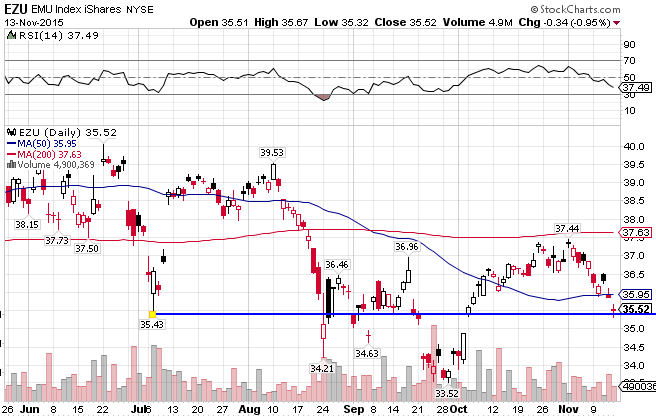

The EMU Index (N:EZU), or the European Economic and Monetary Union, fell more gradually over a longer period of time when compared with its US counterpart. And it never recovered with the same verocity. Europe has been consistently underperforming the US for some time now, after outperforming for half of the year. The index is down 0.52% for all of 2015.

After a huge “irrationally exuberant” run into April, the Chinese markets (N:FXI) plunged over 35%, breaking both long-term MAs. After rebounding slightly, the index is at the precipice of another downward move, if you can’t hold support at the 37.5-38 level. The China Large Cap index is now down 10.31% in 2015.

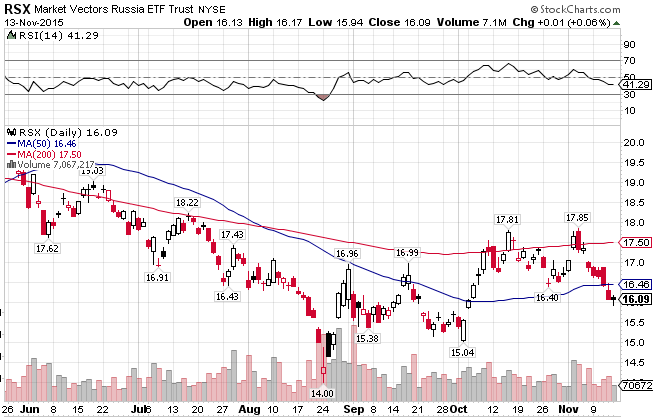

The Russian Index Market Vectors Russia (N:RSX) has been hit pretty hard by the collapse in the price of crude oil and by the US-EU-imposed sanctions. It is mired in an ugly downtrend line and after once-again failing at resistance; this time at the 50-day MA. RSX is now up only 9.98% in 2015 after a spectacular first half of the year.

A stronger US dollar, ISIS, and crashing crude oil prices are just a few of the things the Middle East Index WisdomTree Middle East Dividend (O:GULF) has to contend with. The index may be looking at new lows in the near future. The supply of crude oil is probably the biggest driving factor of this market, and that is still a net negative for the index, especially with Iran coming to the market soon. The index is down 13.81% since the beginning of the year.

Another region hit hard by the commodity bust. The Latin American market iShares Latin America 40 (N:ILF) broke down in May and again in August after an impressive recovery from its March lows. It now finds itself just below support at the 50-day MA. It has moved concurrently with the crashing commodities market and is still struggling to hold any support. The index has recorded a loss of 26.23% this year.

Africa’s market Market Vectors Africa (N:AFK) has managed to grind higher for most of 2014. But continued upheaval in Northern Africa, coupled with a weak global economy, has finally dampened Africa’s run. It is down 26.83% for 2015 after a tough summer and a horrendous November.

Japan iShares MSCI Japan (N:EWJ) is holding onto gains that were made after the BOJ unexpectedly eased monetary policy in the beginning of the year. Japan is up 10.43% YTD, the best-performing market.