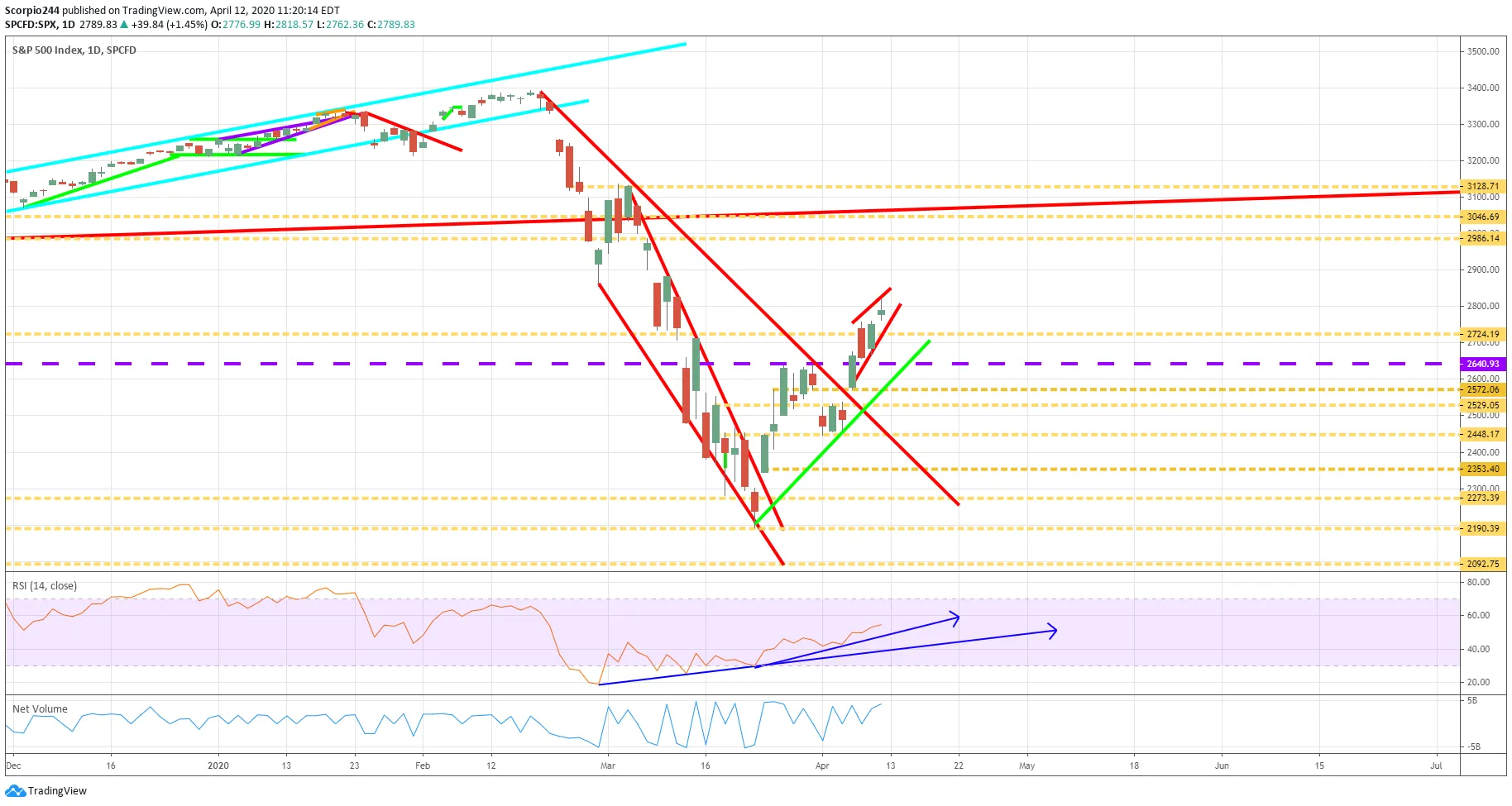

S&P 500 (SPY)

This week kicks off earnings season, and that means the volatility may once again pick up in the stock market. The S&P 500 appears to have a bearish reversal pattern known as a rising wedge, and it suggests that the index may be due to drop this week. It could result in the index filling the technical gap at 2,450.

