The data yesterday has clearly put a chill through short positions in the AUD against all major pairs apart from the NZD. The EUR, GBP, CAD, CHF and JPY were sent packing by 1% or more, to go with the huge upside seen in November – the short squeeze is clearly on.

The RBA’s 2015

The movement in the AUD has to put the RBA in focus. It has been quite a tricky year for the board. The Australian economy is undergoing one of the larger transitions in decades. It has faced a huge amount of distraction this year as the commodities boom comes to a screeching halt, it moved rates for the first time since August 2013 to record lows, and has two states contracting while two other states face ‘bubble’ fear in housing. However, if you look at the mandates the RBA manages on current data, the Australian economy is finishing the year with:

- Credit growth is at a seven-year high

- Business conditions are in the positive while business confidence is also in the ‘positive’ side of the ledger, despite some terrible CAPEX reads

- Consumer confidence has hit a two-year high - you can argue this is down to changes at the federal government level but the RBA plays a part for its rate cuts and the confidence that this builds

- GDP today is likely to show Australia growing year-on-year at around 2.4%. While this is ‘below trend’, it’s not by an amount the bears have been calling for and well away from the predicted ‘recession’ coming

- Employment is much better than what was forecasted at the start of the year, back in the 5% handle

- The moderation of the housing market through its macro prudential rules is working (although the housing-led recovery has been one of the key drivers of the Australian economy and the S&P/ASX 200 over the past three years)

- The only thing that is below expectations is inflation, however it is still inside the comfort band of 2% to 3% on a trimmed-mean basis

I believe that if they could, the board would give themselves an 8/10 maybe even a 9. Everything they have wanted to happen mainly has. It is hard to argue with the scorecard above and although plenty will take the RBA to task on certain parts of the economy or certain data points, you can understand why it is ‘chilled out’ and awaiting 2016 data as it looks at the whole picture to make its next move.

ASX total return in the black

The ASX has 19 trading days to add 145 points in order for it to breakeven for the year on a cash basis. 5411 is where it started the year and considering the market does look primed for a Santa rally, (it has been treading water since mid-August) it could indeed reach breakeven at the close of 31 December.

What is more interesting is that the dividend debate has died away in the back half of 2015 as the issues around commodities and China ramped up. Yet, on a total return basis, using the current average dividend rate of 2.47% the ASX on a total return basis is up 3.52% year-to-date at 5594. This should make the fund managers a little happier.

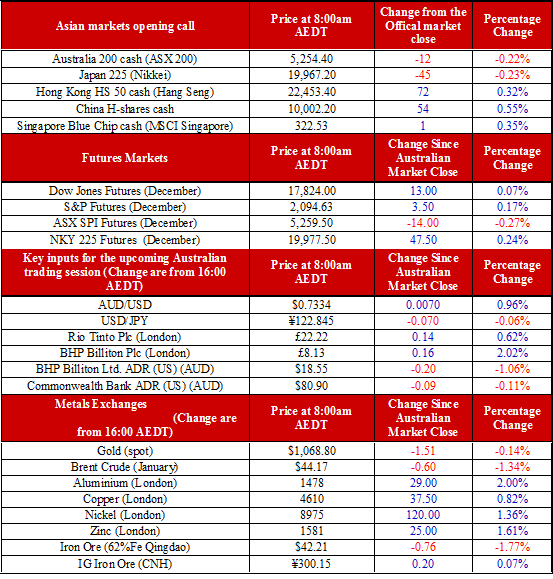

Ahead of the Australian Open

A new decade low for iron ore last night at US$42.27 a tonne. It’s motoring towards US$40 a tonne, however the other industrial metals had a somewhat positive night, adding around half of one percent.

The net exports in the current accounts yesterday has seen several investment banks and economists retching up their forecasts for today’s Q3 GDP read. Expectations are for 0.8% growth quarter-on-quarter, up from the original estimate of 0.7% while year-on-year is estimated at 2.4%. This was likely priced in to markets considering the jump in the ASX and the AUD. However, if there is a better than expected read, the short squeeze in the AUD is likely to feel even more pressure than it has over the last four weeks.

On the market front, we are calling the ASX down slightly to 5254. BHP's (N:BHP) cover rally yesterday unwinds today with its ADR off 1%, which should see the cash price following suit, while CBA's (AX:CBA) ADR is also slightly lower at $80.90.