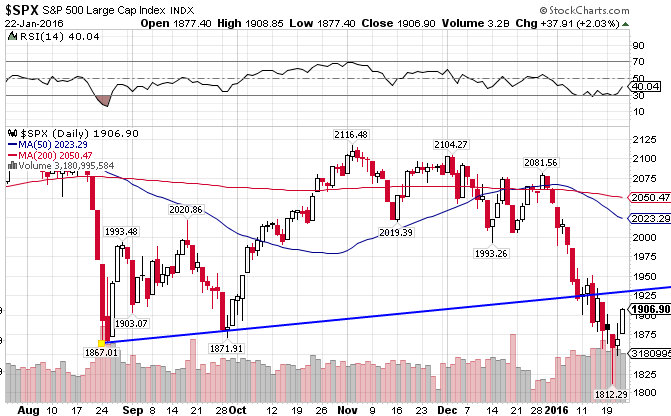

The S&P 500 Index ((N:IVV)) has had a rough first part of the year. Having failed at strong resistance at both moving averages, the index was essentially in a freefall on its way down to the 1800 level. After a drop of over 250 points, it managed to hold that level and now looks likely to bounce back up to at least 1925 as a result. The index is down 6.53% YTD.

The S&P 500 Value Index ((N:IVE)), which consists primarily of US large-cap value stocks in the financial services, industrial, and consumer cyclical industries, tend to have lower price to earnings ratios and higher dividend yields than the market as a whole. The value index had been out of form in 2015, having underperformed vs the S&P 500 by a pretty significant margin. The trend continues into this year, as the index is down 7.13% year-to-date.

The S&P 500 Growth Index ((N:IVW)), which consists primarily of US large-cap growth stocks in the tech, healthcare, and energy industries, tend to have higher earnings growth rates, higher earnings multiples, and little or no dividend yields. Conversely, growth stocks have been the better bet in 2015, and so far in 2016, as the index is ahead of the pace set by the S&P 500, returning -6.16% YTD.

A short-term trend of growth stocks solidly outperforming value stocks has emerged. Over the longer term, you can see the shift from value stocks to growth stocks occurring in mid-2013. A switch might be fast approaching.

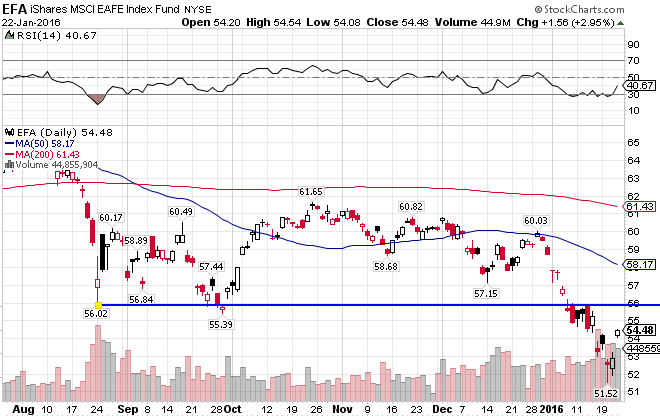

The MSCI EAFE Index ((N:EFA)), a global developed market index that encompasses Europe, Australasia, and the Far East, had significantly underperformed versus the S&P 500 in 2014, 2015, and into 2016. The EAFE Index is returning -7.22% YTD.

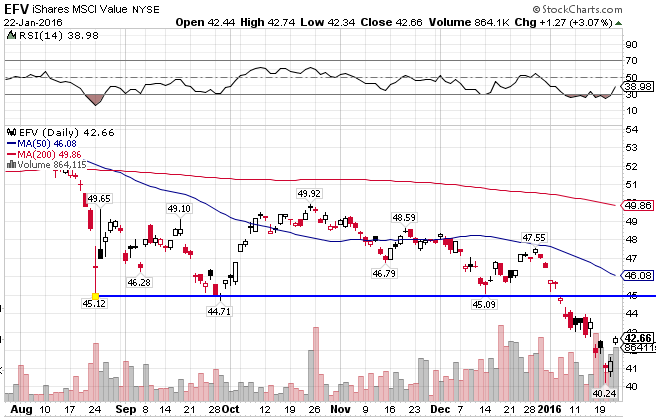

The MSCI EAFE Value Index ((N:EFV)) consists primarily of low P/E international large-cap value stocks in the financials, energy, and communications industries. Like the US markets, international value stocks are also underperforming growth stocks of late, returning -8.30% YTD.

The MSCI EAFE Growth Index ((N:EFG)), which consists primarily of high-growth international large-cap growth stocks in the industrial, healthcare, and consumer cyclical industries, has outperformed compared to the value index, and the spread is widening. The index is down 6.82% YTD.

Over the long term, a shift from value stocks to growth occurred in late 2014.