Our friends at Pathfinder Capital have created an excellent report on frontier markets. These guys live and breath the frontier, putting boots on the ground where most of us wouldn’t care to visit.

Both of the founders are ex-military guys who cut their teeth in places like Libya, Iraq and eastern Europe. Chris and I have spent a lot of time with them, including at our Meet Ups in Mongolia, Cambodia, Singapore and Sri Lanka. We really respect their analysis and expertise. We recommend taking the time to download and review their report linked at the end of this post.

Last week we attended an asset management conference in London, in which the agenda featured several prominent speakers and a panel conference on emerging markets. We noted that some of the UK’s largest fund managers would be represented in the discussion, so with our curiosity piqued we walked down to Threadneedle Street in order to listen in.

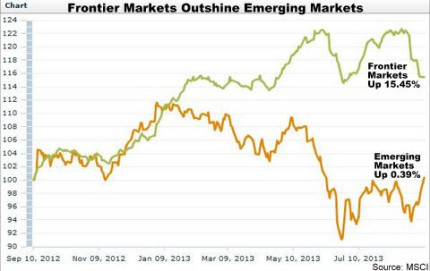

For the most part the event did not disappoint – it’s always useful to hear other fund managers discuss the issues that keep them awake at night. However we were somewhat taken aback by one comment at the emerging markets panel; in general, this person (a partner at a firm claiming to focus on the emerging markets) told the audience that he didn’t see any reason to distinguish between the emerging and frontier markets, given the relatively high correlations of their currencies and equity indices.

In our opinion, this comment couldn’t have been further off the mark – and we have the empirical evidence to back it up. At the bottom of this post you can see a link to our latest white paper “Introducing the I-3″. We have spent the past several months building this document, with special thanks to our friends Owain Mulligan (currently at London Business School) and Joe Holliday (currently at Harvard Business School) for their invaluable assistance.

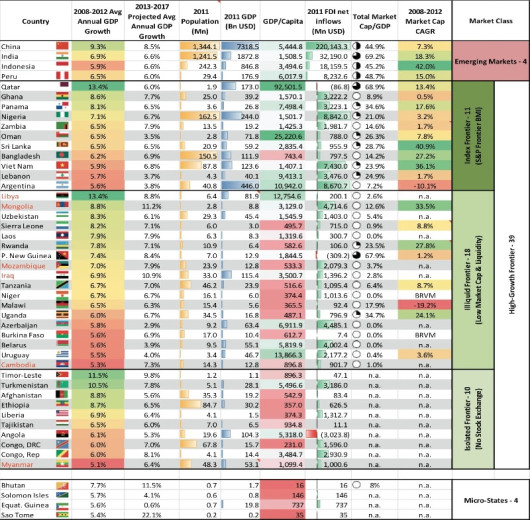

Many institutional investors have acknowledged that frontier markets deserve consideration as a distinct asset class. After twenty years of strong growth, the “traditional” emerging markets (the famed BRICs of Brazil, Russia, India and China) are beginning to resemble developed Western economies. However, the majority of global growth in the next decade will instead be generated by “frontier markets”. Indeed, over the past five years, 43 of the 47 highest-growth economies have come from the frontier. Less than one third of those are represented on mainstream equity indices.

Traditional definitions of the frontier market are unsatisfactory. They are typically defined as “those markets that are not yet classified as developed or emerging markets”. While this is technically true, and a valid first step, frontier markets can also be defined by the specific characteristics they exhibit in comparison to more developed economies:

- Lower liquidity

- Smaller market capitalization

- Higher trading costs

- Higher volatility

- Reduced transparency

- Higher geopolitical/sovereign political risk

It should also be recognized that frontier markets are not homogenous. In fact, they can be further broken down into three distinct categories that we have identified as the I-3:

- Indexed Frontier. Countries that are included on mainstream equity indices.

- Illiquid Frontier. Countries that have small stock exchanges with low trading volumes and low market cap-to-GDP ratios.

- Isolated Frontier. Those high-growth economies that do not have a sovereign stock exchange, or participate in a regional stock exchange.

Between 2008 and 2012, forty-seven economies achieved an average annual GDP growth rate greater than 5% (see Figure 1). Of these, none were developed economies and only four were classified as emerging markets, leaving 43 from the frontier.

Most investors overlook frontier markets due to perceptions of higher risk and, often more so, a general lack of familiarity. Frontier markets also have little or no representation in mainstream equity indices and are therefore not easily investable. While a handful of frontier-focused indices exist, their market capitalization remains very small when compared to emerging markets equity indices. This lack of representation creates difficulties for the investor who seeks exposure to this exciting asset class. In this era of quantitative easing and negative real deposit rates, investors are increasingly turning to the high growth opportunities offered in the frontier markets. After reading the attached document, we believe that the reasons behind this trend will become plainly evident.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI