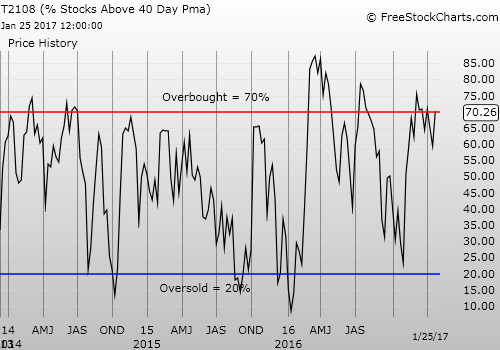

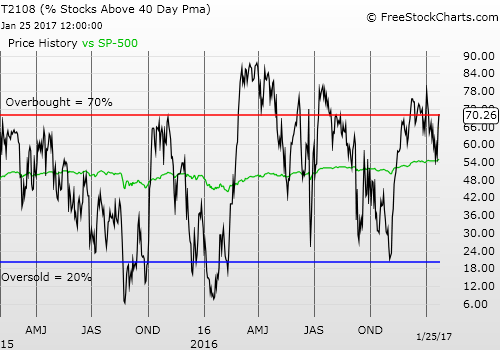

T2108 Status: 70.3% (Overbought day #1)

T2107 Status: 69.7%

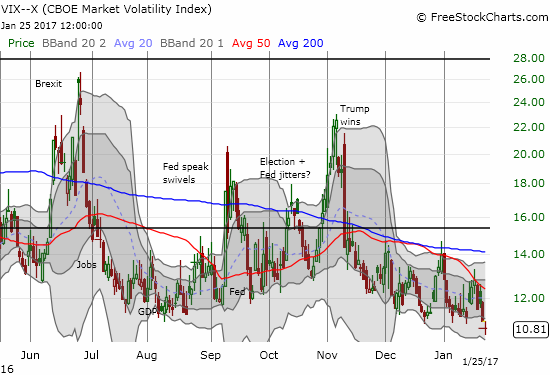

VIX Status: 10.8

General (Short-term) Trading Call: neutral

Active T2108 periods: Day #234 over 20%, Day #54 over 30%, Day #53 over 40%, Day #51 over 50%, Day #2 over 60%, Day #1 over 70% (overperiod, ending 13 days under 70%)

Commentary

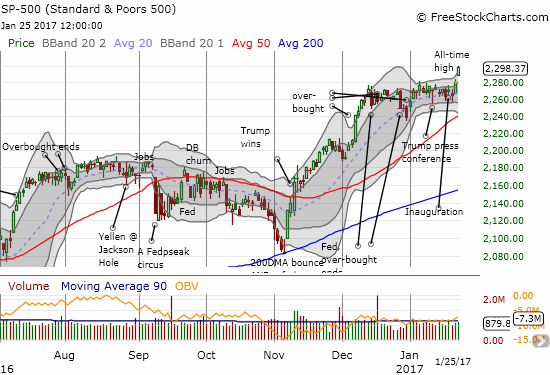

I noted in my last T2108 Update that my bearish trading call was not likely to last much longer. Sure enough, the bulls and buyers put on a display that convincingly confirmed the previous day’s bullish moves. The S&P 500 (via SPDR S&P 500 (NYSE:SPY)) cleanly broke out and broke away from a frustrating trading range that had been in place since December 8, 2016.

The S&P 500 broke out in convincing fashion with a 0.8% gain to another all-time high.

Unlike the previous day, T2108, the percentage of stocks trading above their respective 40-day moving averages (DMAs), confirmed the bullish tone on the day with a jump into overbought territory. The close just above the 70% threshold marked the fourth trip into overbought conditions over the past 6 weeks.

This churn tempers my desire to flip the short-term trading call from bearish to bullish, so I am compromising with a neutral rating. I expect this neutral stance to stay in place for the duration of this overbought period.

I am particularly cautious because the VIX, already low the previous day, is now scratching at rock bottom levels. The volatility index has not been this low since July 3, 2014. In fact, reaching prior to June 6, 2014, the VIX was last this low on February 22, 2007.

That day ended an incredible run of complacency with the VIX below Wednesday's level for 48 trading days out of 90 starting October 13, 2006. In other words, the odds do not favor the VIX staying this low for much longer. If the VIX DOES manage to sustain a historic run of rock bottom levels, the event could exhaust buyers enough to carve out a major top in the stock market. This is a scenario to keep in the back pocket for now: it is too early to make such projections.

The volatility index, the VIX, took another plunge. The 3.7% loss took the VIX to a fresh 2 1/2 year low.

