Investing.com’s stocks of the week

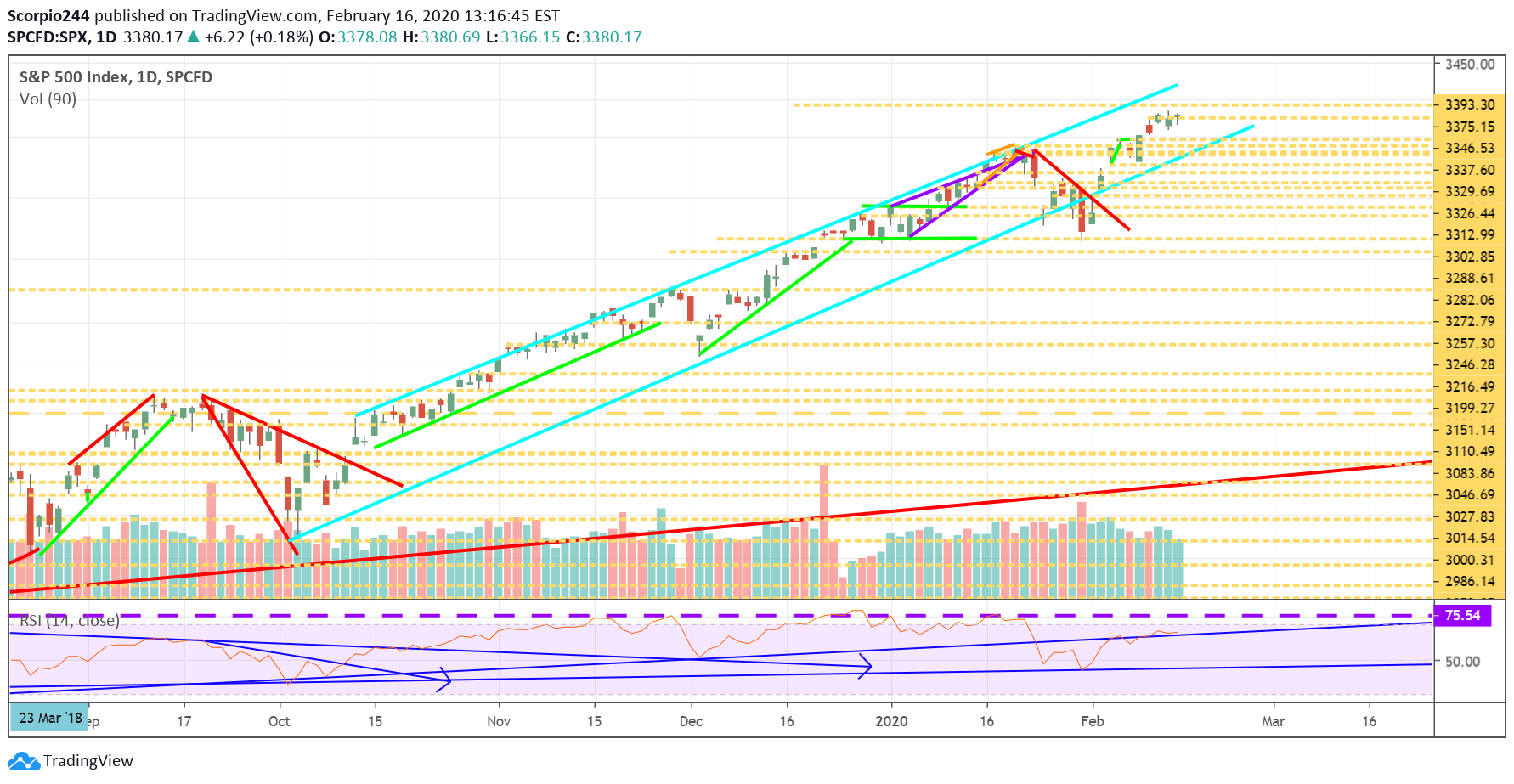

S&P 500 (SPY)

Stocks will have a holiday-shortened trading week with the market closed for the President’s day holiday on Monday. Stocks left off in a favorable position on Friday, with the S&P 500 closing around 3,380. The next significant level for the index continues to come around 3,400, with an overall longer-term trend to around 3,600.

