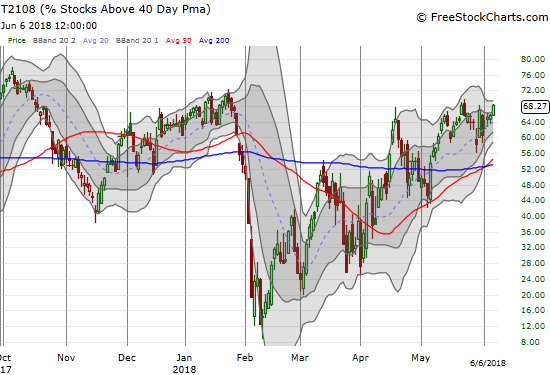

AT40 = 68.3% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 56.3% of stocks are trading above their respective 200DMAs (a 4-month high)

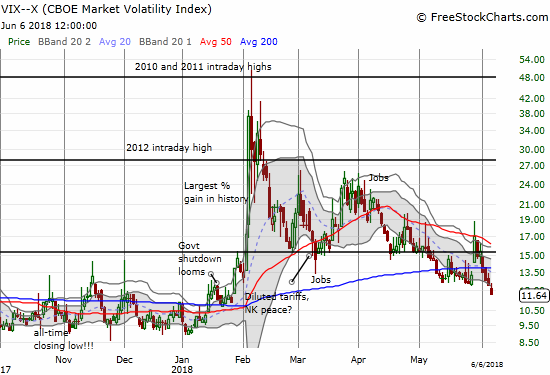

VIX = 11.6

Short-term Trading Call: neutral

Commentary

It is tough avoiding a flip on my short-term trading call to bullish, but I am sticking by my rules. Last week, uncomfortable divergences kept me planted on neutral. In my last Above the 40 post, I complained about the narrow nature of the rally. Well, TODAY (June 6th), while the rally finally broadened out a bit, AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), still failed to punch through the overbought threshold of 70%.

Almost but not quite. AT40 (T2108) rallied just short of the overbought threshold.

Once/if AT40 gets overbought, I will flip bullish in anticipation of an (extended) overbought rally. As the index charts below show, it looks late to get short-term bullish. Fortunately, the signal to retreat from bullishness will also come from AT40. Once my favorite indicator confirms a fall out of overbought territory, a market pullback becomes very likely. Just such a scenario accompanied the February sell-off.

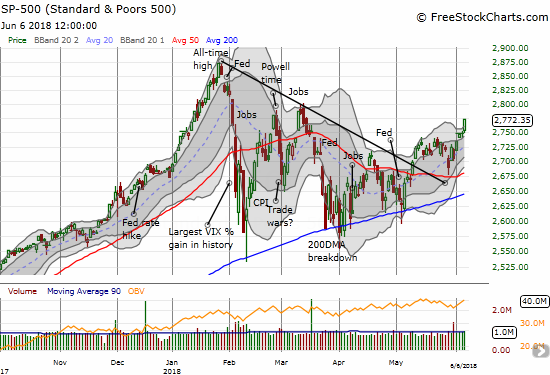

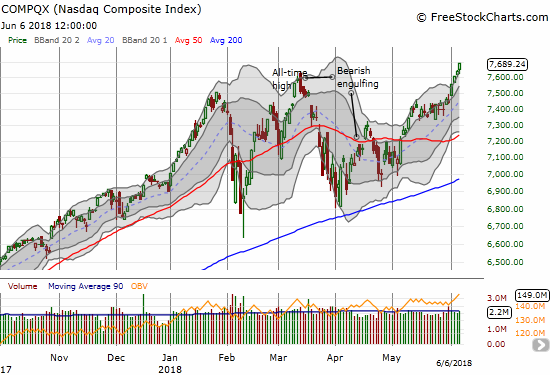

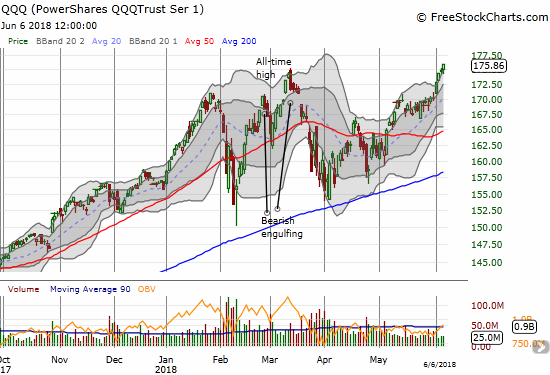

The S&P 500 SPY gained 0.9% to close above its upper-Bollinger Band (BB). The NASDAQ gained 0.7% with its third straight all-time high and fourth straight close above its upper-BB. The PowerShares QQQ ETF (QQQ) gained 0.6% in a carbon-copy move with the broader NASDAQ index.

