Eyes on today Spanish and German CPI (Preliminary release) and U.S. GDP data.

Draghi said the ECB sees growth that is above trend and well distributed across the euro area, but reiterated that “a considerable degree” of stimulus is still needed in the euro zone (stronger growth outlook but a weaker inflation picture across the projection horizon), and that the ECB must be “prudent” in how it unwinds it. The euro reversed recent gains after Bloomberg reported that ECB sources said market misinterpreted Draghi's remarks.

The speech "was intended to strike a balance between recognizing the currency bloc's economic strength and warning that monetary support is still needed" Bloomberg said.

German Manufacturing PMI better than expected, German Services declined. Same for Eurozone data (Preliminary releases).

EUR/USD boosted up by dovish Fed’s hints. Yellen said that, even though jobless rate low, inflation has continued to run below Fed’s objectives. Fed is looking carefully at inflation expectations but they are not getting a consistent story on inflation.

Italian municipal elections marks a change with right-wing (no-euro) parties placing more mayors than expected.

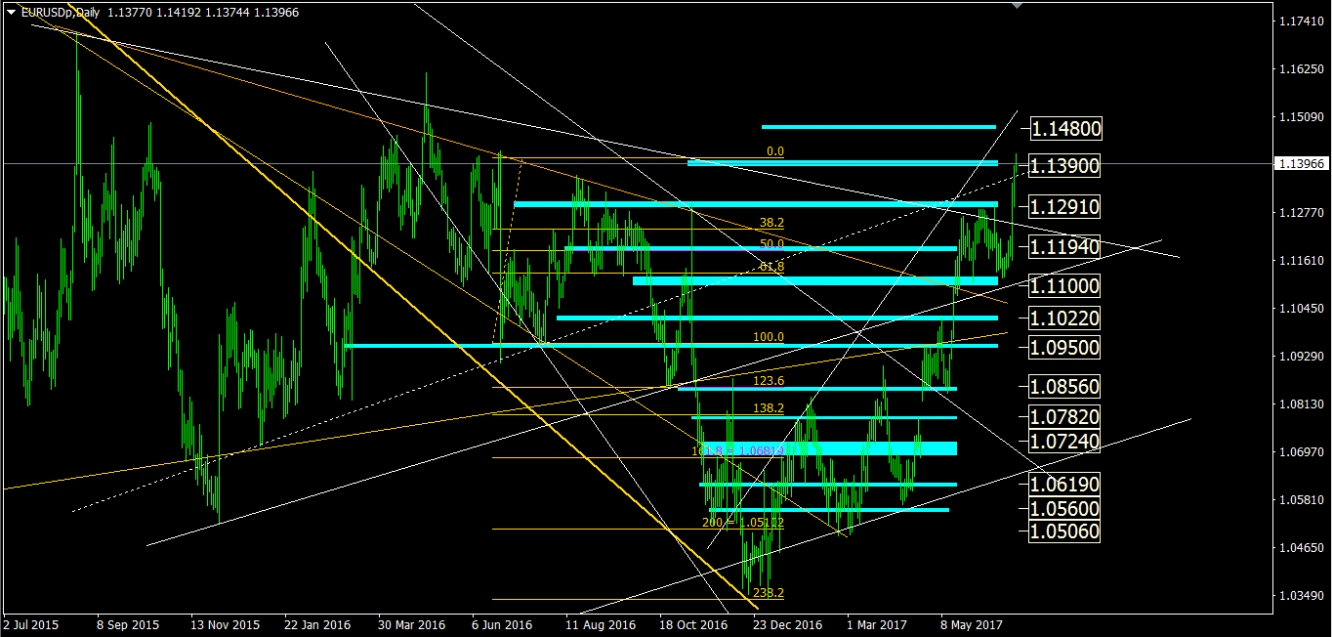

1.1390 is the current important Resistance. Break out would push price up to 1.148. On the other hand, failing to break 1.139 will converge down to 1.1194 Support area.