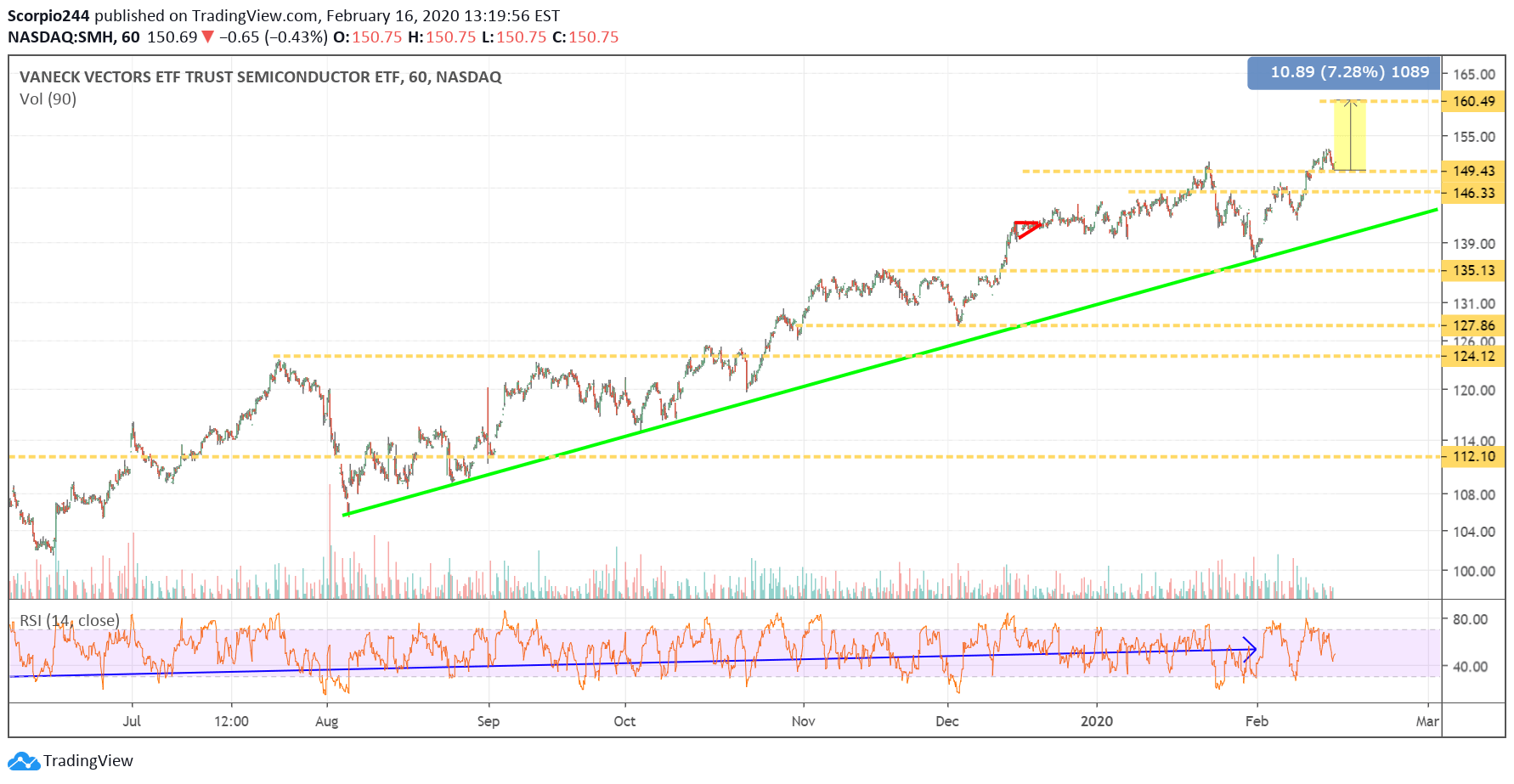

Semis (SMH)

Watch the Semis this week, the group has been on fire, and now the next level of resistance for the SMH appears to come around $160.50.