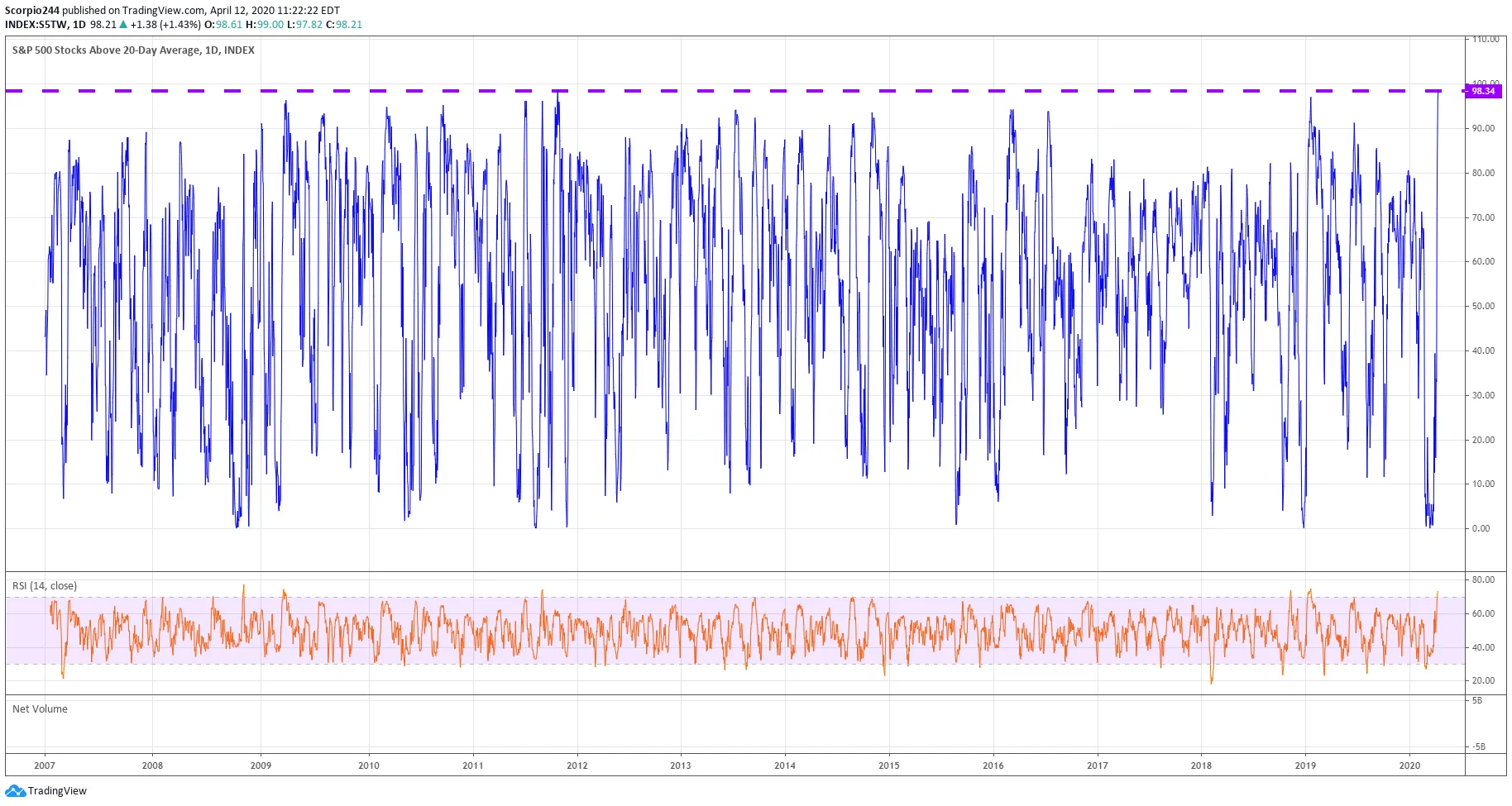

20-Day Moving Average

Another negative indicator is that number of stock in the S&P 500 above their 20-day moving average is at 98.3%. That is the highest reading ever!

Russell 2000 (IWM)

There is also the same bearish pattern that has formed in the Russell 2000 (NYSE:IWM), the rising wedge. It indicates the index drops to around 1,160.