The S&P 500 (SPY) confirmed its 50DMA breakout and the test of that support. The index is poised to go much higher from here.

The NASDAQ has accelerated its rally over the past week by. It is getting over-extended at these all-time highs.

Like the NASDAQ, the PowerShares QQQ ETF (QQQ) has kicked its rally into a higher gear and is now well-extended above its upper-BB.

The volatility index, the VIX, has almost reached its own milestone. Trading at 11 or below qualifies as “extremely low” volatility. In posts over the past year I have explained how and why trading at such low levels is bullish for the stock market. The VIX closed at 11.6, down 6.1% and a 4 1/2 month low.

The volatility index, the VIX, is tumbling back to bullish territory (under 11).

I took this opportunity to buy a third (and final) tranche of UVXY call options as a stock market hedge. Next week’s Fed meeting SHOULD stir up some volatility.

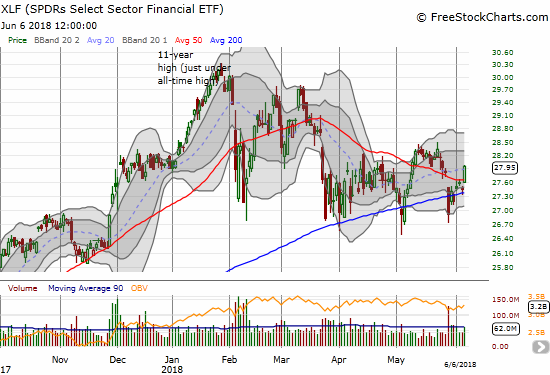

Evidence of the broadening rally was especially evident in financials. The Financial Select Sector SPDR ETF (NYSE:XLF) soared 1.9% in a move that shook off a lot of funk. XLF broke through its 50DMA and seemingly confirmed 200DMA support.

The Financial Select Sector SPDR ETF (XLF) is bouncing off and away from its 200DMa for the third time since March. Is the third time a charm?

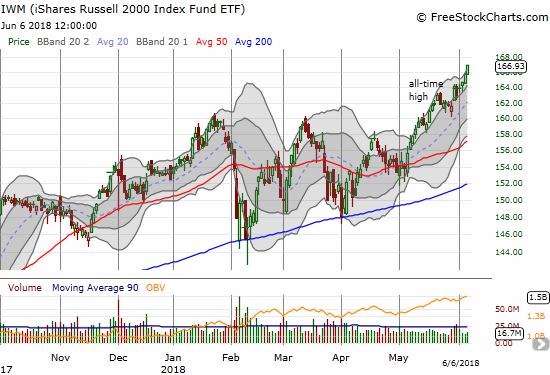

Shame on me for doubting the small-caps for a hot minute. The iShares Russell 2000 ETF (IWM) gained 0.7% and notched another all-time high. IWM has now increased in value 20 of the last 26 days in a display of nearly uninterrupted relative strength.

The iShares Russell 2000 ETF (IWM) has been on a tear for over a month. Yet, the index only just now closed above its upper-BB.

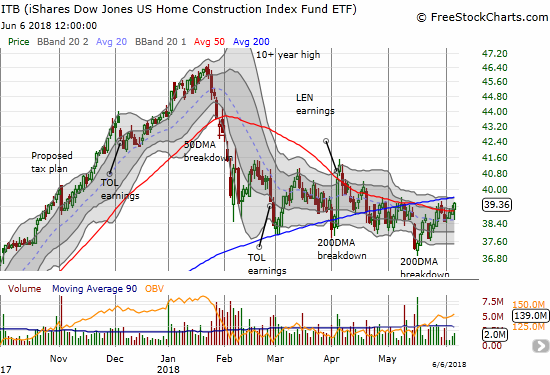

Even iShares US Home Construction ETF (ITB) participated with a 0.9% gain on the day. ITB is pivoting around its 50DMA with an important test of 200DMA resistance imminent.

The iShares US Home Construction ETF (ITB) is still capped by its still upward trending 200DMA.

With signs of strength broadly distributed, flipping to a short-term bullish trading call will generate a dive straight into the headwinds of “overbought” and “overextended” indices. Fortunately, with AT200 (T2107) at a new 4-month high and just above 50%, there are a lot of stocks that have plenty of room for catch-up even with market leaders over-extended. Some of the charts below show some of these opportunities for a tide that rises all boats.