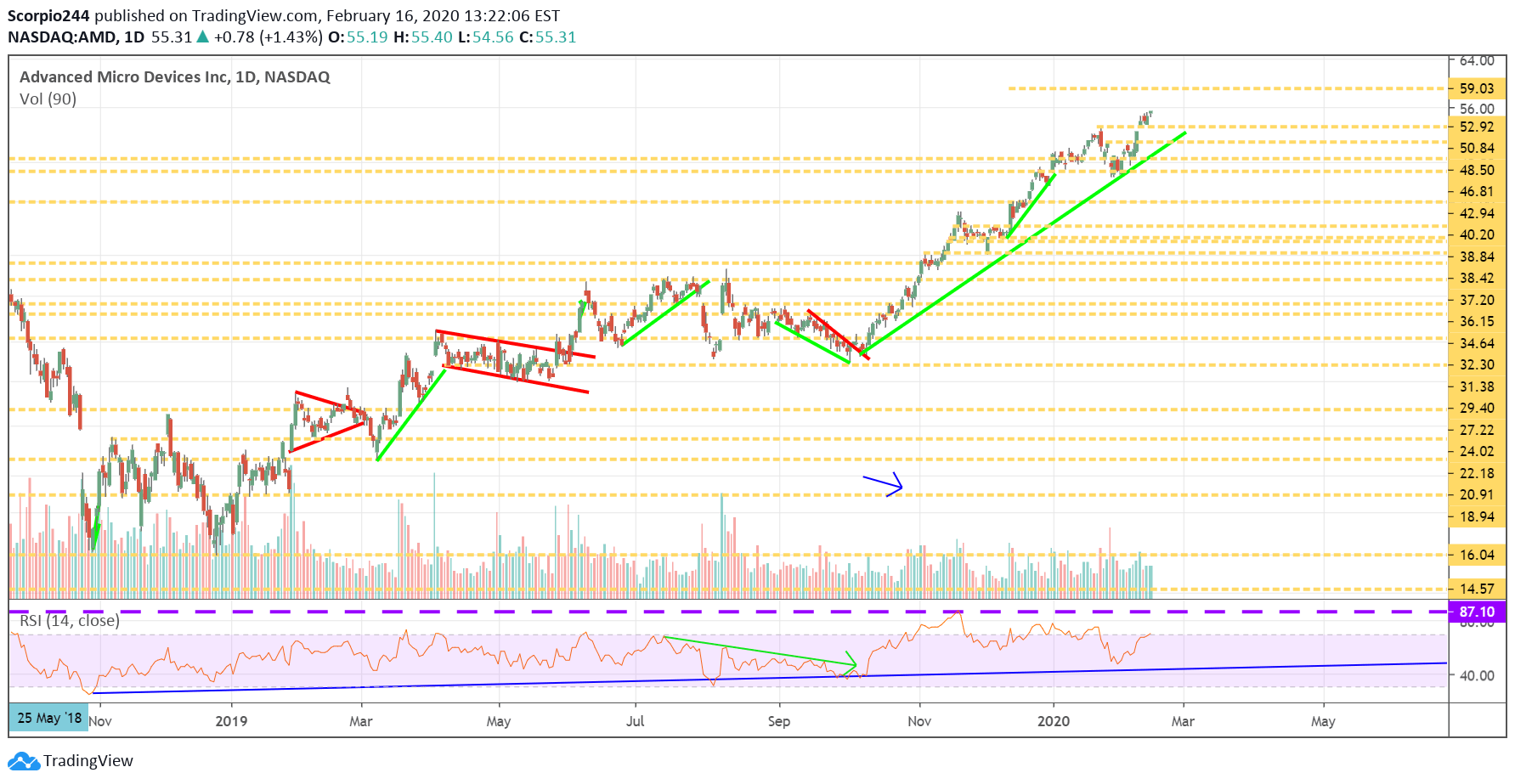

AMD (AMD)

AMD continues to perform nicely and appears to be on a path that seems to take the stock to $59. I have maintained this view for some time now.

