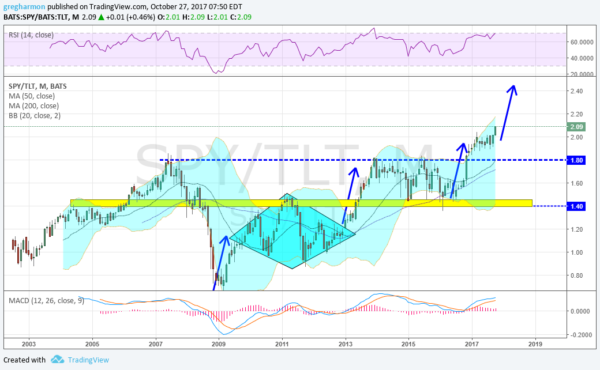

Much has been said about the stock-to-bond ratio. It has been recognized as a barometer of risk acceptance. As the pendulum swings from placing money in bonds to putting it to work in stocks the market place as a whole is more accepting of risk taking. That is an overly simplified view, but not too far off. take a look at the chart below of the stock to bond ratio as measured by the S&P 500 ETF SPY and the US Treasury ETF TLT.

The ratio rose from 2003 to a peak in the middle of 2007. As the financial crisis began to take hold it started to fall and then accelerated to a low in the beginning of 2009. Risk taking was high ahead of the crisis and low at the bottom, easy-peasy. As markets started to recover so did the stock to bond ratio and it moved higher off of the 2009 low. The correction (yes, I said correction) in markets in 2011 led to a consolidation in a Diamond shape and it pushed to the upside out of the diamond as markets rallied again.

As the ratio met its target move it stalled at the end of 2013. The morass that followed, with the ratio stagnating through to the end of 2016 was notable as a period of time when markets took turns, with one sector rallying as others consolidated. In particular the S&P 500 in this case. Its slow growth, coupled with a rebound in Bonds from a premature sell off for expected rising rates, leveled the ratio.

And then the election happened. The ratio took off to the upside in favor of risk taking. It quickly got bogged down as the political landscape showed a strong push forward of the Republican agenda was not a slam dunk. And now it is moving up out of that consolidation. Is it because of the belief that tax reform is coming? Or just very strong growth in corporate earnings? I do not know. But I can see it is happening and I am long stocks.