NVIDIA (NVDA)

NVIDIA (NASDAQ:NVDA) may move lower this week, I noted some bearish options betting in this past week, and the stock could have a considerable drop ahead with support at $218.

Amazon (AMZN)

Amazon (NASDAQ:AMZN) also has that same rising wedge pattern, and it too could be suggesting that Amazon is due to correct back towards $1825.

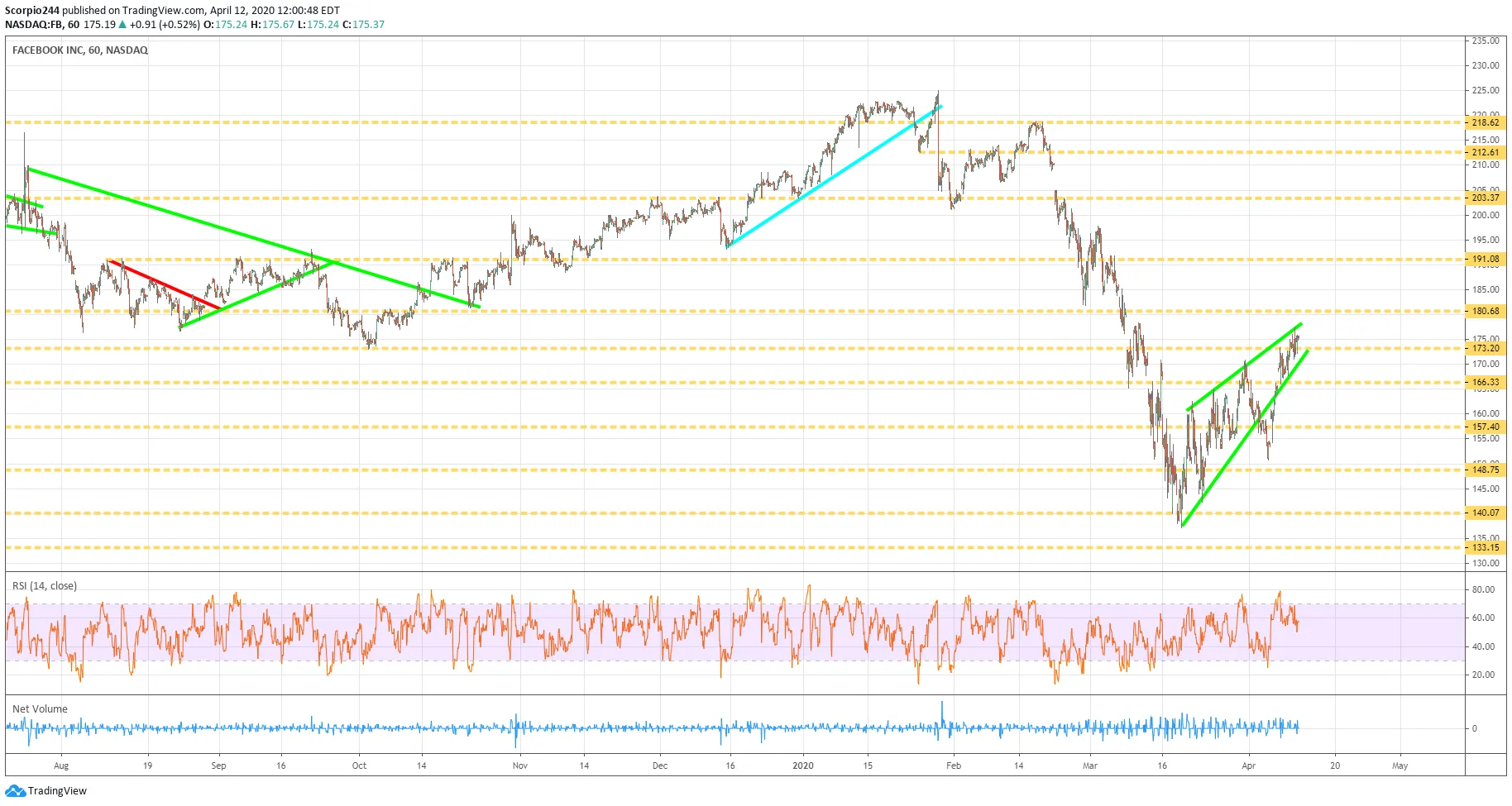

Facebook (FB)

Facebook (NASDAQ:FB) also has that similar pattern, and it could even be a bear flag, setting up a decline to around $140.