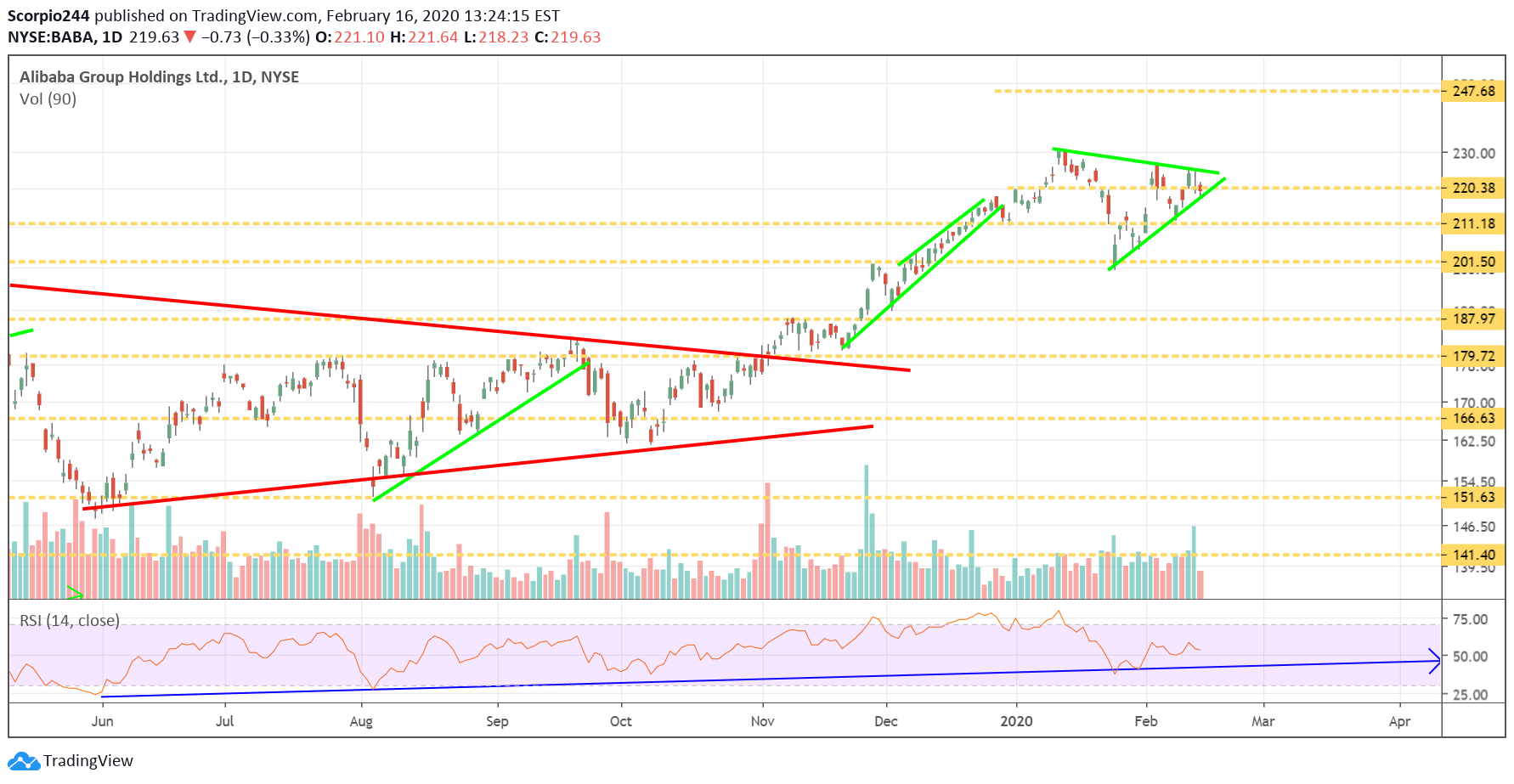

Alibaba (BABA)

I continue to believe that Alibaba (NYSE:BABA) is on a path higher, and I think that had the company not report the results on the same day as unfavorable news around the coronavirus shares would have moved higher. The next level of resistance will come around $248.