Our special Fibo Retracement is confirming the following S/R levels against the monthly and weekly trendlines obtained by connecting the relevant highs and lows back to 2012:

Weekly Trend: Neutral

1st Resistance: 1.1390

2nd Resistance: 1.1480

1st Support: 1.1194

2nd Support: 1.1100

EUR

Recent Facts:

9th of March, ECB Interest Rate decision + ECB Press Conference

Interest Rates unchanged, ECB President Dovish (can be cut again in the future if necessary).

14th of March, German CPI + German ZEW Economic Sentiment

German CPI as expected, German ZEW worse than expected.

24th of March, German Manufacturing PMI

Significantly better than expected.

30th of March, German CPI

Lower than expected.

31st of March, German Unemployment Change + Eurozone CPI

German Unemployment Change better than expected (for the sixth time in a row), Eurozone CPI worse than expected.

3rd of April, German Manufacturing PMI

As expected.

11th of April, German ZEW Economic Sentiment

Better than expected.

21st of April, French Manufacturing PMI + German Manufacturing PMI

Better than expected.

23rd of April, French Elections (first round)

Centrist Emmanuel Macron, a pro-EU ex-banker and former economy minister, emerged as the leader of the first round of voting and qualified for a May 7 runoff alongside the second-place finisher, far-right leader Marine Le Pen.

24th of April, German Ifo Business Climate

Better than expected.

27th of April, ECB Interest Rate decision + ECB Press Conference

Unchanged, eyes on next Inflation data.

28th of April, CPI (Preliminary)

Higher than expected.

2nd of May, German Manufacturing PMI

As expected.

3rd of May, German Unemployment Change + Eurozone GDP (Preliminary)

German Unemployment Change better than expected (for the 5th time in a row).

Eurozone GDP (Preliminary) as expected.

7th of May, French Elections

Centrist pro-EU Macron Won French Elections.

12th of May, German GDP (Preliminary release)

As expected.

16th of May, Eurozone GDP (Preliminary release) + Trade Balance + ZEW Economic Sentiment

Better than expected.

17th of May, Eurozone CPI

As expected.

23rd of May, German Manufacturing PMI

Better than expected.

30th of May, German CPI (Preliminary release)

Worse than expected.

31st of May, German Unemployment Change + Eurozone CPI (Preliminary)

German Unemployment Change better than expected (for the 8th time in a row), Eurozone CPI worse than expected.

1st of June, German Manufacturing PMI

Slightly better than expected.

8th of June, GDP, Interest Rate Decision + ECB Press Conference

GDP better than expected, ECB moving closer to an exit from its stimulus program.

13th of June, French Non-Farm Payrolls

Better than expected.

13th of June, German Zew Economic Sentiment

Worse than expected.

23rd of June,

German Manufacturing PMI Better than expected.

German Services PMI worse than expected.

Eurozone Manufacturing PMI better than expected.

Eurozone Services PMI worse than expected.

26th of June, German Ifo Business Climate

Better than expected.

Eyes on today release: German CPI + Spanish CPI

USD

Recent Facts:

5th of May, Nonfarm Payrolls + Unemployment Rate

Better than expected.

11th of May, U.S. Producer Price Index (PPI)

Higher than expected.

12th of May, U.S. Retail Sales + Core CPI (Inflation data)

Worse than expected.

18th of May, Initial Jobless Claims + Philadelphia Fed Manufacturing Index

Better than expected.

23rd of May, Manufacturing PMI + New Home Sales

Worse than expected.

24th of May, FOMC Meeting Minutes

U.S. central bank kept its benchmark rate unchanged, highlighting a slowdown in economic activity (more proof that weakness in the first-quarter was temporary is needed for future rate hikes).

26th of May, Core Durable Good Orders + U.S. GDP (Preliminary release)

Core Durable Goods Orders worse than expected, GDP (Preliminary) better than expected.

31st of May, Chicago PMI + Pending Home Sales

Worse than expected.

1st of June, ADP Nonfarm Employment Change + ISM Manufacturing PMI

Better than expected.

2nd of June, Nonfarm Payrolls + Unemployment Rate

Nonfarm Payrolls worse than expected, Unemployment Rate better than expected.

13th of June, Producer Price Index

Core PPI (ex food and energy) better than expected.