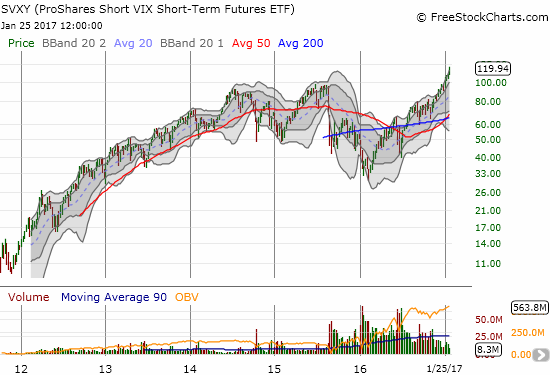

ProShares Short VIX Short-Term Futures (SVXY): The bet against volatility has paid off remarkably (and shockingly?) well in recent years. SVXY is up over 10x since late 2011.

The breakout on the S&P 500 provides a clean stop for new positions and a guidepost for any future change in the short-term trading call. A close below 2280 would end the breakout and likely signal a bearish change in momentum. Until then, I will assume that momentum and the path of least resistance favors the bulls and buyers. Accordingly, I will close out my small position in ProShares UltraShort S&P500 (NYSE:SDS).

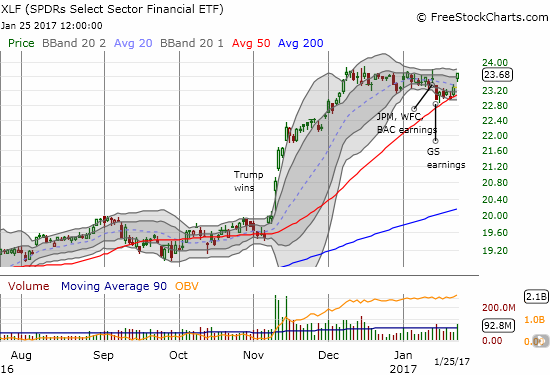

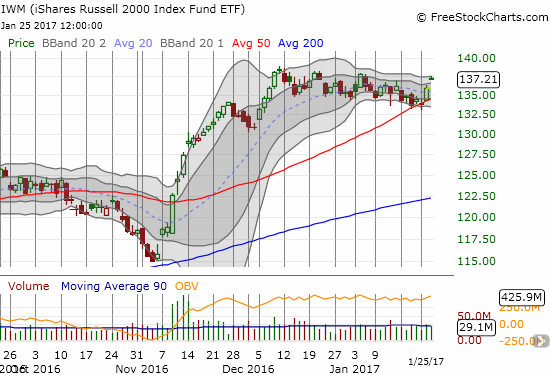

The Financial Select Sector SPDR ETF (NYSE:XLF) and iShares Russell 2000 (NYSE:IWM) add to the tone of bullish confirmation by following through on successful tests of support at their respective 50DMAs.

The Financial Select Sector SPDR ETF (XLF) confirmed support at its 50DMA.

iShares Russell 2000 (IWM) confirmed support at its 50DMA.

One of the most impressive confirmations of the bullish tone in the market came from Caterpillar (NYSE:CAT). CAT gapped up to a fresh 2+ year high in a move that confirmed a push away from 50DMA support. Its 20DMA (the dashed blue line) is now turning upward to support the new upside momentum.

Caterpillar (CAT) contributed to the bullish tone of the market with an impressive gap up and break out to a fresh 2+ year high.

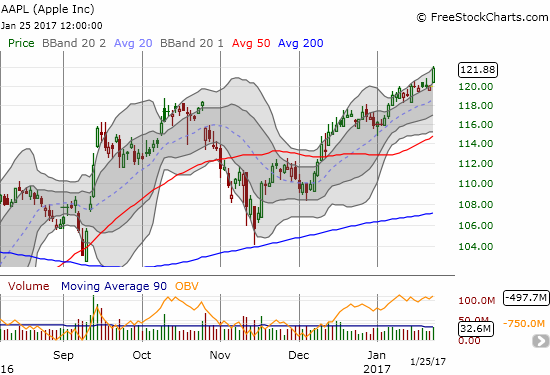

Finally, I have to acknowledge Apple (NASDAQ:AAPL). The stock has overcome a lot of technical hurdles and negative headlines to reach its current heights. AAPL broke out to a new 15-month high and finally closed a gap from November 10, 2015 (not shown below).

Apple (AAPL) printed a 1.6% gain that traveled from the bottom to the top of its upward trend channel defined by the upper-Bollinger Bands (BB).

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Be careful out there!

Full disclosure: long SDS