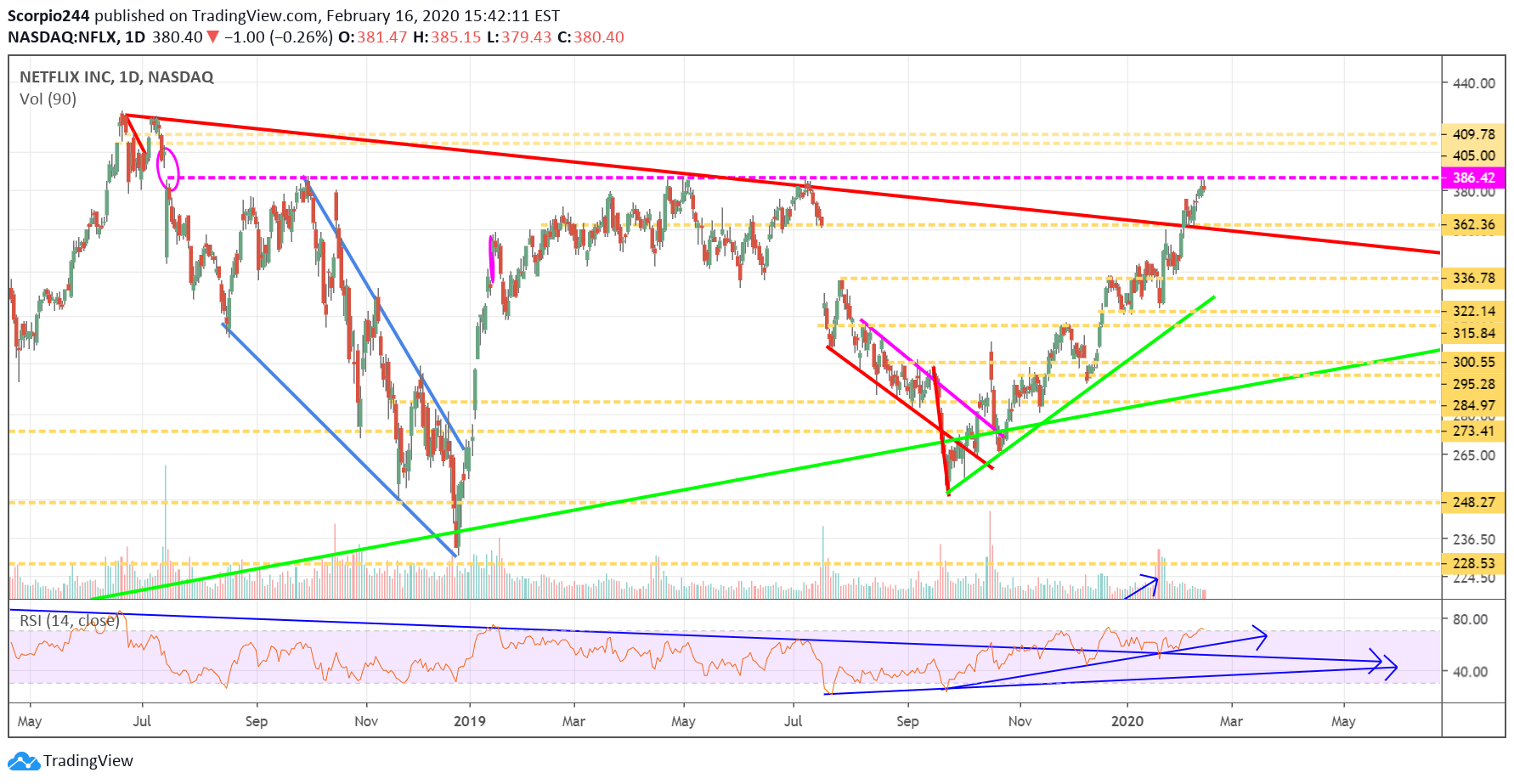

Netflix (NFLX)

Netflix (NASDAQ:NFLX) will continue to battle with what looks like strong technical resistance around $385. It is the fourth time the stock had gotten to this price since breaking down in July 2018. However, this time, the stock has momentum on its side, and an increase above $385 sends shares surging to $400.