14th of June, CPI + Retail Sales

Worse than expected.

14th of June, FOMC Interest Rates Decision + Statement

Interest Rate hike as expected (to 1.25%).

23rd of June, Manufacturing PMI

Worse than expected.

26th of June, Durable Goods Orders

Worse than expected.

28th of June, Pending Home Sales

Worse than expected.

Eyes on today release: U.S. GDP.

GBP/USD boosted up by Carney statement regarding removal of monetary as spare capacity in the economy erodes and by recent dovish Fed’s messages. The agreement between Conservative Party and Democratic Unionist Party is occupying only the background of the global Sentiment on Pound.

The day after Governor Carney ruled out imminent rate hikes, warning of weak wage growth and incomes as Britain prepares to leave the European Union, pound attempted a significant recovery as Bank of England (BoE) chief economist Haldane revealed that he is likely to vote for rate hike “relatively soon”.

UK CPI (Inflation) data again higher than expected while UK Retail Sales worse than expected. Last data regarding UK manufacturing and industrial production were worse than expected along with UK GDP, Preliminary release.

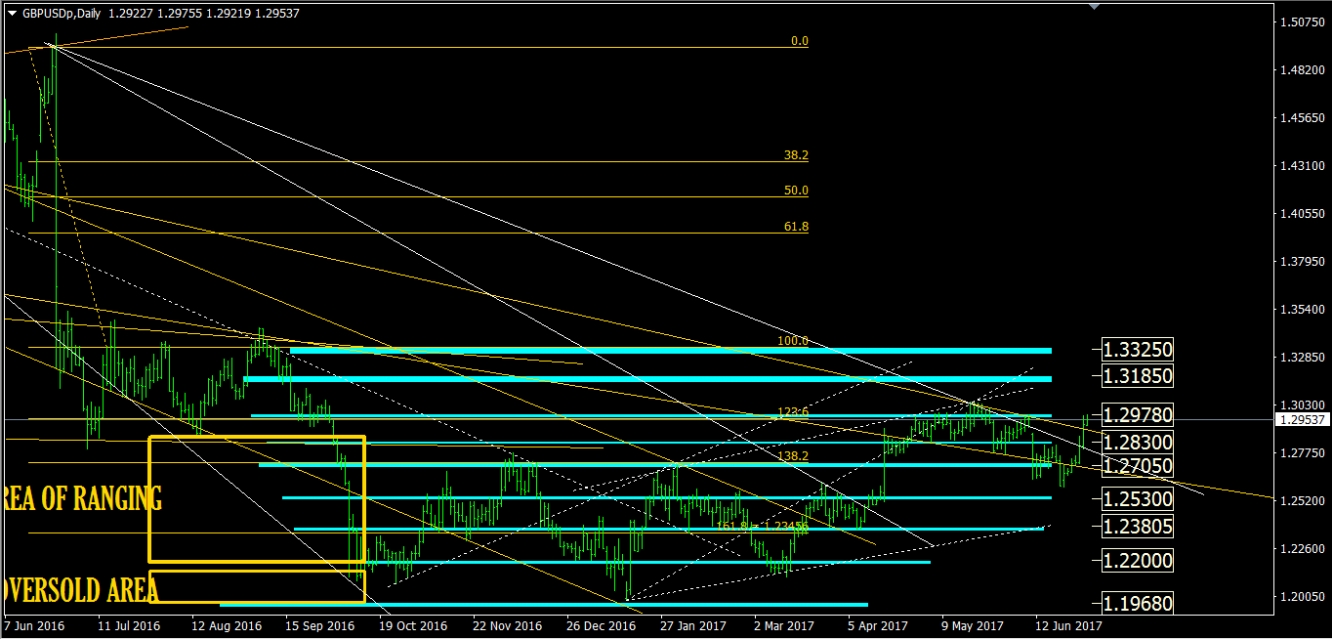

Breakout of Resistance around 1.283 area happened and, as we wrote previously, this pushed the price up to 1.2978 (important Resistance area). Now, only a definitive Breakout of 1.298 would take up to 1.3185. On the other hand, failing to break 1.298 will create the setup for a Bearish wave down to 1.28 Support.