CHART REVIEWS

Ax

I made the case for AXON last week. The trade turned out even more fortuitous than I could have imagined. The company announced major news today, sending the stock up an amazing 160.0%!

-

Exclusive worldwide license to lentiviral vector gene therapy constitutes the first transaction of Axovant’s 2018 pipeline expansion.

-

Fraser Wright, Co-Founder and former Chief Technology Officer of Spark Therapeutics, to join Axovant as CTO for gene therapy programs.

-

Axovant will receive $25 million equity financing from Roivant Sciences to support clinical development of AXO-Lenti-PD and additional business development.

I sold the stock at around an 88% gain on the day as it pulled back from the open. I certainly could not tell that buyers would soon step back in for a fresh run-up. This is the kind of stock that represents high upside potential in a truly bullish market that also features speculative tendencies. I will be looking for new entry points in the stock, but I do not expect them to come quickly or easily. Regardless, this latest company news seems to confirm my earlier thesis that the company has successfully hit a reset button on its way to an extended recovery.

Axovant Sciences (AXON) ripped 160% higher on positive news. The next upside challenge will be the sharply descending 200DMA and the coincident gap fill around $5.25.

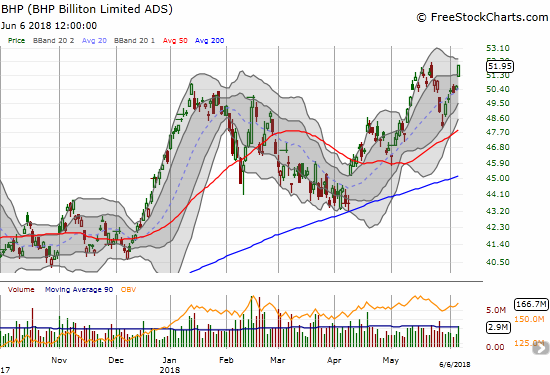

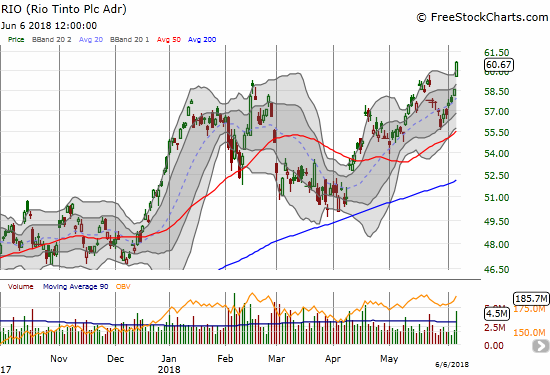

BHP Billiton (LON:BLT) and Rio Tinto (LON:RIO)

The only reason I hold no regret over holding my BHP puts during the last pullback is that I chose to double down on RIO call options instead of taking BHP profits. That decision paid off well today as RIO soared 3.7% to a new 6+ year high. I decided to hold onto the call options at least one more day to see whether RIO can deliver more follow-through to this impressive breakout. With expiration coming up next week, I need to make a move soon to take profits on this latest pairs trade.

BHP Billiton (BHP) increased 2.8% to a new 3-year high.

Rio Tinto (RIO) ripped higher to a 5+ year high on the back of a 3.7% gain. Like BHP however, trading volume has been on the decline.

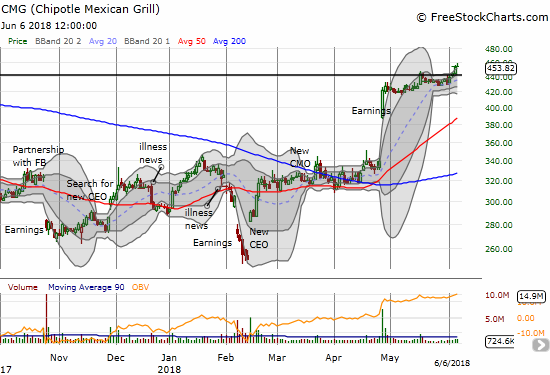

Chipotle Mexican Grill (NYSE:CMG)

I have practically posted to death on CMG. I am posting this time just to point out that CMG is in the breakout mode I have been anticipating for some time. Even more importantly, the stock received fresh backing from CNBC Mad Money’s Jim Cramer. I had already taken profits on the breakout ahead of his segment, so I was admittedly a bit dismayed that. I set in motion a new trade using a calendar call spread. Going forward I will continue to play this stock on the bullish side while trying out different call option configurations.

Chipotle Mexican Grill (CMG) pulled back from its high on the day and gave me a slightly cheaper entry point for the next play on CMG’s on-going breakout.