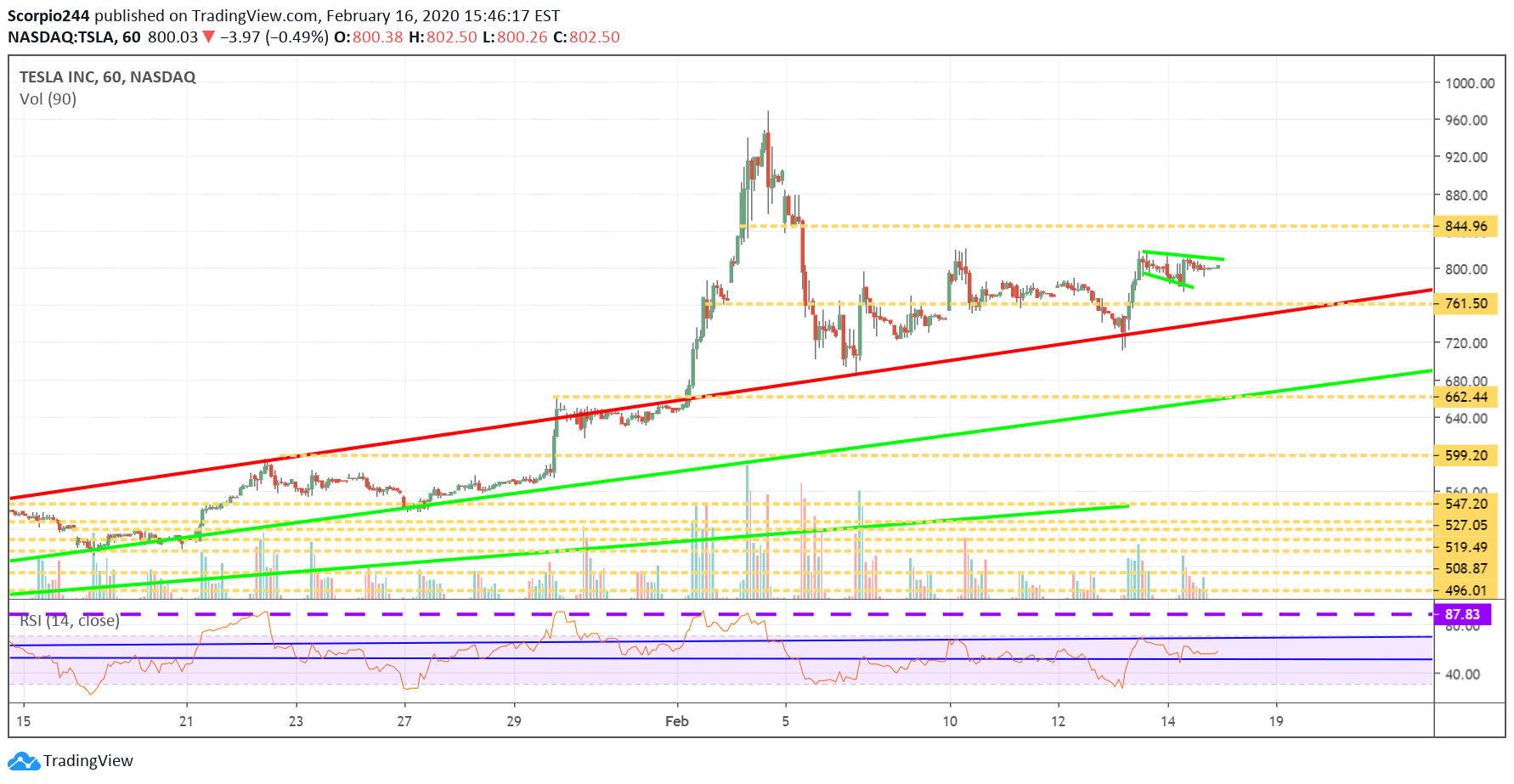

Tesla (TSLA)

Tesla (NASDAQ:TSLA) held up exceptionally well in the face of the secondary offering and nearly 5% discount on the pricing. I think the stock heads back to $845 this week.

