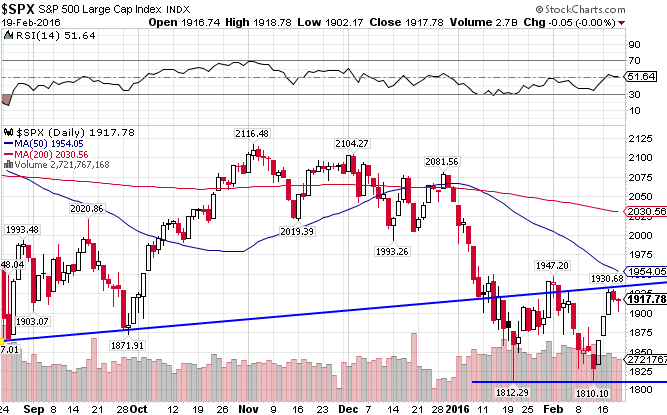

This past week, the S&P 500 Cap-Weighted Index ((N:IVV)) tested and then broke strong support at the 50 and 200-day moving averages after a remarkable rebound from its crushing meltdown in August of last year. Look for a possible bounce here, so long as it can get above resistance at the 1950 level, as the market is slightly oversold. The S&P 500 is down 5.83% for the year.

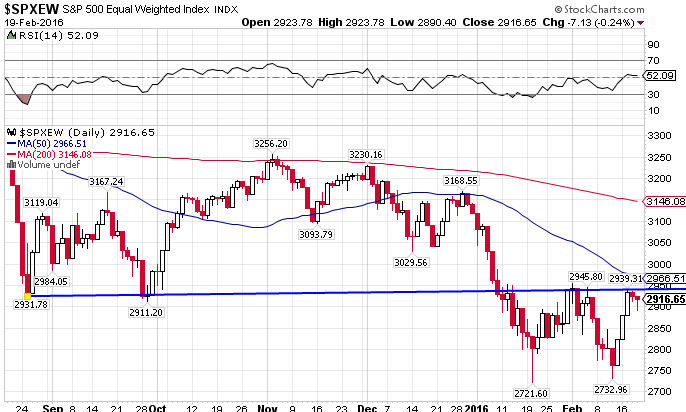

The S&P 500 Equal-Weighted index ((N:RSP)) is set up so that every stock in the index has the same weight, thereby eliminating the market-weighting growth bias. As a result, the index tilts more towards mid-cap and value stocks, which accounts for much of the out-performance versus the cap-weighted index in the last decade. So far this year, the index is down 6.18% year-to-date, slightly underperforming the cap-weighted index.

One of the themes of the past decade has been growth-oriented, smaller cap stocks outperforming high quality, blue chip stocks. That trend is no longer intact for 2015 and into 2016, as the bottom fell out from under the Russell 2000 index ((N:IWM)) in the 4th quarter of 2015 and into 2016. IWM is underperforming the large cap index and is down 10.81% YTD.

The S&P 500 versus the Russell 2000 Index, Weekly Chart. It seems that the large cap index has broken out in the past couple of months. A big move was expected, and that is now coming to fruition.

Looks like the weakening Chinese economy managed to deflate the MSCI EAFE Index ((N:EFA)). The index is down 8.17% since the beginning of the year, slightly worse than its US counterpart, continuing the trend that began in the second half of last year.

The MSCI EAFE Small Cap ((N:SCZ)) has performed slightly better than the large cap index this year (-7.95%), after impressively holding onto a 9% gain last year. Unlike the US markets, international small caps are outperforming their large cap index over the last 12 months.

EAFE Large Cap Index vs EAFE Small Cap Index, Weekly View. It’s been a steady small cap outperformance since October of last year.