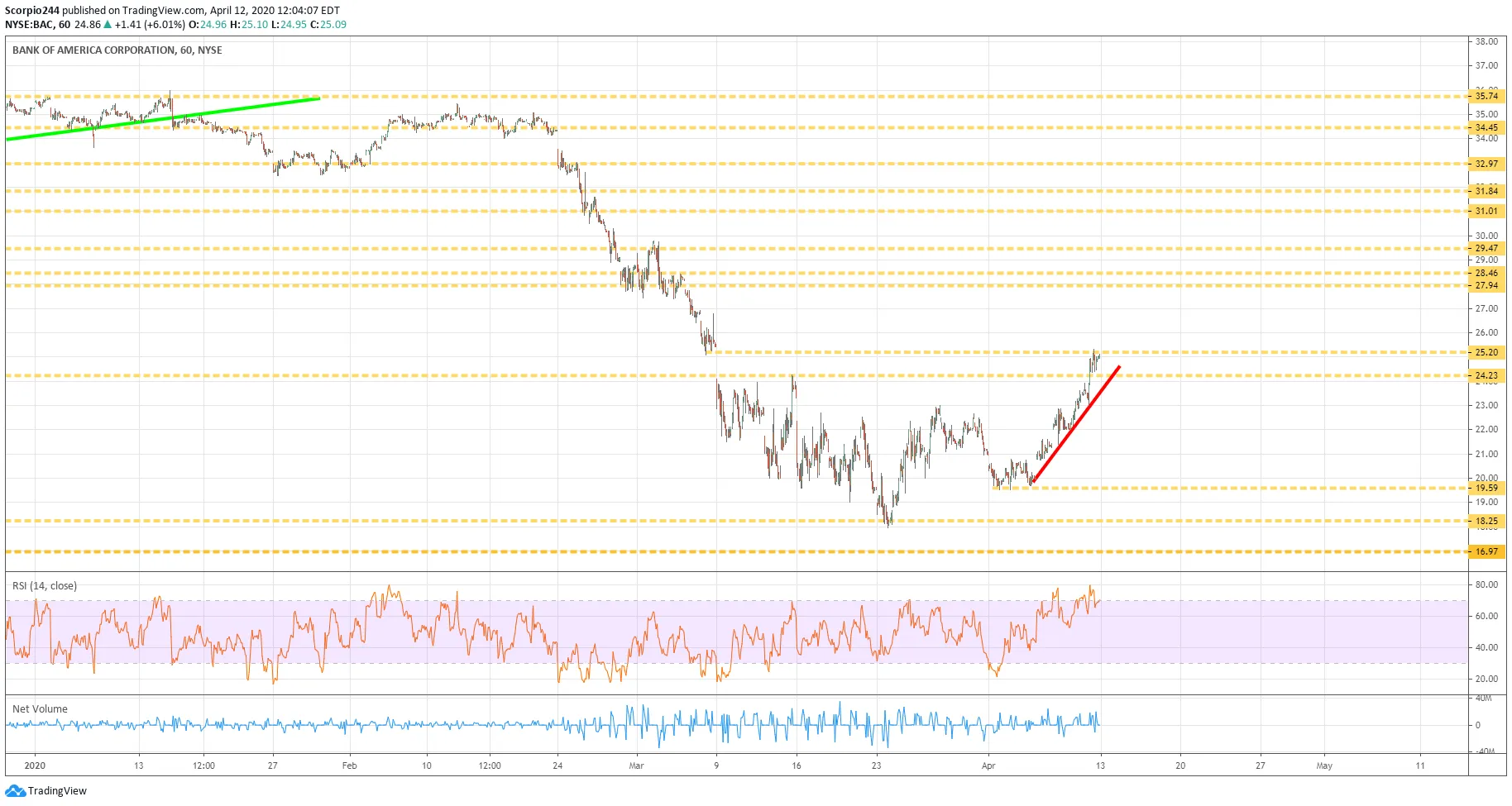

Bank of America (BAC)

Bank of America (NYSE:BAC) reports results this week, and it has successfully filled the gap up to $25.20, and with a break of the uptrend, the stock could fall back to $19.60.