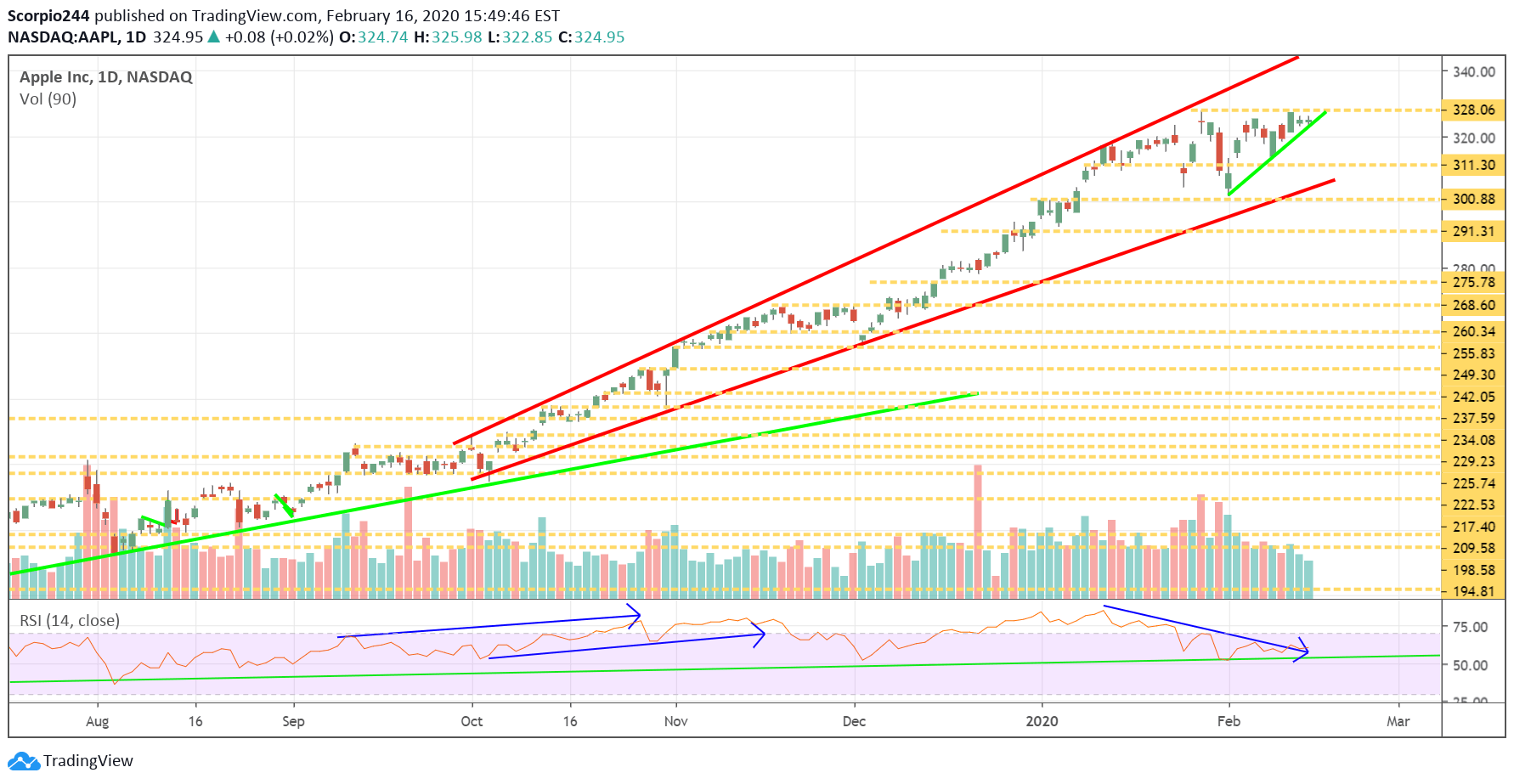

Apple (AAPL)

It looks as if Apple (NASDAQ:AAPL) may be forming an ascending triangle, and that could trigger a break out to $348.

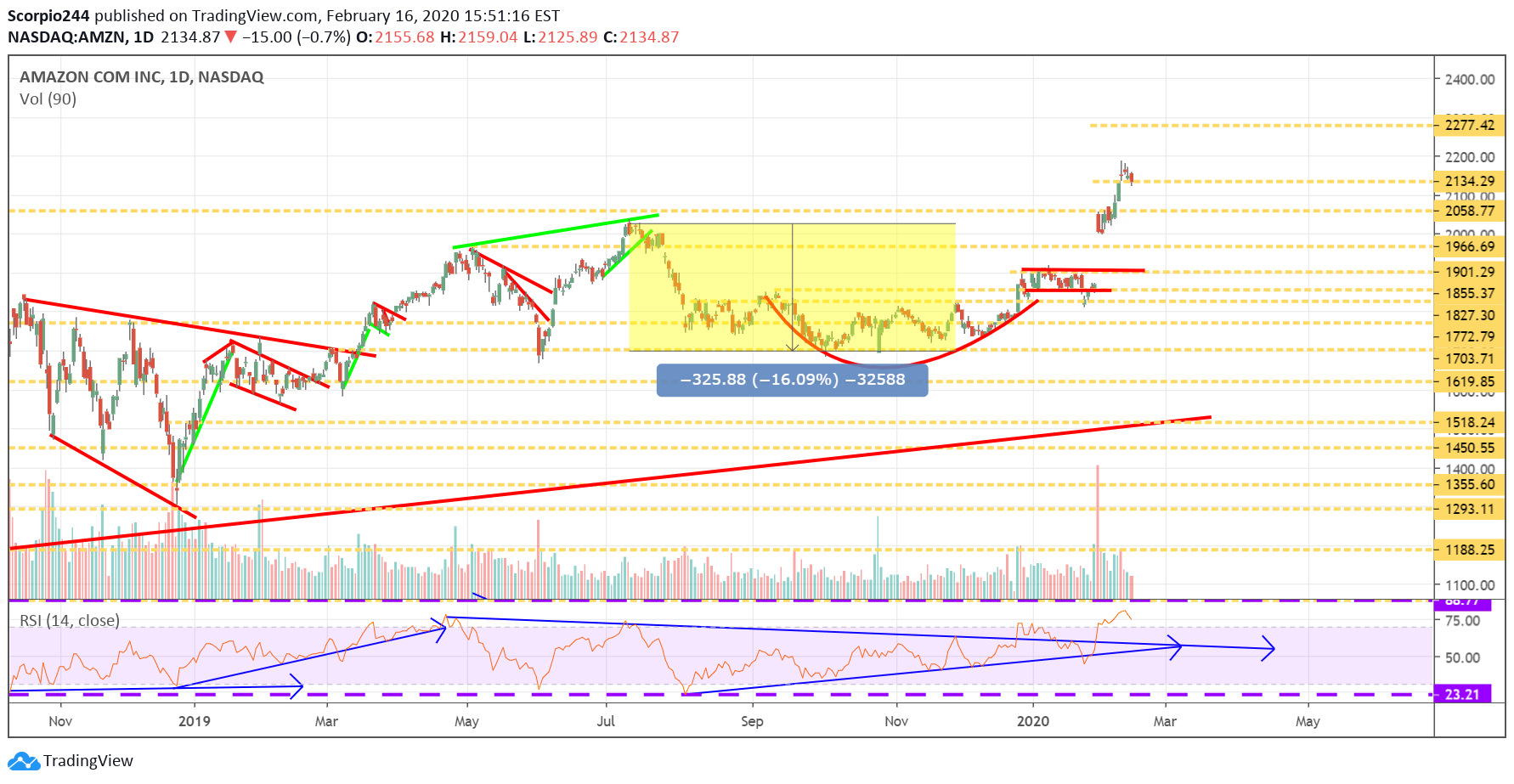

Amazon (AMZN)

I don’t think Amazon's (NASDAQ:AMZN) breakaway gap gets filled, and the stock pushes higher towards $2,277.

