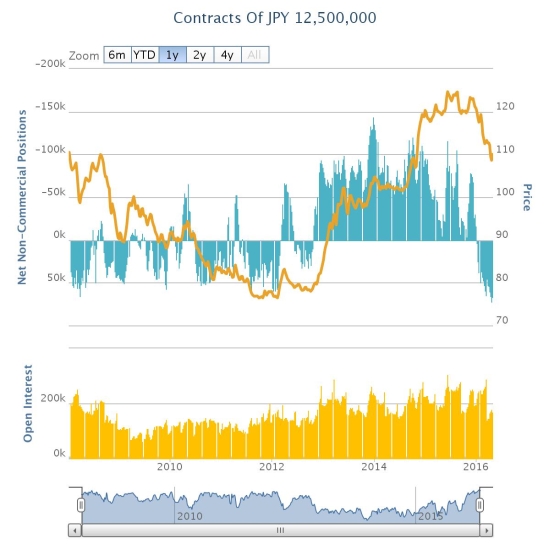

Traders remain very confident in the strength of the Japanese yen (NYSE:FXY). Net longs stayed at “maximum bullishness” even ahead of last week’s monetary policy meeting by the Bank of Japan.

Source: Oanda’s CFTC’s Commitments of Traders

Traders have not been this bullish on the yen since at least 2008.

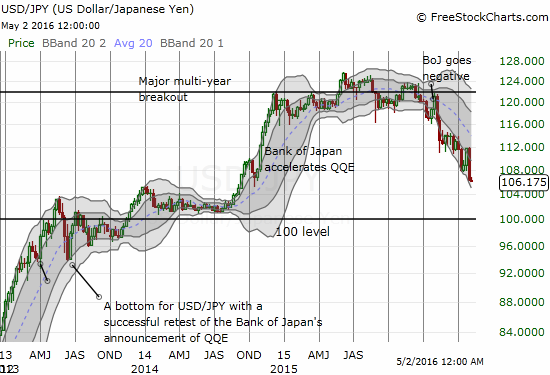

That boldness paid off as the BoJ failed to deliver more easing -- and the yen soared. USD/JPY dropped to levels last seen in October, 2014 in what now looks like a major top.

Was that major -- multi-year -- top/plateau for USD/JPY?

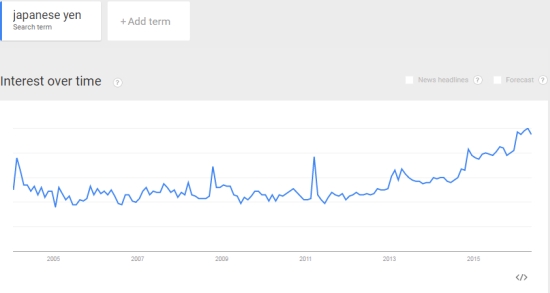

Search Trends

In the midst of this dramatic turn in sentiment for the yen, I stumbled upon another soaring indicator. Google Trends, an index of the popularity of search terms, shows searches for “Japanese yen” breaking out at the end of 2014 just as USD/JPY was in its final run-up. The search index reached a new all-time high in the last month.

Source: Google Trends

Searchers are at maximum interest in the Japanese yen.

I typically use Google Trends as a sentiment indicator. I like to assess whether the trends or, even more importantly, the extremes in moves are consistent or contrary to other important indicators. In this case, I am comparing Google Trends with the price level of the Japanese yen currency pairs. Note that Google trends broke out just as USD/JPY was running up to multi-year highs (multi-year cheapness for the yen). If I had been looking then, I would have guessed the run-up was coming to an end. In other words, the extreme in USD/JPY was not being confirmed by Google Trends.

Now, indicators are all pointing in favor of yen strength. Yet sentiment seems to be reaching feverish levels. I know I am early in anticipating a bottom for USD/JPY (100 seems like destiny right now), but I am now adding a top in Google Trends as a potential sign that the fever will break sooner than later -- the timing will never be precise. Note that while Google Trends reached a new all-time high in April, the momentum in 2016 has definitely slowed. If Google Trends hits a fresh, new high, I will need to revisit my assessments.

In the meantime, I'm sticking with my strategy of slowly accumulating a long USD/JPY position while fading all other currencies against the yen, especially the British pound, for shorter-term trades.

Be careful out there.

Full disclosure: long USD/JPY, short GBP/JPY

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.