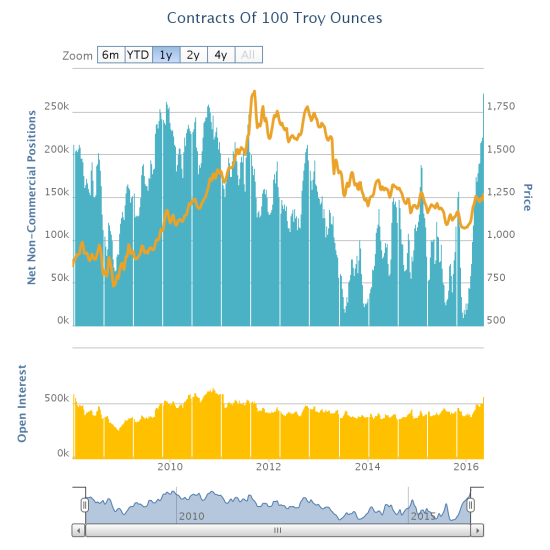

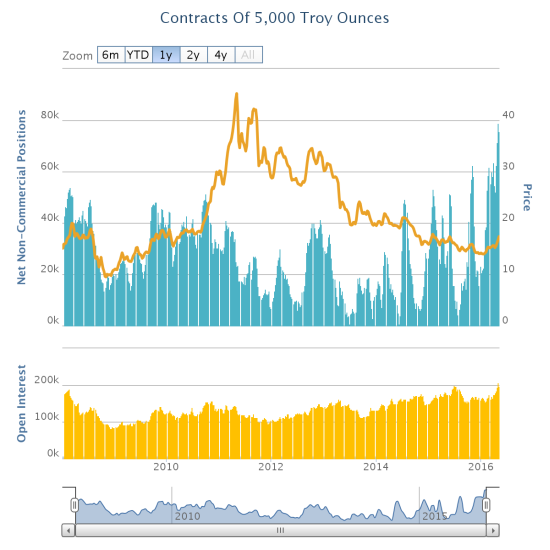

Speculators are now net long gold at levels that surpass the financial crisis of 2008/2009 and the major 2011 peak in gold prices.

Last week net non-commercial positions in gold soared from 220,857 to 271,648. This is a level unseen since at least the financial crisis (the yellow line represents gold)

Given this surge, I expected to see a fresh, major run-up in SPDR Gold Shares (NYSE:GLD). Instead, GLD spent most of the week rolling back some of the breakout that occurred at the end of April.

SPDR Gold Shares (GLD) hit a new 15-month high in April on a major breakout. The momentum cooled off a bit from there….

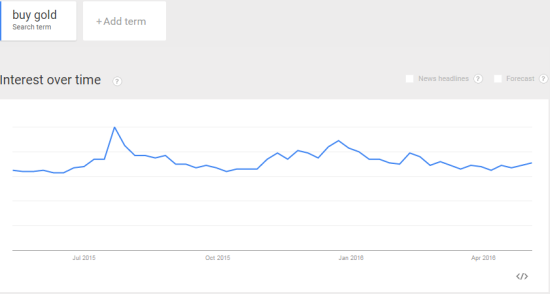

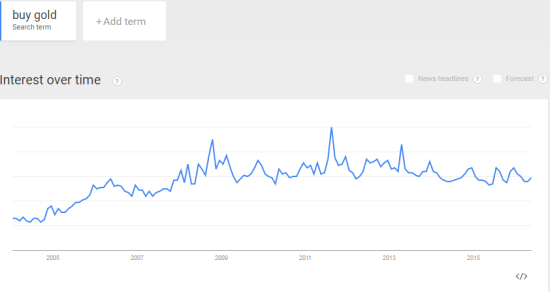

Next, I turned to my favorite indicator of gold sentiment: Google Trends.

For perspective, the monthly view of Google Trends for “buy gold”

Although Google (NASDAQ:GOOGL) Trends has not responded to the current trading extremes for gold, I fully expect a response in due time.

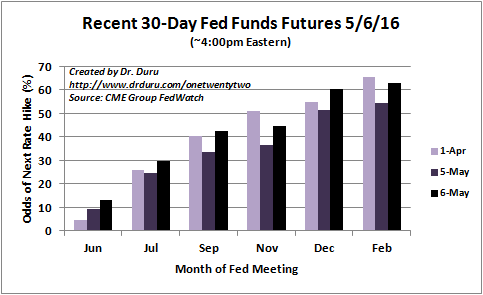

One reason gold buyers have remained bold is the waning credibility of the Fed on “rate normalization.” For many months now, the 30-Day Fed Fund futures have mostly left odds for the next rate hike late in 2006, sometimes off into 2017.

The odds for the next rate hike are higher for December than the odds following the jobs report for March

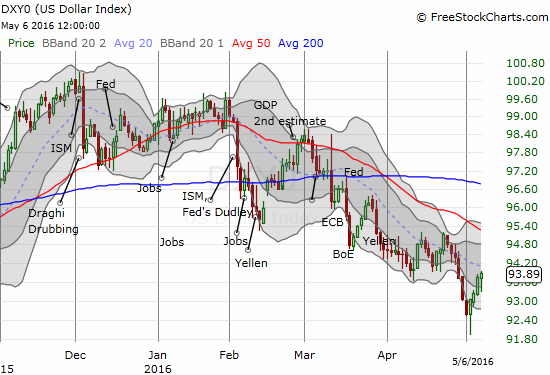

The market’s skepticism about rate normalization has also come through in the persistent slide in the U.S. dollar (PowerShares DB US Dollar Bullish (NYSE:UUP)).

The U.S. dollar index may have hit rock bottom for now.

Trader confidence in the dollar’s decline has come through in the near one-way bets against the dollar across most major currencies. Recently, however, I have seen hints that a great unwind may be looming for the Japanese yen (Guggenheim CurrencyShares Japanese Yen (NYSE:FXY)) and the Australian dollar (Guggenheim CurrencyShares Australian Dollar (NYSE:FXA)).

Overall, my trading approach on gold remains the same.

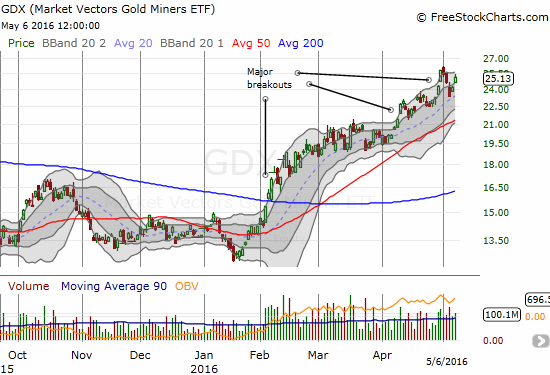

The VanEck Vectors Gold Miners ETF (NYSE:GDX) has been on fire in 2016 with an 83% year-to-date gain

I also dabbled in silver which I saw as itching to catch-up to gold’s run.

Silver (the yellow line) finally seems to be bottoming after traders have ramped up net long bets multiple times in the past 16 months.

Full disclosure: long GLD, long and short various currencies versus the U.S. dollar