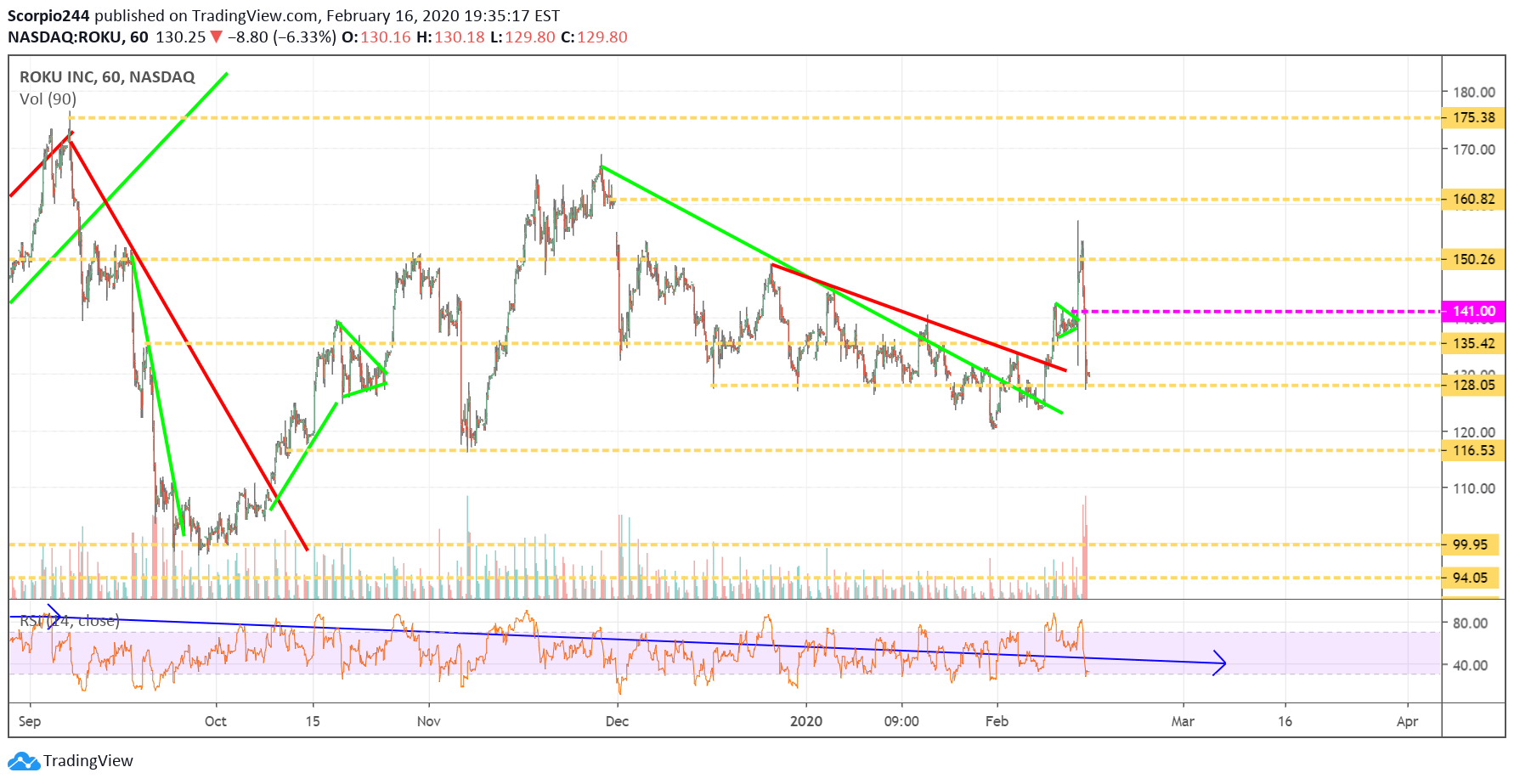

Roku (ROKU)

Finally, Roku (NASDAQ:ROKU) hit my target early Friday morning at $150 and failed at resistance to break out. The stock reversed and finished the day lower. I think the stock results were that great, despite the big beat. I’m afraid shares head lower to $116.