Our special Fibo Retracement is confirming the following S/R levels against the monthly and weekly trendlines obtained by connecting the relevant highs and lows back to 2001:

Weekly Trend: Neutral

1st Resistance: 1.2978

2nd Resistance: 1.3185

1st Support: 1.2830

2nd Support: 1.2705

GBP

Recent Facts:

4th of August, Bank of England Interest Rates decision (expected a cut)

Bank of England lowers Interest Rates as expected (record low of 0.25%) and increases purchase program.

15th of March, Job Market

Better than expected.

16th of March, Interest Rates Decision + BoE Meeting Minutes

A Bank of England policymaker unexpectedly voted to raise interest rates.

11th of May, UK Manufacturing Production + Trade Balance + BoE Interest Rate Decision

Manufacturing Production + Trade Balance worse than expected.

The Bank of England made no changes to monetary policy but warned that living standards will fall this year as the headwinds from Brexit mount.

16th of May, UK CPI (Inflation data)

Higher than expected.

17th of May, UK Job Market

Worse than expected.

18th of May, Retail Sales

Better than expected.

25th of May, GDP (Preliminary)

Worse than expected.

1st of June, UK Manufacturing PMI

Slightly better than expected.

2nd of June, Construction PMI

Better than expected (Highest level since February 2016).

5th of June, UK Services PMI

Worse than expected.

8th of June, UK General Elections

British Prime Minister Theresa May's Conservative Party lost its parliamentary majority in a general election, throwing the country's politics into turmoil and potentially disrupting Brexit negotiations.

9th of June, industrial production + manufacturing production

Worse than expected.

13th of June, UK CPI

Higher than expected.

14th of June, UK Job Market

Claimant Count Change better than expected, Average Earnings Index worse than expected.

15th of June, Retail Sales

Retail Sales worse than expected.

20th of June, BoE Gov Carney Speech

Carney ruled out imminent rate hikes, warning of weak wage growth and a likely hit to incomes as Britain prepares to leave the European Union.

USD

Recent Facts:

See above.

Australia’s House Market (New Home Sales) improved.

Yellen said that, even though jobless rate low, inflation has continued to run below Fed’s objectives.

Fed is looking carefully at inflation expectations but they are not getting a consistent story on inflation.

Nigeria and Libya, which were exempt from the OPEC-led cuts, have also increased production and last increase in U.S. output has undermined the impact on inventories of output cuts by major producers.

So large part of the gains in the Australian dollar is still driven by the Country’s job market report (seen as stronger-than-expected). Australia GDP also better than expected but the performance came one day after the Reserve Bank of Australia (RBA) cautioned that growth "is expected to have slowed in the March quarter",

In the last meeting, the Reserve Bank of Australia held Interest Rates at 1.5% as expected but reporting that the current account widened to a deficit of A$3.1 billion, compared with a surplus of A$100 million seen for the first quarter.

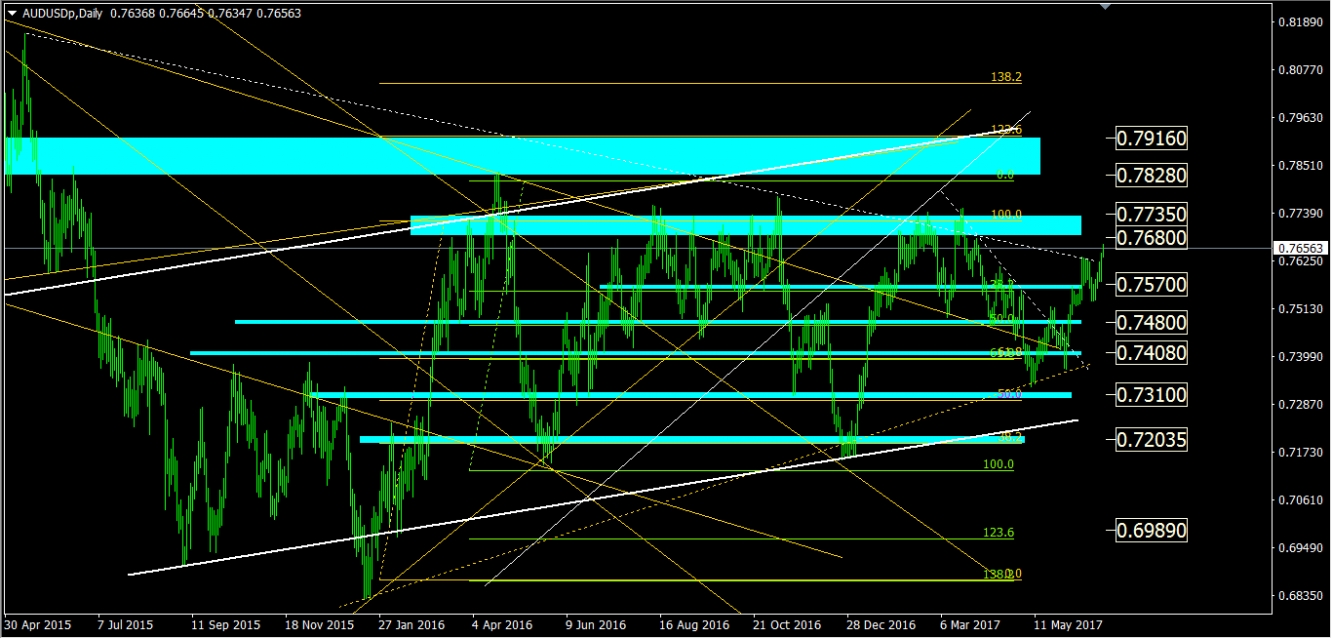

We are in the scenario of a breakout of 0.764 and this will lead up to our first new Resistance in area 0.768.

Our special Fibo Retracements are confirming the following S/R levels against the monthly and weekly trendlines obtained by connecting the relevant highs and lows back to 2012:

Weekly Trend: Neutral

1st Resistance: 0.7680

2nd Resistance: 0.7735

1st Support: 0.7480

2nd Support: 0.7408

AUD

Recent Facts:

7th of February, RBA Interest Rates Decision + RBA Rate Statement

RBA held steady as expected at a record low 1.50%, while noting better economic conditions with China.

8th of February, New Zealand Interest Rate Decision + RBNZ Monetary Policy Statement

Interest Rates unchanged and RBNZ’s agenda contains no changes for 2017.

16th of February, Employment Change

Better than expected.

28th of February, New Home Sales, Current Account, Private Sector Credit.

1st of March, Australia GDP

Better than expected.

16th of March, Employment Change + Unemployment Rate

Worse than expected.

2nd of April, Retail Sales

Worse than expected.

4th of April, RBA Interest Rate Decision

Interest Rates unchanged, as expected. Dovish tone in Philip Dowe’s Speech.

9th of April, Home Loans

Worse than expected.

13th of April, Australia Employment Change

Better than expected.

18th of April, RBA Meeting Minutes

Dovish.

26th of April, Australia CPI

Lower than expected.

2nd of May, RBA Interest Rate Statement

RBA holds Rates at 1.5%.

4th of May, Australia New Home Sales + Trade Balance

Worse than expected.

9th of May, Australia Retail Sales

Worse than expected.

18th of May, Australia Employment Change

Better than expected.

24th of May, Australia Construction Work Done

Worse than expected.

24th of May, Moody’s Credit Rating on China

Moody's Investors Service downgraded China's credit rating to A1 from Aa3, changing its outlook to stable from negative.

25th of May, OPEC Meeting

OPEC decided to extend production cuts by nine months to March 2018.

30th of May, Building Approvals + Private House Approvals

Better than expected.

1st of June, Australia Retail Sales

Better than expected.

6th of June, Reserve Bank Of Australia Interest Rate Decision and Statement

In the last meeting, the Reserve Bank of Australia held Interest Rates at 1.5% as expected, reporting that the current account’s deficit widened.

7th of June, Australia GDP

Better than expected.

15th of June, Australia Employment Change

Better than expected (3rd month in a row).

29th of June, HIA New Home Sales

Better than expected.

USD

Recent Facts:

See above.