Alibaba (BABA)

Alibaba (NYSE:BABA) also has a rising wedge in the chart and suggests a gap fill down to $188.

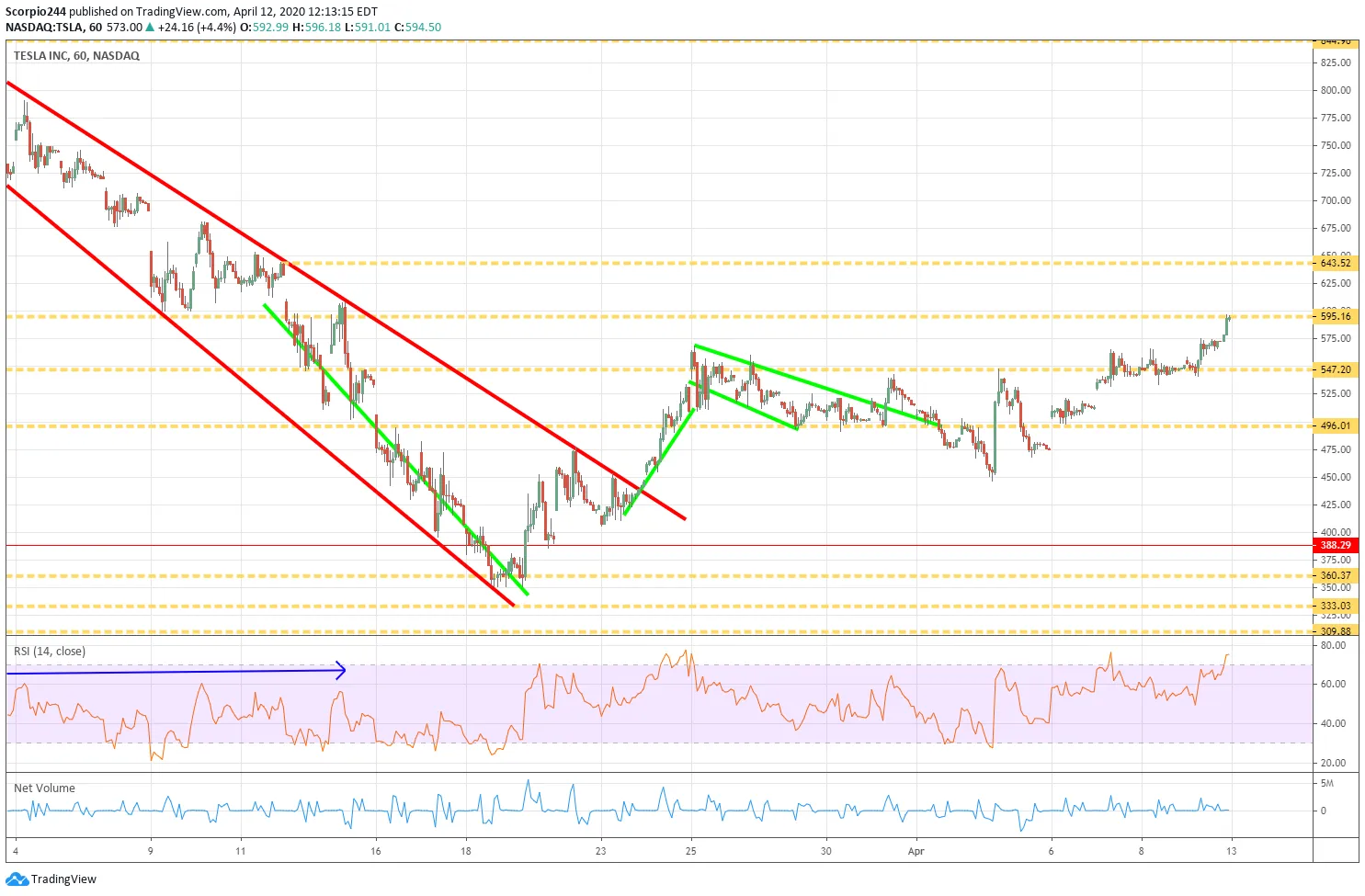

Tesla (TSLA)

If Tesla (NASDAQ:TSLA) can get back above $595, it has room to climb to around $640.